In dynamic stock trading, scalping and swing trading require distinct skills. Scalping focuses on rapid, short-term trades leveraging small price fluctuations, while swing trading captures substantial market moves over days or weeks using recurring patterns. Both demand research, practice, and continuous learning from stock trading courses for adaptation to the changing market. Courses teach identifying high-potential stocks through trend analysis, financial statements, news, and technical/fundamental assessment. Day trading involves quick reflexes and precision in profiting from slight market movements, while swing trading leverages technical indicators for consistent profits from smaller price fluctuations. Effective risk management, including goal setting, loss limits, and portfolio diversification, is crucial for both strategies. Advanced stock trading courses offer immersive learning on technical analysis tools and dynamic trading tactics to adapt to market fluctuations.

In the dynamic world of finance, understanding scalping and swing techniques can unlock significant profits in day trading. This comprehensive guide explores these strategies in depth, offering insights into identifying high-potential stocks through expert stock trading courses. From fast-paced market navigating to capitalizing on short-term trends, we delve into proven day trading strategies and advanced tactics for enhancing your skills. Additionally, learn crucial risk management techniques to protect your trade portfolio.

- Unlocking Profits: Scalping vs Swing Trading Techniques

- Stock Trading Courses: Identifying High-Potential Stocks

- Day Trading Strategies: Fast-Paced Market Navigating

- Swing Trading: Capitalizing on Short-Term Trends

- Risk Management: Protecting Your Trade Portfolio

- Advanced Tactics: Enhancing Trading Skills

Unlocking Profits: Scalping vs Swing Trading Techniques

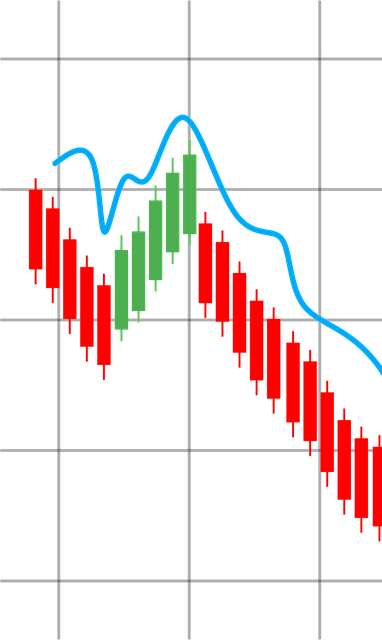

In the dynamic realm of stock trading, understanding the nuances between scalping and swing trading techniques can be a game-changer for aspiring traders. Scalping involves rapid, short-term trades, often executing multiple deals within a single day, aiming to profit from slight price fluctuations. This strategy requires lightning-fast decision-making skills and a deep grasp of market dynamics. On the other hand, swing trading is a more long-term approach, focusing on capturing substantial moves in the stock market over a period of days or weeks. Swing traders seek to capitalize on recurring patterns and trends, employing technical analysis tools to identify potential entry and exit points.

For those interested in enhancing their trading expertise through comprehensive stock trading courses, mastering these techniques can unlock significant profits. Scalping demands agility and precision, while swing trading necessitates patience and a strategic mindset. Both methods offer unique advantages and cater to different risk tolerance levels, enabling traders to tailor their strategies accordingly. Whether one prefers the fast-paced thrill of scalping or the methodical approach of swing trading, successful execution hinges on rigorous research, practice, and continuous learning within the ever-evolving market landscape.

Stock Trading Courses: Identifying High-Potential Stocks

When delving into stock trading courses, one of the most crucial skills to master is identifying high-potential stocks. This involves a keen understanding of market trends, financial statements, and industry news. Many successful traders start by learning technical analysis, which uses charts and patterns to predict future price movements. By combining this knowledge with fundamental analysis, which assesses a company’s intrinsic value based on economic factors, investors can make informed decisions about where to allocate their capital.

