Monitoring economic indicators like inflation rates, unemployment figures, and GDP is crucial for navigating local share trading successfully. By understanding these metrics, investors can anticipate market trends, identify risks and booms, and strategically position investments for both short-term gains and long-term portfolio stability. Local share markets offer attractive opportunities with lower entry barriers, allowing savvy investors to capitalize on regional growth drivers like GDP growth, employment rates, and infrastructure developments to wealth within their communities. Effective navigation in this dynamic environment relies on key indicators like GDP, unemployment rates, and inflation for managing market volatility and maximizing gains.

In today’s dynamic global market, leveraging economic indicators is a powerful strategy for local share trading. This article guides you through the essentials of understanding key economic metrics for smart decision-making. We explore how local share markets present unique opportunities to unlock hidden wealth. Discover crucial metrics and effective strategies for navigating these markets, enabling you to maximize gains and accumulate wealth within reach.

- Understanding Economic Indicators for Smart Trading

- Local Share Markets: Unlocking Wealth Opportunities

- Key Metrics to Navigate and Maximize Gains

- Strategies for Effective Wealth Accumulation

Understanding Economic Indicators for Smart Trading

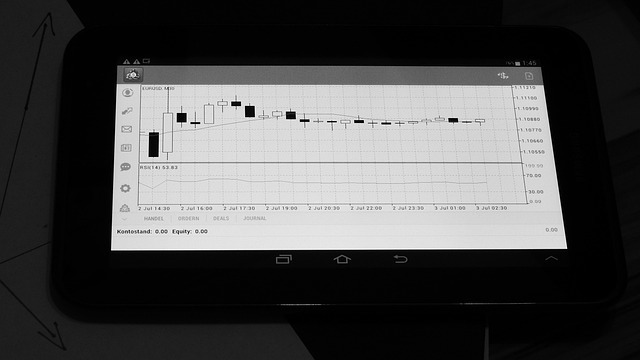

Understanding economic indicators is a cornerstone for smart local share trading, enabling investors to make informed decisions and leverage opportunities for significant gains. These indicators provide valuable insights into a country’s economic health, reflecting factors such as inflation rates, unemployment figures, and gross domestic product (GDP). By closely monitoring these metrics, traders can anticipate market trends, identify potential risks or booms, and strategically position their investments.

For instance, a rising GDP indicates robust economic growth, often correlating with increasing stock prices. Conversely, high inflation rates might signal a weakening economy, prompting investors to reassess their portfolios. Profitable trading involves navigating these indicators, ensuring that decisions are aligned with the broader economic landscape. This approach fosters wealth within the portfolio, catering to both short-term gains and long-term market stability.

Local Share Markets: Unlocking Wealth Opportunities

Local share markets offer a unique and lucrative opportunity for investors seeking to unlock wealth within their communities. These markets are often overlooked, yet they can provide substantial returns with lower entry barriers compared to their global counterparts. By focusing on local economic indicators, savvy investors can identify promising stocks and sectors that drive regional growth. This strategic approach allows for a deeper understanding of the businesses and industries shaping the community’s future, enabling investors to make informed decisions and capitalize on emerging trends.

The key lies in recognizing the intrinsic value of local companies and their contribution to the wealth within a region. Economic indicators such as GDP growth rates, employment figures, and infrastructure developments can serve as powerful tools for gauging investment prospects. Investors who stay attuned to these signals can position themselves advantageously, anticipating market shifts and capitalizing on undervalued assets. Ultimately, navigating local share markets requires a fine balance between analyzing global trends and understanding the unique dynamics of one’s own region.

Key Metrics to Navigate and Maximize Gains

In the dynamic landscape of local share trading, navigating the market with precision is paramount to unlocking substantial gains and fostering wealth within. Key metrics play a pivotal role in this endeavor, offering insights that can guide investment decisions effectively. Among these, Gross Domestic Product (GDP) stands out as a robust indicator of a country’s economic health, reflecting overall production and consumption trends. Closely watching GDP growth rates enables traders to anticipate market movements and make informed choices regarding portfolio allocation.

Additionally, unemployment figures and inflation rates are essential metrics to consider. Lower unemployment typically correlates with stronger consumer spending, positively influencing share prices. Conversely, rising inflation may prompt central banks to adjust interest rates, potentially impacting stock markets. By meticulously analyzing these economic indicators, investors can navigate market volatility, maximize gains, and strategically position their wealth within the local trading arena.

Strategies for Effective Wealth Accumulation

Building wealth within local share trading requires a strategic approach. One effective strategy involves staying informed about economic indicators that can signal market trends. Key metrics such as GDP growth rates, inflation data, and employment statistics provide valuable insights into a region’s economic health, enabling investors to make informed decisions. For instance, positive GDP growth often indicates a robust economy, potentially driving up stock prices. Conversely, high inflation rates may impact purchasing power and influence investment choices.

To maximize wealth accumulation, investors should develop a diversified portfolio tailored to their risk appetite. Regularly reviewing and rebalancing this portfolio based on economic indicators ensures that investments align with current market conditions. Additionally, staying abreast of geopolitical events and policy changes can offer opportunities for strategic adjustments, ultimately contributing to the growth of your investment portfolio and within-market wealth.

Economic indicators are powerful tools that can help local investors navigate the share market with confidence, uncovering substantial wealth opportunities. By understanding key metrics and employing effective strategies, individuals can maximize their gains and work towards accumulating significant wealth. Leveraging these insights is essential for navigating the dynamic local share trading landscape and achieving financial success within this arena.