Market liquidity is essential for successful trading, especially in leverage trading, where borrowed funds amplify buying power. High liquidity allows traders to enter and exit positions swiftly, capitalizing on market movements. Leverage trading offers significant growth potential but also heightened risk, requiring careful management to avoid margin calls and spiral losses. By assessing risk tolerance, employing strategic goals, using stop-loss orders, and diversifying investments, traders can optimize leverage while minimizing risks and maximizing wealth within the market for sustainable growth.

Market liquidity and leverage are double-edged swords that significantly influence trading performance. While proper understanding and strategic application can drive substantial wealth generation, missteps can lead to financial losses. This article delves into these critical aspects, offering insights on “Understanding Market Liquidity: The Foundation of Trading Success” and exploring the nuances of “Leverage Trading: A Double-Edged Sword for Wealth Generation.” We also navigate the impact of leverage on performance and provide strategies to optimize it, helping traders maximize their wealth within the market.

- Understanding Market Liquidity: The Foundation of Trading Success

- Leverage Trading: A Double-Edged Sword for Wealth Generation

- Navigating the Impact of Leverage on Trading Performance

- Strategies to Optimize Leverage and Enhance Wealth Within the Market

Understanding Market Liquidity: The Foundation of Trading Success

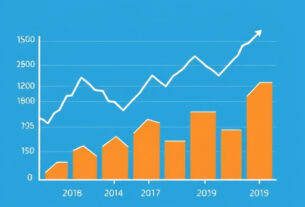

Market liquidity refers to the ease with which assets can be bought or sold in a market without significantly impacting their price. It’s the foundation for successful trading, acting as the lubricant that allows investors to enter and exit positions smoothly. When a market is liquid, orders can be executed quickly, minimizing slippage—the difference between expected and actual execution prices. This is particularly crucial for leverage trading, where traders borrow funds to increase their buying power and potentially amplify wealth within.

High liquidity ensures that trades can be closed promptly, even during periods of high volatility. It allows traders to take advantage of market movements without waiting for buyers or sellers, thereby maximizing gains or minimizing losses. In essence, understanding and leveraging market liquidity effectively is a key component in navigating the financial markets and achieving trading performance goals, especially when employing leverage trading strategies aimed at growing wealth.

Leverage Trading: A Double-Edged Sword for Wealth Generation

Leverage trading represents a double-edged sword in the quest for wealth generation. While it amplifies potential returns by allowing traders to control a more substantial position with a relatively smaller capital outlay, it also magnifies losses. This inherent risk is a core aspect of leverage trading—it can lead to significant gains or substantial losses, depending on market conditions and the trader’s skill. The allure of leveraging wealth within markets lies in the possibility of exponential growth, attracting folks seeking to amplify their financial returns.

However, this increased risk requires careful management. Unwise use of leverage can result in margin calls, where traders are forced to liquidate positions to cover losses, potentially leading to a spiral of sell-offs and exacerbated declines. Thus, navigating leverage trading demands a delicate balance: leveraging the potential for wealth within markets while employing strategies that mitigate the risks associated with this powerful tool.

Navigating the Impact of Leverage on Trading Performance

Navigating the impact of leverage on trading performance is an art that requires a delicate balance to harness its power for wealth within. While leverage can amplify gains, it also magnifies losses, making it a double-edged sword. Traders must understand their risk tolerance and strategic objectives before employing leverage trading strategies. Overuse can lead to excessive exposure, causing investors to lose control, especially during volatile markets.

However, when used judiciously, leverage becomes a catalyst for growth. It enables traders to maximize returns by allowing them to control larger positions with less capital. This strategic move can be particularly beneficial in liquid markets where prices fluctuate, offering ample opportunities for profit. The key lies in managing risk effectively, setting stop-loss orders, and diversifying investments to ensure that potential losses are capped while maximizing the wealth-building potential of leverage trading.

Strategies to Optimize Leverage and Enhance Wealth Within the Market

Optimizing leverage in market trading is a strategic approach to enhance wealth accumulation. Traders often employ this tactic to amplify potential returns by borrowing funds, allowing them to control larger positions. However, it’s a delicate balance; excessive leverage can lead to significant losses if the market moves against the trader. Therefore, a key strategy is to maintain a healthy debt-to-equity ratio, ensuring that borrowed funds are utilized efficiently. Diversification plays a crucial role here; by spreading investments across various assets and sectors, traders can reduce risk associated with over-leveraging.

Additionally, setting clear stop-loss orders is essential. These orders automatically trigger the sale of an asset when it reaches a certain price, limiting potential downside exposure. By combining these strategies, traders can effectively manage leverage, minimize risks, and maximize wealth within the market, ensuring sustainable growth over time.

Market liquidity and leverage are powerful tools that can significantly influence a trader’s journey towards wealth generation. By understanding the intricacies of market liquidity and mastering the art of leverage trading, investors can optimize their strategies to enhance performance. This article has explored these concepts, offering insights into how they interact to create opportunities and challenges. Embracing a balanced approach, combining strategic leveraging with careful risk management, is key to navigating this dynamic landscape. With the right techniques, traders can unlock substantial wealth within the market while ensuring long-term sustainability.