Australian forex traders leverage a mix of market trends, technical analysis tools, and cutting-edge software to navigate risks and achieve "wealth within" dynamic currency markets. By understanding economic indicators, employing strategic risk management, and mastering technical analysis, they predict price movements accurately, capitalize on global events, and aim for consistent profitability. Building a strong foundation through education and disciplined strategies is key to unlocking their trading potential.

Discover the secrets to mastering Australian forex trading with our comprehensive guide. Learn proven strategies, effective tools, and technical analysis techniques that empower you to unlock wealth within the dynamic forex markets. From navigating risks to building a solid foundation, this article covers everything you need to know for successful trades in Australia’s financial landscape. Start your journey towards financial freedom today!

- Unlocking Secrets: Australian Forex Trading Strategies

- Effective Tools for Wealth Creation in Forex Markets

- Navigating Risks: Safeguarding Your Forex Journey

- Technical Analysis: Decoding Market Trends in Australia

- Building a Solid Foundation for Successful Forex Trades

Unlocking Secrets: Australian Forex Trading Strategies

The Australian forex trading landscape offers a unique blend of opportunities and challenges, especially for those seeking to unlock the secrets to building wealth within the global currency market. With its robust economy and strategic location, Australia is home to a diverse range of forex traders, each with their own strategies and techniques. Uncovering these insider tips can be a game-changer for beginners and seasoned traders alike.

One key aspect often discussed in Australian sessions is the importance of understanding market trends and utilizing technical analysis tools. Traders share insights on identifying supportive and resistant levels, recognizing chart patterns, and interpreting economic indicators. By mastering these skills, forex enthusiasts can make more informed decisions, anticipating price movements with precision and potentially reaping significant rewards while navigating the dynamic currency markets.

Effective Tools for Wealth Creation in Forex Markets

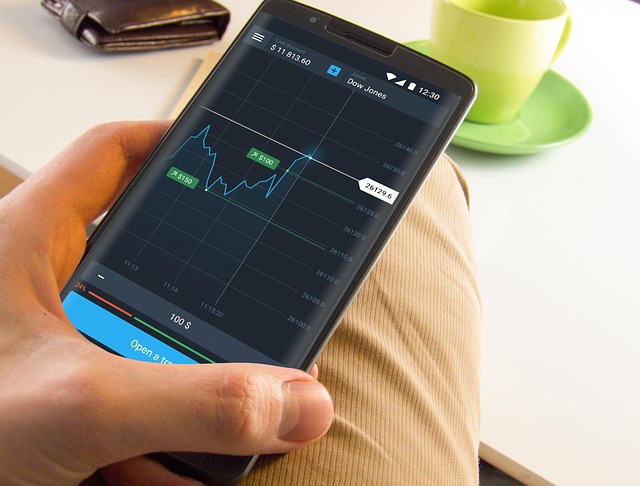

In the dynamic world of foreign exchange (forex) trading, effective tools are the secret weapon for achieving wealth within this global market. Traders in Australia have access to a range of cutting-edge technologies and strategies that can significantly enhance their success. One of the most powerful assets is the use of specialized software designed to analyze vast amounts of data in real time. These tools provide traders with valuable insights, enabling them to make informed decisions based on historical trends and market dynamics.

Additionally, automation plays a crucial role in wealth creation. Automated trading systems can execute trades at speeds unattainable by humans, taking advantage of market fluctuations within milliseconds. This not only ensures faster profits but also reduces the emotional element often associated with trading, minimizing impulsive decisions. With these effective tools at their disposal, Australian forex traders are well-positioned to navigate the markets successfully and ultimately achieve their wealth-building goals.

Navigating Risks: Safeguarding Your Forex Journey

Navigating risks is a vital component of any successful forex trading journey, and it’s key to unlocking wealth within this dynamic market. Forex trading, due to its high liquidity and global nature, comes with inherent risks that traders must understand and manage effectively. One of the primary concerns is volatility; currency values can fluctuate significantly in a short period, leading to potential gains or losses. Traders should implement robust risk management strategies, such as setting stop-loss orders to limit downside exposure and take-profit targets to secure profits. Diversification is another powerful tool; distributing capital across multiple pairs reduces the impact of any single trade’s outcome.

Moreover, understanding and managing risk means keeping a close eye on economic factors that influence forex markets. News events, interest rates, and geopolitical developments can trigger rapid market movements. Staying informed about these factors allows traders to anticipate potential risks and make timely decisions. Ultimately, successful navigation of risks is not just about minimizing losses but also maximizing the potential for wealth within the forex market by ensuring a well-balanced and strategic approach to trading.

Technical Analysis: Decoding Market Trends in Australia

In the quest for wealth within the dynamic forex market, Australian traders often turn to Technical Analysis as a powerful tool. This method involves deciphering historical price patterns and market indicators to predict future trends. By studying charts and utilizing various technical tools, traders can identify recurring motifs that signal potential buy or sell points. The beauty of this approach lies in its ability to provide insights into the collective sentiment of market participants, enabling informed decision-making.

Australian sessions play a pivotal role in this process, offering unique advantages such as access to global financial events and news cycles, as well as a robust trading environment. During these sessions, traders can capitalize on intraday opportunities, leveraging technical analysis to execute trades with precision. The goal is to identify short-term trends that align with the overall market direction, ultimately aiming for consistent profitability and the wealth within that comes with successful forex trading.

Building a Solid Foundation for Successful Forex Trades

Building a solid foundation is key to unlocking the potential for wealth within the dynamic realm of forex trading. New traders often rush into the market, but success demands a systematic approach. The first step involves understanding the fundamentals: market dynamics, currency pairs, and the unique factors that influence each pair’s behavior. Educating oneself about economic indicators, political events, and their impact on exchange rates is essential. This knowledge base equips traders with the tools to make informed decisions.

Furthermore, establishing clear trading goals and developing a disciplined strategy are vital. Traders should define their risk tolerance, preferred timeframes, and entry/exit signals. Consistent risk management practices, such as setting stop-loss orders and position sizing, ensure that each trade aligns with broader strategic objectives. By fostering discipline and sticking to the plan, even during volatile market periods, traders can build a solid foundation for consistent and successful forex trading, ultimately working towards their wealth creation goals.

Australian forex trading offers unique opportunities for wealth creation, as evidenced by the comprehensive strategies and tools discussed in this article. By unlocking market secrets, navigating risks wisely, and mastering technical analysis, individuals can build a solid foundation for successful trades. Embracing these effective techniques allows investors to embark on a journey towards achieving their financial aspirations and securing a prosperous future within the dynamic forex markets.