Before trading in Bendigo, define financial aspirations and risk tolerance for a successful trading plan. Research markets, set specific goals, choose a suitable brokerage, execute trades based on clear strategies, monitor performance, and refine your approach over time.

Looking to start trading in Bendigo? Crafting a winning trading plan is your first step towards financial success. This comprehensive guide breaks down essential components, from understanding your financial goals and assessing risk, to conducting market research and selecting the right brokerage. Learn how to craft a strategy that aligns with your comfort zone and execute it effectively. With these steps, you’ll be well-prepared to navigate the markets confidently.

- Understanding Your Financial Goals

- Risk Assessment: Know Your Comfort Zone

- Market Research: Identify Trading Opportunities

- Crafting a Winning Strategy

- Selecting the Right Brokerage in Bendigo

- Executing and Monitoring Your Plan

Understanding Your Financial Goals

Before plunging into the world of trading, it’s paramount to define your financial aspirations. Understanding your goals is the cornerstone of crafting a successful trading plan in Bendigo. Are you aiming to supplement your income, save for retirement, or fund your child’s education? Clarifying these objectives will shape your risk appetite and investment strategies. For instance, if short-term gains are your priority, you might opt for day trading with quick, small investments. Conversely, long-term financial security may require a more conservative approach, focusing on building a diverse portfolio over time.

This process involves not just knowing what you want but also how much. Setting specific, measurable goals provides a roadmap for your trading journey. For example, “I aim to save $50,000 in the next 10 years for my child’s education” offers a clear target and timeframe, enabling you to tailor your trading activities accordingly, whether through regular savings, strategic investments, or diversifying your portfolio with various asset classes.

Risk Assessment: Know Your Comfort Zone

Before you start trading, defining your risk assessment and comfort zone is vital. Understanding how much risk you’re willing to take on each trade is key to developing a successful trading plan in Bendigo. Consider your financial situation, investment goals, and emotional readiness—are you comfortable with potential losses or do certain levels of volatility make you uneasy?

Knowing your risk tolerance allows you to set stop-loss orders and position sizes that align with your comfort zone. A well-defined risk assessment ensures that trading decisions are based on logic rather than emotion, which is essential for consistent performance in the market.

Market Research: Identify Trading Opportunities

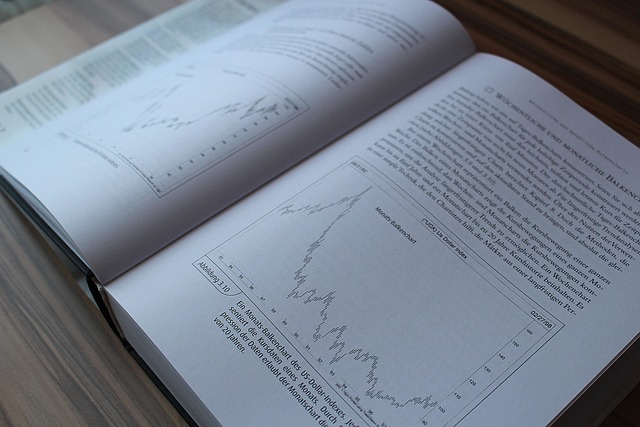

Market research is a fundamental step in crafting your trading plan, especially when diving into the dynamic world of financial markets in Bendigo. It involves a thorough exploration of various factors that can impact market trends and identify potential opportunities. By analysing historical data, economic indicators, and industry news, traders can gain valuable insights into emerging patterns and sectors with high growth potential.

This process enables you to pinpoint specific assets or markets that align with your investment goals. Whether it’s tracking down undervalued stocks, anticipating commodity price movements, or monitoring forex trends, market research provides the data needed to make informed decisions. A well-researched trading plan, tailored to Bendigo’s financial landscape, significantly enhances your chances of success in the market.

Crafting a Winning Strategy

Crafting a winning strategy is the cornerstone of successful trading in Bendigo or anywhere else. A well-defined trading plan acts as your compass, guiding decisions and actions based on clear objectives and risk management principles. Start by identifying your investment goals – are you aiming for short-term gains or building long-term wealth? This sets the direction for choosing the right markets, assets, and timeframes to trade.

Next, determine your risk tolerance level. How much potential loss are you comfortable with in any given trade? Define stop-loss orders, take-profit targets, and position sizing accordingly. Combining these elements creates a structured framework that helps maintain discipline during volatile market conditions, ensuring each trade aligns with your overarching strategy.

Selecting the Right Brokerage in Bendigo

When considering starting trading with a plan in Bendigo, selecting the right brokerage is a pivotal step. It’s essential to look for a firm that aligns with your trading goals and style. Research various brokerages in Bendigo, examining their offerings, fees, regulatory status, and customer reviews. A reputable brokerage should provide a user-friendly platform, robust research tools, and excellent customer support.

Consider factors such as the types of assets they offer, trade execution speed, and any additional services like educational resources or automated trading options. Ensure they are regulated by a recognised authority to safeguard your funds. Ultimately, choose a brokerage that not only meets your current needs but also allows for potential growth as you advance in your trading journey with a well-defined trading plan.

Executing and Monitoring Your Plan

Executing your trading plan is the first step towards achieving consistent results in Bendigo. Once you’ve established clear entry and exit points, defined risk management strategies, and identified your investment goals, it’s time to put the plan into action. Utilize reliable trading platforms that offer real-time data and advanced tools to execute trades swiftly and accurately. Regularly monitor market conditions, keeping an eye on price movements, news, and trends that may impact your chosen assets. This proactive approach ensures you remain agile and adaptable, allowing for quick adjustments if needed.

Effective monitoring involves setting up alerts for specific price targets or market changes, enabling you to respond promptly. Stay disciplined by adhering to the predefined rules of your plan, even in volatile markets. Regularly review your performance against the initial goals, assessing both successes and areas that require improvement. This iterative process is key to refining your strategy over time, helping you become a more informed and successful trader in Bendigo’s dynamic market.

Starting your trading journey in Bendigo begins with a solid, tailored trading plan. By understanding your financial aspirations, assessing risks appropriately, conducting thorough market research, developing a winning strategy, and choosing the right brokerage, you’ll be well-equipped to navigate the markets successfully. Consistently execute and monitor your plan, allowing for adjustments as needed, to achieve your financial goals with confidence. Remember, a well-defined trading plan is key to navigating the complexities of the Bendigo market and beyond.