Sydney's forex market is highly volatile, driven by global economic indicators and events. Traders must stay informed about key factors like interest rate changes and political developments to thrive. Adaptability, risk management, and regular portfolio rebalancing are essential strategies for navigating this dynamic environment. Companies can gain competitive advantages by embracing innovative approaches to currency fluctuations.

Rapid and unpredictable currency fluctuations can significantly impact financial decisions in vibrant markets like Sydney. This article delves into the effects of these volatile shifts on the local forex market, exploring how businesses and investors navigate uncertainty. We examine strategies for adapting to rapid changes and analyze the long-term implications on economic decisions, providing insights crucial for understanding Sydney’s forex landscape in an ever-shifting global economy.

- Understanding Rapid Currency Fluctuations

- Impact on Sydney's Forex Market

- Strategies for Navigating Uncertainty

- Long-Term Effects on Economic Decisions

Understanding Rapid Currency Fluctuations

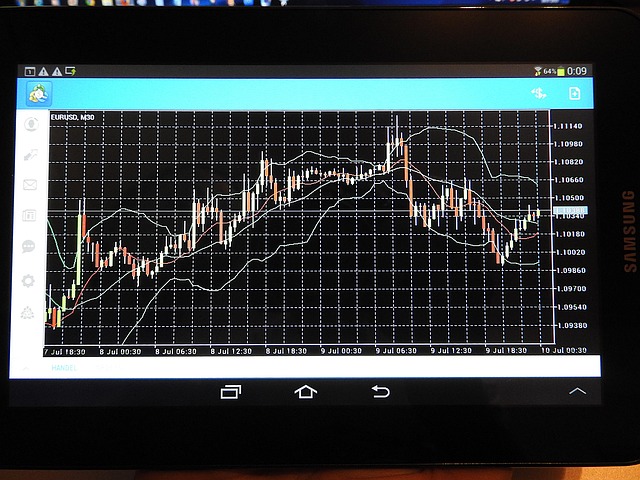

Rapid currency fluctuations are a common feature in the dynamic world of foreign exchange (forex). These fluctuations, often driven by economic indicators, geopolitical events, and market sentiment, can significantly impact forex decisions in Sydney. For instance, unexpected changes in interest rates or political instability in key trading partners can cause currencies to rise or fall precipitously.

Traders and investors must stay abreast of these movements, as they can lead to substantial gains or losses in a short period. Understanding the factors influencing currency values is crucial for making informed decisions in the forex market. By closely monitoring economic calendars, news releases, and market analyses, Sydney-based traders can navigate these fluctuations effectively and capitalize on emerging opportunities.

Impact on Sydney's Forex Market

Rapid currency fluctuations significantly shape Sydney’s forex market, introducing both challenges and opportunities. With Australia being a major financial hub, local traders are keenly attuned to global economic shifts that can swiftly alter exchange rates. This volatility necessitates a proactive approach from participants who must swiftly adapt their strategies.

The dynamic nature of the forex market in Sydney allows for significant gains, especially when navigating the complexities of international trade and investment flows. However, it also demands meticulous risk management and constant monitoring of news events that could trigger substantial price movements. This environment fosters a culture of adaptability among traders who continually refine their techniques to capitalise on emerging trends while mitigating potential losses.

Strategies for Navigating Uncertainty

Navigating the volatile world of forex can be challenging, especially with rapid currency fluctuations. To manage this uncertainty, traders in Sydney and beyond employ several strategic approaches. Firstly, staying informed about economic indicators and global events is crucial. By keeping a close eye on news cycles and market analyses, investors can anticipate potential shifts in exchange rates. This proactive approach enables them to make more informed decisions when trading.

Additionally, diversifying one’s portfolio can mitigate risk. Investing in multiple currencies or utilizing derivatives allows traders to spread their bets, so to speak. This strategy ensures that even if one currency pair experiences a sharp drop, other positions might offset the loss. As the forex market is open 24/5, timely execution of trades and regular portfolio rebalancing are essential tactics to adapt to ever-changing exchange rate dynamics.

Long-Term Effects on Economic Decisions

Rapid currency fluctuations can have significant long-term effects on economic decisions in Sydney and across Australia. For businesses operating in the foreign exchange (forex) market, these volatile changes can create both challenges and opportunities. On one hand, unpredictable currency shifts might deter international investments or cause export/import costs to surge, impacting business strategies and profitability.

On the other hand, dynamic forex conditions can also encourage innovative approaches to risk management and open doors for businesses to diversify their operations globally. Adaptability becomes a key driver, with companies that efficiently navigate these fluctuations potentially gaining competitive advantages in both local and international markets.

Rapid currency fluctuations can significantly influence Sydney’s forex decisions, affecting both short-term trades and long-term economic strategies. By understanding these shifts and adopting flexible navigation strategies, market participants can mitigate risks while capitalizing on opportunities. This adaptability is crucial for navigating the dynamic nature of global exchange rates and ensuring informed financial choices in a constantly evolving forex landscape.