Rapid forex fluctuations in Sydney present challenges and opportunities. Traders use real-time data, news, and analysis tools to predict market shifts, integrating fundamental and technical approaches. Volatility requires dynamic strategies: shorter-term trades for high volatility, longer-term plans for calmer markets. This adaptability is crucial for successful navigation of the global forex landscape.

Rapid currency fluctuations are a defining feature of today’s global forex market, significantly influencing economic decisions in vibrant metropolitan centers like Sydney. This article delves into the dynamic interplay between unpredictable exchange rate swings and their profound effect on Sydney’s financial strategies, from trading to investment. We explore how local forex traders navigate volatility, adapt their approaches, and capitalize on opportunities amidst these constant shifts, underscoring the importance of staying agile in a constantly evolving foreign exchange landscape.

- Understanding Rapid Currency Fluctuations in Forex

- Impact on Sydney's Economic Decisions and Trading Strategies

- Navigating Volatility: Adjustments for Local Forex Traders

Understanding Rapid Currency Fluctuations in Forex

Rapid currency fluctuations are a defining feature of the global foreign exchange (forex) market, creating both challenges and opportunities for traders in Sydney and worldwide. These fluctuations are driven by a multitude of factors, including economic indicators, geopolitical events, interest rates, and investor sentiment. In the forex market, where transactions occur in pairs, even minor shifts in exchange rates can result in significant gains or losses for investors.

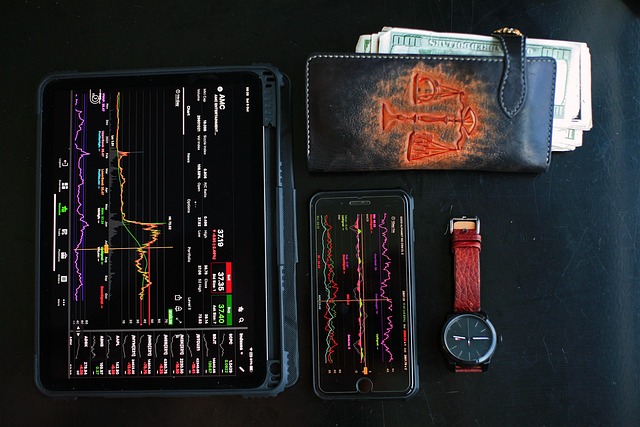

Understanding these rapid changes is crucial for making informed decisions. Forex traders need to stay abreast of real-time data, news releases, and economic calendars to anticipate potential market movements. Technical analysis tools, such as charts and indicators, also play a vital role in deciphering price trends and identifying entry and exit points. By combining fundamental and technical analysis, Sydney forex traders can navigate the dynamic nature of currency fluctuations and potentially profit from short-term volatility.

Impact on Sydney's Economic Decisions and Trading Strategies

Rapid currency fluctuations significantly shape economic decisions in Sydney, particularly within the forex market. Businesses and investors must closely monitor these changes as they can affect import/export costs, tourism revenue, and overall investment strategies. For instance, a sudden appreciation of the Australian Dollar (AUD) may boost exports but also make imports more expensive, impacting production costs for local businesses.

Trading strategies in Sydney’s forex market become more dynamic in response to these fluctuations. Traders employ various techniques such as hedging to mitigate risks associated with currency volatility. They also leverage technical analysis tools to predict short-term price movements and take advantage of opportunities that arise from rapid shifts in exchange rates. This adaptability is crucial for navigating the ever-changing forex landscape, ensuring Sydney’s economic decisions remain strategic and responsive.

Navigating Volatility: Adjustments for Local Forex Traders

Navigating volatility is a key skill for local forex traders in Sydney, given the rapid and unpredictable nature of currency fluctuations. When markets are uncertain, traders must be agile and adaptable to capitalize on opportunities or minimize losses. This often involves adjusting trading strategies and risk management techniques to align with the shifting landscape.

For instance, during periods of high volatility, traders might opt for shorter-term trades to take advantage of quick price movements. They may also increase their use of stop-loss orders to protect against sudden market swings. Conversely, in calmer markets, longer-term trading strategies and fundamental analysis can become more effective tools for predicting currency trends. Adjusting to these changes is crucial for Sydney forex traders looking to stay competitive and successful in a dynamic global market.

Rapid currency fluctuations significantly influence Sydney’s forex decisions, making it crucial for traders to stay informed and adapt their strategies. By understanding these swings and navigating volatility, local forex traders can capitalize on opportunities while mitigating risks in this dynamic market. Whether adjusting trading tactics or diversifying portfolios, staying agile is key to success in today’s volatile forex landscape.