Stock trading courses often teach students to look for stocks that display strong growth trends, solid financial health, and favorable market conditions. This might include companies introducing innovative products or services, expanding into new markets, or enjoying high demand for their offerings. By staying abreast of industry developments and company-specific news, traders can identify early signs of potential success, giving them an edge in the fast-paced world of day trading and swing trading.

Day Trading Strategies: Fast-Paced Market Navigating

Day trading involves navigating the fast-paced market with precision and speed, making it a challenging yet rewarding strategy for investors. Successful day traders employ various techniques to capitalize on short-term price fluctuations. One common approach is scalping, which focuses on making numerous small trades throughout the day, aiming to profit from even the slightest market movements. This technique requires a deep understanding of technical analysis and the ability to interpret charts swiftly.

Day trading strategies often include fast-paced decision-making, utilizing real-time data and advanced tools provided by reputable stock trading courses. Traders analyze price patterns, volume indicators, and market sentiment to identify short-term opportunities. With their fingers on the pulse of the market, they can execute trades quickly, ensuring they stay ahead of the constant ebb and flow of prices. This dynamic approach demands keen observation, quick reflexes, and a well-defined risk management plan.

Swing Trading: Capitalizing on Short-Term Trends

Swing trading involves capturing short-term price movements in stocks, often holding positions for several days or weeks. It’s a dynamic approach that leverages technical analysis to identify trends and patterns. By joining the dots between daily charts, swing traders aim to capitalize on the momentum within a particular trend, aiming for consistent profits from smaller price fluctuations.

This technique requires a keen understanding of market indicators and chart patterns. Stock trading courses often emphasize the importance of tools like moving averages, relative strength index (RSI), and Bollinger bands in swing trading strategies. These tools help traders make informed decisions by providing insights into asset price action, momentum, and potential reversals, enabling them to time their trades effectively.

Risk Management: Protecting Your Trade Portfolio

In the high-stakes world of day trading and swing trading, risk management is not just a best practice—it’s an essential survival skill. Protecting your trade portfolio involves strategic techniques that go beyond simply choosing the right stocks or mastering technical analysis. Effective risk management demands a holistic approach, beginning with setting clear and achievable goals for each trade. Traders should determine their maximum allowable loss before entering a position, often expressed as a percentage of their total capital. This disciplined approach ensures that even in the face of market volatility, you maintain control over your financial well-being.

Additionally, diversifying your portfolio across various sectors and asset classes can serve as a powerful risk mitigation strategy. By not putting all your eggs in one basket, so to speak, you reduce the impact of any single trade’s outcome on your overall investment health. Remember, successful trading isn’t just about making profits; it’s about preserving capital and learning from every trade, whether it’s a winning or losing one. Enrolling in reputable stock trading courses can equip you with the knowledge and tools to implement these risk management principles effectively.

Advanced Tactics: Enhancing Trading Skills

In the ever-evolving landscape of stock trading, advanced tactics play a pivotal role in enhancing one’s skills and staying ahead of the curve. Beyond basic scalping and swing trading techniques, professional traders often employ intricate strategies that demand meticulous analysis and swift execution. These advanced methods include sophisticated indicators, such as technical analysis tools like Bollinger Bands and Relative Strength Index (RSI), which provide valuable insights into market trends and potential turning points.

Participating in specialized stock trading courses can equip investors with these cutting-edge tactics. Through immersive learning experiences, these courses delve into complex topics like momentum trading, volume analysis, and advanced order types. By mastering such skills, traders can capitalize on short-term fluctuations in the market, making their strategies more dynamic and adaptable to the ever-changing financial environment.

Scalping and swing trading offer unique approaches to capitalize on market movements. By understanding these techniques, traders can enhance their strategies through specialized stock trading courses. Combining fast-paced decision-making with robust risk management, these methods empower investors to navigate the markets effectively. Advanced tactics further refine skills, ensuring traders stay ahead in today’s dynamic financial landscape.