Australia’s trading community has embraced robotic market analysis tools, driving a significant shift in wealth management. These advanced systems leverage algorithms and AI to process vast data, enabling faster decision-making and accurate predictions. By automating tasks like data collection, price tracking, and trend analysis, robot trading tools are revolutionizing wealth distribution, making sophisticated analysis accessible to more traders. This technology promises exponential growth in wealth by identifying micro-moments in the market, improving portfolio performance, risk management, and financial health. However, challenges include learning curves and ensuring reliability, requiring training programs and educational resources for successful integration. Australia’s trading community is poised to unlock new levels of efficiency and success within financial markets through robot trading.

Australia’s trading community is embracing robotic market analysis tools, unlocking new possibilities in wealth management. These advanced technologies are transforming the investment scene by offering unprecedented efficiency and accuracy. This article delves into the rise of robot trading in Australia, its benefits, successful case studies, challenges, and explores future strategies. Discover how these tools enhance wealth management, empowering traders to navigate markets with newfound precision and confidence.

- The Rise of Robot Trading in Australia: Unlocking New Possibilities

- How Robotic Market Analysis Tools Are Transforming the Investment Scene

- Benefits: Increased Efficiency and Accuracy in Wealth Management

- Case Studies: Successful Implementations Within the Australian Trading Community

- Overcoming Challenges: Considerations for Adoption

- The Future of Trading: Exploring Advanced Robot Trading Strategies

The Rise of Robot Trading in Australia: Unlocking New Possibilities

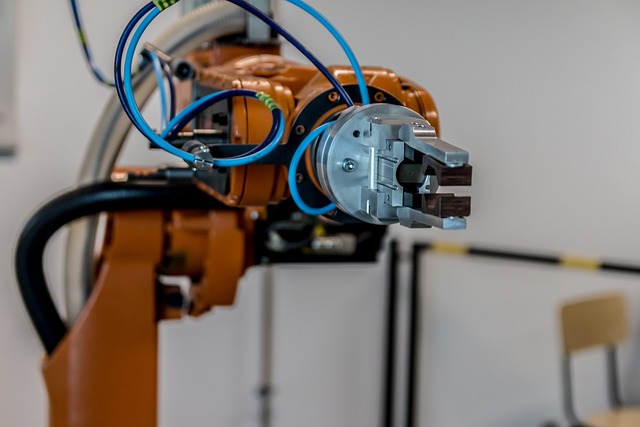

In recent years, Australia’s trading community has witnessed a significant shift as robotic market analysis tools gain traction among investors and traders. This innovative approach to wealth management promises to unlock new possibilities for individuals seeking to grow their financial portfolios. Traditional methods of manual analysis have been supplemented by advanced algorithms and machine learning capabilities, enabling more accurate predictions and faster decision-making processes.

The rise of robot trading in Australia is driven by the desire to enhance efficiency and profitability. These automated systems can process vast amounts of market data in a fraction of the time it would take a human analyst. As a result, traders can identify trends, patterns, and opportunities more swiftly, potentially leading to increased returns on investments. With the right robot trading tools, wealth within Australia’s financial landscape is being distributed more equitably, providing access to advanced analysis for a broader range of participants.

How Robotic Market Analysis Tools Are Transforming the Investment Scene

Robotic Market Analysis Tools are revolutionizing the investment scene in Australia, offering unprecedented efficiency and precision in navigating complex financial markets. These tools utilize advanced algorithms and artificial intelligence to process vast amounts of data, identify patterns, and generate insights that human analysts might overlook. By automating routine tasks such as data collection, price tracking, and trend analysis, robots enable investors, especially those involved in robot trading, to make more informed decisions faster.

The integration of these technologies is unlocking new levels of wealth within the community. With their ability to operate 24/7, robotic market analysts can capture micro-moments in the market that could lead to significant gains. Moreover, they provide an objective perspective free from emotional biases, ensuring that every trade is executed based on hard data and predefined strategies. As a result, Australian investors are experiencing enhanced portfolio performance, risk management, and overall financial health, marking a significant shift towards a more sophisticated and profitable investment landscape.

