Economic indicators are key to navigating local share trading, providing insights into regional financial health. Understanding GDP growth, unemployment, and inflation helps interpret consumer spending and market sentiment. Positive GDP growth encourages investment, while high inflation weakens currencies. Monitoring these changes allows strategic portfolio positioning for significant returns and risk mitigation. Local markets offer unique opportunities to unlock wealth within communities by tracking economic indicators. A rising GDP usually indicates a robust economy, while declining GDP signals challenges. Moderate inflation stimulates growth, but high levels erode purchasing power. Combining technical analysis with economic data interpretation enables traders to identify trends, time trades precisely, and build wealth within dynamic local markets. Effective risk management involves understanding inflation, interest rates, unemployment, and GDP growth to anticipate risks and make informed decisions, allowing investors to mitigate losses and enhance long-term financial goals.

“Unleash your investment potential by harnessing the power of economic indicators in local share trading. In today’s dynamic market, understanding key metrics like GDP growth, inflation rates, and unemployment data is crucial for informed decision-making. This article explores how to navigate local share markets effectively, uncovering hidden wealth opportunities. From interpreting economic data to employing technical analysis, we provide strategies to maximize gains even in volatile conditions. Learn risk management techniques tailored for local share trading, ensuring your journey towards wealth within reaches.”

- Understanding Economic Indicators for Informed Trading

- Local Share Markets: Unlocking Wealth Opportunities

- Key Metrics Driving Stock Market Performance

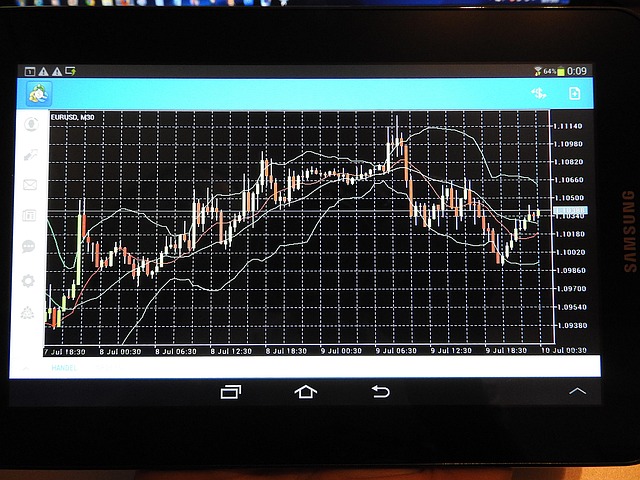

- Technical Analysis Meets Economic Data Interpretation

- Strategies to Maximize Gains in Volatile Markets

- Navigating Risks: Risk Management in Local Share Trading

Understanding Economic Indicators for Informed Trading

Economic indicators are vital tools for navigating local share trading, offering insights into a region’s financial health and potential. For investors aiming to harness the wealth within these markets, understanding these indicators is key. By interpreting data such as GDP growth rates, unemployment figures, and inflation levels, traders can make more informed decisions.

These economic indicators provide a glimpse into consumer spending patterns, business operations, and overall market sentiment. For instance, positive GDP growth often signals a robust economy, encouraging investment opportunities. Conversely, high inflation rates might indicate a weak currency, impacting share prices. Staying attuned to these changes allows investors to strategically position their portfolios, aiming for significant returns while mitigating risks.

Local Share Markets: Unlocking Wealth Opportunities

Local share markets offer investors an incredible opportunity to unlock vast amounts of wealth within their own communities. These markets are dynamic and responsive, providing a direct line to the economic health of a region. By closely monitoring key economic indicators such as GDP growth, employment rates, and inflation, astute investors can gain valuable insights into businesses’ performance potential and make informed trading decisions.

This strategic approach allows individuals to participate actively in their local economy, fostering a sense of financial empowerment. With the right tools and knowledge, investors can identify thriving sectors, emerging trends, and undervalued assets, all while mitigating risks through diversification. Unlocking wealth within local share markets is not just about making profits; it’s about contributing to the prosperity of one’s own region and securing a brighter financial future for the community at large.

Key Metrics Driving Stock Market Performance

In the dynamic landscape of local share trading, understanding key economic indicators is akin to unlocking the secrets to cultivating wealth within a vibrant tapestry. Metrics such as Gross Domestic Product (GDP) serve as compasses guiding investors through the hustle and bustle of market fluctuations. A rising GDP indicates a thriving economy, often translating to bullish stock market trends and opportunities for substantial returns on investments. Conversely, declining GDP signals potential challenges, prompting investors to navigate with caution.

Inflation rates also wield significant influence over stock market performance. Moderate inflation typically stimulates investment growth as it reflects a healthy economic expansion. However, elevated inflation can erode purchasing power and cause investor anxiety, leading to more conservative strategies. By keeping a keen eye on these economic indicators, astute investors can anticipate market shifts, capitalize on emerging trends, and secure wealth within the ever-changing financial realm.

Technical Analysis Meets Economic Data Interpretation

Technical analysis and economic data interpretation are two powerful tools that, when combined, offer a comprehensive strategy for local share trading. By leveraging economic indicators, traders can gain valuable insights into market trends and make informed decisions to potentially boost their wealth within the local market.

Economic indicators provide a glimpse into the health of an economy, offering signals about inflation, interest rates, and growth prospects. These indicators influence stock prices, creating opportunities for astute traders. Incorporating technical analysis alongside economic data interpretation allows investors to identify patterns, confirm trends, and time their trades effectively. This synergy between analytical methods can unlock hidden potential within the local share market, enabling investors to navigate with confidence and maximize returns on their investments.

Strategies to Maximize Gains in Volatile Markets

In volatile markets, navigating the local share trading landscape requires a strategic approach to maximize gains and mitigate risks. One effective strategy is diversifying your portfolio across various sectors and industries, ensuring that your investments are not concentrated in a single area prone to rapid fluctuations. Additionally, staying abreast of economic indicators such as inflation rates, interest levels, and GDP growth can provide valuable insights into market trends, enabling investors to make informed decisions.

Utilizing technical analysis tools and charts can offer further guidance on entering and exiting trades at optimal moments. Identifying key support and resistance levels, for instance, helps in pinpointing potential turning points in the market. Moreover, embracing a disciplined trading strategy, such as setting predetermined stop-loss orders and profit targets, allows investors to manage their risk effectively and seize opportunities for substantial wealth within volatile environments.

Navigating Risks: Risk Management in Local Share Trading

Navigating risks is a critical aspect of local share trading, where investors must manage their exposure to market volatility and economic uncertainties. Effective risk management involves a comprehensive understanding of various economic indicators that influence stock prices. By closely monitoring factors such as inflation rates, interest rates, unemployment figures, and GDP growth, traders can anticipate potential risks and make informed decisions.

This strategic approach allows investors to build wealth within their portfolios by identifying market trends and adapting their strategies accordingly. For instance, rising inflation may signal a need for defensive investments in sectors with built-in cost protection. Conversely, declining interest rates could indicate an opportune time to invest in growth stocks. Through meticulous risk management, local share traders can navigate the market’s complexities, mitigate potential losses, and enhance their chances of achieving long-term financial goals.

By understanding and leveraging economic indicators, local share trading offers a path towards unlocking significant wealth opportunities. This article has explored key metrics driving stock market performance, the intersection of technical analysis and economic data interpretation, and strategic approaches to maximize gains in volatile markets. While risks are inherent, effective risk management enables investors to navigate these challenges and harness the potential for substantial returns within local share markets. With a keen eye on economic indicators, informed trading decisions can lead to significant wealth creation.