Market analysis is crucial for successful leverage trading, involving scrutiny of price movements, volume, and news events to make informed decisions. Leverage amplifies gains but also risks, requiring strategic adjustments, stop-loss orders, and diversification. Technical analysis identifies trends using indicators and patterns, enabling data-driven decisions. In today's fast-paced market, traders who monitor news and anticipate events can capitalize on fleeting opportunities, making leverage trading both challenging and rewarding.

In the dynamic realm of finance, market analysis and news impact are powerful catalysts driving trading trends. This article explores how these factors intertwine to create opportunities for savvy investors. From understanding key metrics and tools in market analysis to deciphering news events’ financial influence, we delve into effective leverage trading strategies. Additionally, we uncover technical analysis techniques for trend identification and provide insights on making timely, data-driven decisions in today’s fast-paced markets.

- Understanding Market Analysis: Key Metrics and Tools

- News Impact: How Events Shape Financial Markets

- Leverage Trading Strategies for Risk and Reward

- Identifying Trends: Technical Analysis Techniques

- Staying Ahead: Time-Sensitive Trading Decisions

Understanding Market Analysis: Key Metrics and Tools

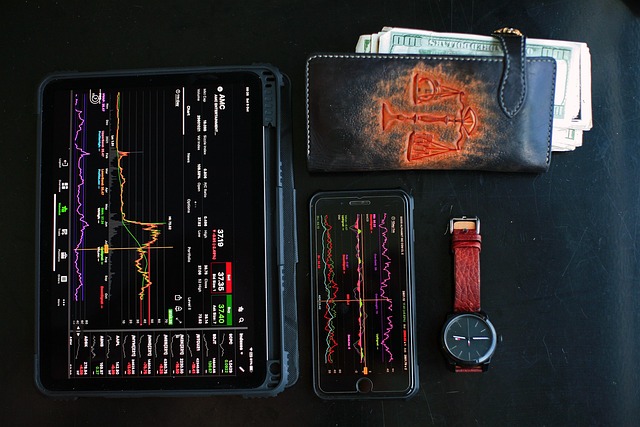

Market analysis is a crucial aspect of successful trading, especially when it comes to leverage trading. It involves an in-depth examination of various financial indicators and data points to identify trends, patterns, and potential opportunities in the market. By understanding these dynamics, traders can make informed decisions and strategize effectively. Key metrics such as price movements, volume, open interest, and volatility play a significant role in gauging market sentiment and predicting future directions.

Tools like technical analysis indicators (e.g., moving averages, RSI, MACD), charts, and economic calendars are essential for navigating the complexities of the financial markets. These resources provide insights into historical data, enabling traders to identify recurring trends and make predictions with greater accuracy. Additionally, real-time market news and updates can significantly impact trading strategies, as they offer a snapshot of current events that may influence asset prices.

News Impact: How Events Shape Financial Markets

News plays a pivotal role in shaping financial markets and influencing trading trends, offering ample opportunities for investors to leverage trading strategies. A single event can trigger significant price fluctuations across various assets, creating a ripple effect that traders keenly monitor. From geopolitical shifts to economic indicators, every piece of news is analyzed for its potential market impact.

Investors who stay abreast of breaking news and understand its implications can make informed decisions, often leveraging the volatility created by these events. This involves swiftly adjusting portfolios, executing trades, or adopting specific strategies to capitalize on market movements. The dynamic nature of financial markets, driven by news, requires traders to remain agile and adaptable, continually refining their approach to leverage trading opportunities effectively.

Leverage Trading Strategies for Risk and Reward

Leverage trading strategies offer both compelling risks and rewards, making them a double-edged sword for investors. By using borrowed capital, traders can amplify their potential gains from market movements. This tactic is particularly attractive in volatile markets where price swings are significant. However, it’s crucial to understand that leverage magnifies both profits and losses. A small price movement in the asset’s favor can lead to substantial gains, but an adverse move can result in substantial losses exceeding the initial investment.

Traders employ various techniques to manage these risks. One common approach is setting stop-loss orders to limit potential downside risk. Diversification across multiple assets or positions can also mitigate risk. Additionally, understanding market trends and news events is vital. Positive news can drive prices higher, offering opportunities for leveraged gains, while negative developments might trigger sharp declines, necessitating careful monitoring and strategic adjustments to leverage positions.

Identifying Trends: Technical Analysis Techniques

Identifying trends is a crucial step in successful leverage trading, and technical analysis tools play a pivotal role in this process. Traders utilize various indicators and chart patterns to decipher market movements and potential breakouts or reversals. For instance, moving averages help smooth out price data, revealing longer-term trend directions while reducing short-term noise.

Support and resistance levels, identified through previous price action, act as key references for traders. These levels indicate where the market has previously struggled to break through, offering insights into potential future barriers or pivot points. Combining these techniques allows traders to formulate strategies that leverage market trends, making informed decisions based on tangible data rather than mere speculation.

Staying Ahead: Time-Sensitive Trading Decisions

In the fast-paced world of finance, staying ahead means making informed decisions in real time. Leverage trading is a powerful tool that enables traders to capitalize on market movements with increased speed and potential returns. However, this also requires constant vigilance and an understanding of how news and analysis can shape trading trends. Every second counts when it comes to leveraging trading; timely insights can turn a profitable opportunity into a significant gain or, conversely, a missed chance.

Traders who excel in this domain consistently monitor market news and analyze its potential impact on various assets. They anticipate the short-term and long-term effects of economic indicators, geopolitical events, and corporate announcements. By staying agile and adapting their strategies accordingly, these traders can exploit fleeting opportunities that may arise from sudden shifts in sentiment or unexpected data releases. This dynamic approach to leverage trading demands a keen sense of timing and a deep understanding of the market’s intricate relationships.

Market analysis, news impact, and leverage trading go hand in hand in today’s dynamic financial landscape. By understanding key metrics, interpreting market movements from global events, and employing strategic technical analysis, traders can identify and capitalize on trends. Leverage trading strategies offer both significant risks and rewards, making it crucial to stay informed and adapt to time-sensitive decisions. With the right tools and insights, individuals can navigate these complexities and potentially enhance their investment outcomes.