Sydney's forex market is a global powerhouse, driven by Australia's robust economy and strong economic indicators. Its 24/7 sessions, deep liquidity, regulatory stability, and proximity to Asian hubs attract international traders. Key factors like GDP growth, employment data, RBA policies, and political stability make Sydney a dynamic hub for diverse forex opportunities, analyzed through currency pair analysis and technical tools, while requiring careful risk management.

Global investors keep a keen eye on Sydney’s dynamic forex market, recognizing its potential as a major financial hub. This article delves into the factors driving international interest, exploring key trading conditions and economic indicators that shape Sydney’s forex landscape. We examine political stability’s role, provide currency pair insights for informed decisions, and highlight technical tools essential for success. Additionally, risk management strategies are discussed to navigate Sydney’s forex market with confidence.

- Sydney Forex Market: Global Investor Interest

- Monitoring Trading Conditions: Key Factors

- Economic Indicators Shaping Sydney Forex

- Political Stability and Forex Dynamics

- Currency Pair Analysis for Informed Decisions

- Technical Tools for Effective Sydney Forex Trading

- Risk Management Strategies in Sydney Forex

Sydney Forex Market: Global Investor Interest

Sydney’s forex market has emerged as a significant player on the global financial stage, attracting investors from around the world. The city’s unique position as a major economic hub in Australia, coupled with its robust financial infrastructure, makes it an ideal location for international traders. The Sydney forex market offers 24-hour trading sessions, aligning with the global financial calendar, allowing investors to capitalize on market movements at any time.

Global investors are drawn to Sydney’s forex scene due to its deep liquidity and tight spreads. The city’s strong regulatory environment ensures transparency and protection for participants, fostering a stable and reliable trading atmosphere. Additionally, Sydney’s proximity to Asian financial centers means that the market benefits from high trading volumes during the Asia-Pacific session, providing ample opportunities for investors seeking diverse and dynamic forex trading conditions.

Monitoring Trading Conditions: Key Factors

Global investors closely monitor Sydney’s forex trading conditions, as Australia’s financial hub offers a unique blend of stability and economic dynamism. Key factors driving this interest include the country’s robust economic indicators, such as GDP growth rates and employment data, which provide valuable insights into market trends. The Australian Dollar (AUD), being a major currency pair in the forex market, is particularly sensitive to these indicators.

Additionally, the Reserve Bank of Australia’s monetary policy decisions play a pivotal role in shaping forex trading conditions. Interest rate changes and economic forecasts from the central bank can significantly impact the AUD’s value. Investors also pay close attention to geopolitical factors, as events affecting global markets can create volatility in Sydney’s forex trading environment. This dynamic interplay of economic indicators, monetary policies, and geopolitical influences ensures that monitoring Sydney’s forex market remains a critical aspect for global investors seeking lucrative opportunities.

Economic Indicators Shaping Sydney Forex

Sydney, as a major financial hub in Australia, is a key center for forex trading, attracting global investors interested in exploring its unique market dynamics. The city’s economic landscape is shaped by various indicators that influence currency exchange rates, making it an intriguing destination for traders worldwide. One of the primary factors driving Sydney’s forex scene is its strong association with the commodities market, given Australia’s abundant natural resources.

Economic indicators such as GDP growth rates, inflation data, and employment statistics play a pivotal role in shaping Sydney’s forex environment. Investors closely follow these releases to gauge the health of the Australian economy, which has significant implications for the value of the Australian Dollar (AUD). Additionally, policy decisions by the Reserve Bank of Australia (RBA) regarding interest rates can create substantial volatility in the forex market, making Sydney an exciting yet challenging trading ground for international investors.

Political Stability and Forex Dynamics

Political stability is a key driver in global investment decisions, including those in the volatile forex market. Sydney, known for its robust economy and stable political climate, offers investors a compelling environment for engaging in forex trading. This stability attracts international investors who seek to capitalize on the city’s dynamic economic landscape while minimizing risk associated with political unrest.

The impact of political events on the forex market is significant, often leading to rapid currency fluctuations. However, Sydney’s consistent political stability has fostered a predictable exchange rate environment, providing traders with a solid foundation for strategic decision-making. This factor, coupled with the city’s strong economic indicators and open trade policies, positions Sydney as an attractive hub for global investors navigating the complex forex dynamics.

Currency Pair Analysis for Informed Decisions

Global investors closely monitor Sydney’s forex trading conditions, recognizing that currency pair analysis is a cornerstone of informed investment decisions in the foreign exchange market (forex). By examining the dynamics between various currencies, traders can identify trends, predict price movements, and capitalize on opportunities. The Australian Dollar (AUD), for instance, often reflects economic health indicators like interest rates and trade balances, making it a closely watched pair alongside other major currencies like the US Dollar (USD) and Euro (EUR).

This analysis extends beyond individual pairs. Investors also consider broader market sentiment, geopolitical events, and central bank policies that can influence currency values globally. Tools such as technical analysis charts, economic calendars, and news feeds play a vital role in staying abreast of these factors. By integrating this data, global investors can navigate the complex forex landscape with greater confidence, aiming to optimize returns while managing risks effectively.

Technical Tools for Effective Sydney Forex Trading

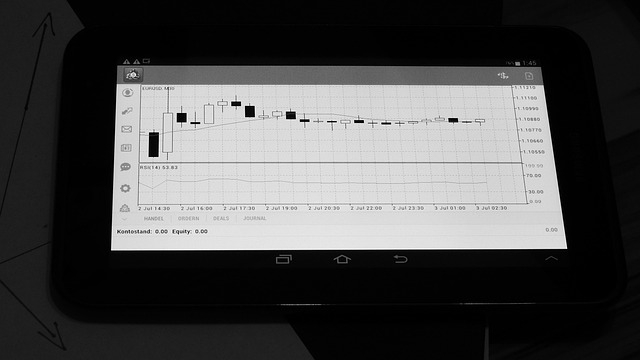

Sydney, a global financial hub, offers investors an exciting opportunity to engage in forex trading. To navigate this dynamic market effectively, technical tools are indispensable. Trading platforms equipped with advanced indicators provide traders with insights into price patterns and potential trends, enabling them to make informed decisions.

Moving averages, for instance, smooth out price data, revealing longer-term trends while Bollinger Bands indicate volatility by showcasing the range of price fluctuations. These tools, combined with effective risk management strategies, empower Sydney forex traders to navigate market uncertainties and capitalize on lucrative opportunities in the global forex arena.

Risk Management Strategies in Sydney Forex

Sydney, as a major financial hub, offers investors a dynamic environment for forex trading, but it also presents unique risks. Effective risk management is crucial to navigate this volatile market. Investors can employ several strategies to mitigate potential losses and secure their positions.

One key approach is setting clear stop-loss orders, which automatically close a trade when the price reaches a predetermined level, limiting downside exposure. Diversifying their portfolio across various currency pairs can also reduce risk; by not concentrating investments in one market, investors can protect themselves from pair-specific volatility. Additionally, staying informed about economic and geopolitical events impacting the Australian dollar is essential. Regularly reviewing and adjusting trading strategies based on these factors ensures investors are prepared for market fluctuations, allowing them to make informed decisions in the ever-changing forex landscape.

Global investors increasingly recognize the allure of Sydney’s vibrant forex market, driven by robust economic indicators and political stability. By meticulously monitoring trading conditions, leveraging key factors, and utilizing advanced technical tools, investors can navigate this dynamic landscape effectively. Currency pair analysis and robust risk management strategies are essential to making informed decisions in the ever-changing Sydney forex environment.