Contracts for Difference (CFDs) are financial instruments allowing traders to bet on asset price movements without owning them. Popular in Australia due to its regulated market, diverse economy, and strong digital infrastructure, CFD trading involves leveraging to control larger positions with less capital but requires risk management strategies like stop-loss orders. Success hinges on understanding market dynamics through technical and fundamental analysis, plus effective risk mitigation. Comprehensive CFD education courses in Australia offer structured curricula with practical exercises, simulations, and real-time data, preparing beginners for successful trading.

Discover the thrilling world of Contracts for Difference (CFDs) with our comprehensive guide. Australia has emerged as a leading market for CFD trading, attracting investors with its dynamic economy and advanced financial infrastructure. We review the best educational courses tailored for beginners, focusing on strategies that promise profitability. From understanding market analysis to practical training, this article equips you with the tools to navigate CFDs successfully. Learn how to harness technical and fundamental approaches for informed decision-making in today’s fast-paced trading environment.

- Understanding Contracts for Difference (CFDs): A Beginner's Guide

- The Appeal of CFD Trading: Why Australia is a Hotspot

- Choosing the Right CFD Education Course in Australia

- Key Components of a Profitable CFD Trading Strategy

- Demystifying Market Analysis for CFDs: Technical and Fundamental Approaches

- Practical Training and Real-World Application: Preparing for Success in CFD Trading

Understanding Contracts for Difference (CFDs): A Beginner's Guide

Contracts for Difference (CFDs) are financial instruments that allow traders to speculate on the price movements of various assets, including stocks, commodities, currencies, and indices, without actually owning them. Essentially, a CFD is a contract between two parties where one agrees to pay the difference in the value of an asset at the time the trade is opened and closed. This innovative trading method offers both advantages and risks, making it crucial for beginners to understand its fundamentals before diving into the market.

For instance, CFDs provide leverage, enabling traders to control a more substantial position with a relatively small amount of capital. This feature can amplify potential profits but also increases exposure to losses. Beginners should grasp how leverage works and set clear risk management strategies, such as stop-loss orders, to protect against significant market movements that could negatively impact their portfolio. Understanding the mechanics of CFDs is the first step towards profitable trading in Australia’s financial markets.

The Appeal of CFD Trading: Why Australia is a Hotspot

In the dynamic realm of financial trading, Contracts for Difference (CFDs) have emerged as a powerful tool for investors and traders worldwide, including Australia. The appeal of CFD trading lies in its ability to offer leverage, allowing participants to speculate on price movements with potential for significant gains, all while assuming limited risk. This accessibility has propelled Australia into a hotspot for CFD trading, driven by a combination of factors.

Firstly, the country’s robust financial infrastructure and highly regulated market environment provide a safe haven for traders, instilling confidence in the platform’s integrity. Additionally, Australia’s diverse and well-developed economy offers a wide range of assets, from equities and commodities to currencies, catering to various trading strategies and preferences. The popularity can also be attributed to the country’s strong internet penetration and digital literacy, enabling easy access to online CFD platforms and fostering a bustling trading community.

Choosing the Right CFD Education Course in Australia

When it comes to choosing a CFD education course in Australia, it’s crucial to consider your trading goals and experience level. Not all courses are created equal, so it’s essential to select one that aligns with your needs. Look for comprehensive programs that cover both fundamental and advanced topics related to contracts for difference (CFDs).

Reputable Australian educational institutions or trading platforms offering CFD courses often provide structured curricula with practical exercises and market simulations. Ensure the course includes hands-on experience with real-time trading data, as this will better prepare you for the dynamic nature of the financial markets. Read reviews and testimonials from past students to gauge the quality of instruction and support provided.

Key Components of a Profitable CFD Trading Strategy

The success of a Contracts for Difference (CFD) trading strategy lies in its well-structured components, each playing a pivotal role in navigating the financial markets with precision. Firstly, understanding market dynamics is paramount. Traders must develop an intuitive grasp of price movements, influenced by various factors like economic indicators, news events, and company performances. This knowledge enables them to identify trends and make informed decisions.

Secondly, risk management is a cornerstone of any profitable CFD strategy. Effective risk assessment and mitigation techniques ensure traders can protect their capital while aiming for gains. This includes setting stop-loss orders to limit potential losses and employing position sizing strategies to manage risk exposure. With these elements in place, traders can confidently execute trades, leveraging the leveraged nature of CFDs to amplify potential returns.

Demystifying Market Analysis for CFDs: Technical and Fundamental Approaches

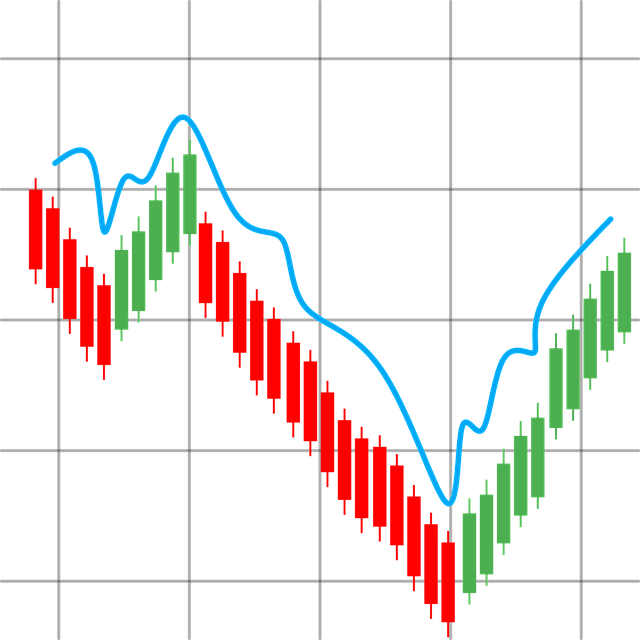

In the realm of contracts for difference (CFDs) trading, understanding market analysis is paramount to achieving profitable outcomes. This involves a blend of technical and fundamental approaches, each offering unique insights into potential price movements. Technical analysis leverages historical data and charts to identify patterns and trends, employing indicators like moving averages and relative strength index (RSI) to predict short-term price actions.

Fundamental analysis, on the other hand, delves into economic factors, company performance, and market sentiment to gauge long-term value. This involves studying financial statements, news events, and geopolitical developments that can influence asset prices. By integrating both technical and fundamental perspectives, traders gain a comprehensive view of market dynamics, enabling them to make more informed decisions when trading CFDs.

Practical Training and Real-World Application: Preparing for Success in CFD Trading

Practical training is a cornerstone of any successful CFD education course. It’s not enough to merely understand theoretical concepts; traders need to apply them in real-world scenarios. Our course incorporates extensive practical sessions, enabling students to gain hands-on experience with contracts for difference (CFDs). They learn to navigate market dynamics, execute trades, and manage risks using live data feeds and simulated trading environments.

This immersive approach ensures that when our graduates enter the market, they are well-prepared to take on its challenges. They develop skills in analyzing market trends, identifying profitable opportunities, and quickly adapting strategies based on real-time price movements. Through this practical application, students gain a deep understanding of CFD trading, equipping them with the tools to make informed decisions and achieve consistent profitability.

In today’s financial landscape, Contracts for Difference (CFDs) offer a dynamic trading opportunity, especially in Australia, where their popularity continues to grow. By choosing an authoritative CFD education course tailored to Australian markets, aspiring traders can gain the knowledge and skills necessary to navigate this complex yet rewarding arena. Combining theoretical understanding with practical training ensures individuals are well-prepared to enter the bustling CFD trading world, enabling them to make informed decisions and potentially achieve profitable results.