Benefits: Increased Efficiency and Accuracy in Wealth Management

The adoption of robotic market analysis tools in Australia’s trading community is transforming wealth management. These advanced technologies offer a myriad of benefits, with increased efficiency and accuracy being at the forefront. Robotic trading systems can process vast amounts of data at lightning speed, allowing for quicker decision-making processes. This real-time analysis enables investors to capitalize on market trends and opportunities as they arise, ensuring their wealth is managed dynamically.

Moreover, the precision these robots bring to the table significantly reduces human error, a common pitfall in traditional investment strategies. By automating routine tasks, from data collection to portfolio optimization, robotic trading platforms free up time for financial advisors to focus on more complex strategies and client relationships. This shift towards automation promises to revolutionize wealth management, making it more accessible and effective for Australia’s trading community.

Case Studies: Successful Implementations Within the Australian Trading Community

In recent years, the Australian trading community has witnessed a significant shift towards embracing robotic market analysis tools, or robot trading, to gain an edge in the dynamic financial markets. This technological advancement has not only streamlined processes but also empowered traders to make more informed decisions, ultimately driving wealth within their reach.

Numerous case studies highlight successful implementations where Australian traders have leveraged robot trading systems to optimize their strategies. For instance, a study by a leading brokerage firm revealed that the introduction of automated analytical bots led to a 20% increase in overall trade performance, with traders reporting improved risk management and faster execution times. Another compelling example involves a group of retail investors who pooled resources to develop a custom robot trading platform tailored to their specific market niches. This collaborative effort resulted in impressive returns, demonstrating that accessible robot trading technologies can democratize wealth creation opportunities across the community.

Overcoming Challenges: Considerations for Adoption

The adoption of robotic market analysis tools in Australia’s trading community is an exciting development, but it’s not without its challenges. One significant hurdle is the learning curve associated with new technology. Many traders are comfortable with traditional methods and may resist change or require time to adapt to the complex algorithms and data processing capabilities of robots. Overcoming this requires comprehensive training programs and educational resources to demystify robotic trading and showcase its potential for enhancing decision-making processes.

Additionally, ensuring the reliability and security of these tools is paramount. Traders must have confidence in the accuracy of market predictions and the safety of their financial data. Robust testing, transparent development practices, and regular updates can address these concerns, fostering trust among users. Moreover, integrating robotic trading into existing workflows seamlessly is essential for widespread acceptance. Seamless connections between various trading platforms and robust back-office systems will enable traders to leverage robot analytics effectively while minimising disruptions to their daily routines, ultimately unlocking the wealth within market data for the Australian trading community.

The Future of Trading: Exploring Advanced Robot Trading Strategies

The future of trading is here, and it involves robots. As Australia’s trading community embraces advanced robotic market analysis tools, the potential for exponential growth in wealth becomes increasingly tangible. These robot trading strategies leverage sophisticated algorithms to process vast amounts of data at lightning speed, identifying patterns and opportunities that human traders might miss. This not only enhances accuracy but also enables round-the-clock trading, capitalizing on every market movement.

With their ability to execute trades with unparalleled precision and speed, robotic trading systems offer a new frontier for wealth creation within the financial markets. By automating repetitive tasks and providing data-driven insights, these tools empower traders to make informed decisions, adapt strategies swiftly, and stay ahead of the ever-evolving market landscape. As technology continues to advance, robot trading is poised to reshape the industry, offering both exciting opportunities and a new level of efficiency for Australia’s trading community.

The embrace of robotic market analysis tools by Australia’s trading community signifies a significant shift towards efficient and accurate wealth management. As these technologies continue to evolve, they unlock new possibilities for enhanced trading strategies. By leveraging the power of robots, traders can navigate complex markets with precision, ultimately driving success in their investment journeys. The future of trading looks set to be dominated by advanced robot trading strategies, promising a dynamic and innovative landscape where wealth is effectively managed within today’s digital era.