Melbourne's CFD trading scene demands robust risk management strategies. Specialized CFD courses teach advanced techniques like stop-loss orders, position sizing (e.g., 1% rule), technical & fundamental analysis tools, and market trend adaptation. These skills safeguard capital, manage risks, and maximize gains in dynamic CFD markets, based on global case studies like the 2008 crisis. Diversifying portfolios and regularly reviewing strategies are key for long-term success.

“Unleash your potential in CFD trading with our comprehensive guide, tailored for Melbourne’s traders. Effective risk management is the cornerstone of successful CFD ventures, and this article explores just that. From understanding intricate market risks to implementing proven strategies, we equip you with the tools needed to navigate Melbourne’s competitive financial landscape. Discover an overview of local CFD courses, real-world case studies, and expert tips for long-term success. Elevate your trading game with our expert insights and master the art of risk management in CFD trading.”

- Understanding Risk in CFD Trading

- Melbourne's CFD Trading Course: An Overview

- Key Strategies for Effective Risk Management

- Tools and Techniques for Risk Assessment

- Case Studies: Real-World Risk Mitigation

- Advanced Tips for Long-Term Success

Understanding Risk in CFD Trading

In the dynamic landscape of CFD (Contract for Difference) trading, understanding risk is paramount. Unlike traditional investments where ownership of an asset is transferred, CFDs allow traders to speculate on price movements without owning the underlying asset. This comes with unique risks, such as the potential for significant losses if market conditions move against your position. A Melbourne-based CFD trading course can equip individuals with the knowledge and tools to navigate these complexities.

Traders often refer to risk as the possibility of losing some or all of their investment. Effective risk management in CFD trading involves assessing, monitoring, and controlling this potential loss. The course delves into key concepts like risk-reward ratios, stop-loss orders, and position sizing, empowering traders to make informed decisions that align with their risk appetite. By mastering these techniques, participants gain a competitive edge, ensuring they’re not just trading but strategically managing their financial exposure in the dynamic markets of CFD.

Melbourne's CFD Trading Course: An Overview

Melbourne, a bustling metropolis known for its vibrant financial sector, is home to an array of CFD (Contract for Difference) trading opportunities. For those looking to navigate this complex world, a well-structured CFD trading course can be a game-changer. This comprehensive program in Melbourne offers traders an in-depth understanding of the market and the tools needed to manage risk effectively.

The CFD trading course covers various aspects, from introducing participants to the fundamentals of CFD markets to teaching advanced strategies. It delves into risk assessment techniques, enabling students to identify potential hazards and develop mitigation plans. Through hands-on sessions and real-world case studies, traders gain practical experience in managing risk, ensuring they are well-prepared for Melbourne’s fast-paced financial environment.

Key Strategies for Effective Risk Management

In the dynamic landscape of CFD trading Melbourne, effective risk management is not just an option—it’s a necessity. A well-rounded CFD trading course should equip traders with key strategies to navigate the market’s uncertainties. One fundamental approach involves setting clear and defined stop-loss orders, which act as a safety net by automatically closing positions when they reach a predetermined price, limiting potential losses. Diversification is another powerful tool; spreading investments across multiple assets can reduce risk by minimizing exposure to any single market’s volatility.

Traders should also employ position sizing techniques, such as the 1% rule, which suggests allocating no more than 1% of total capital to a single trade. This conservative approach ensures that even if a trade goes against you, it won’t drain your account. Additionally, regular review and adjustment of risk management plans are crucial. Staying informed about market trends, economic indicators, and news events allows traders to adapt their strategies promptly, thereby enhancing overall risk mitigation efforts.

Tools and Techniques for Risk Assessment

Effective risk management is a cornerstone of any successful CFD trading strategy. In Melbourne, specialized CFD trading courses equip traders with powerful tools and techniques for risk assessment. These include technical analysis tools like moving averages, RSI, and Bollinger Bands, which help identify trends, overbought/oversold conditions, and potential reversals. Additionally, fundamental analysis plays a crucial role by considering economic indicators, company news, and market sentiment to anticipate broader market movements.

Traders also benefit from risk management strategies such as stop-loss orders, take-profit targets, and position sizing techniques. Stop-loss orders automatically close positions if they reach a certain loss threshold, protecting capital. Take-profit targets lock in gains once reached. Position sizing ensures that each trade aligns with your risk appetite, capping potential losses while allowing for manageable gains. These tools and techniques form the backbone of a robust risk assessment framework in CFD trading courses Melbourne offers.

Case Studies: Real-World Risk Mitigation

In the dynamic landscape of CFD (Contract for Difference) trading, Melbourne’s financial professionals are increasingly turning to comprehensive risk management strategies to navigate the market’s complexities. Case studies from around the globe offer valuable insights into real-world risk mitigation techniques. For instance, a study analyzing the 2008 global financial crisis reveals that traders who incorporated diverse risk management tools, such as stop-loss orders and position sizing techniques, were better equipped to withstand market volatility.

These practical examples underscore the importance of a well-rounded CFD trading course in Melbourne. By studying successful risk management strategies employed by seasoned traders, aspiring professionals can gain invaluable knowledge on how to protect capital, manage exposures, and make informed decisions even in uncertain markets. Such insights are essential for navigating the intricate world of CFDs and ensuring long-term success.

Advanced Tips for Long-Term Success

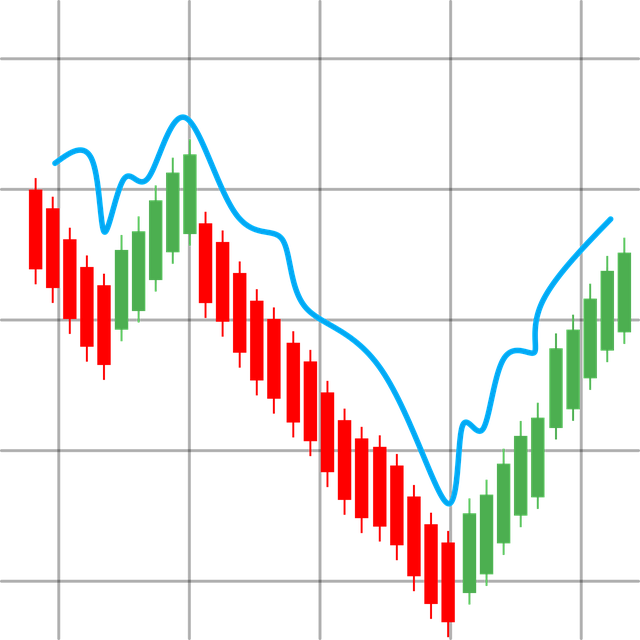

For long-term success in CFD trading, Melbourne-based traders can benefit from advanced strategies that go beyond basic risk management. One key tip is to dive into and understand market trends and patterns. By analysing historical data and identifying recurring trends, traders can make more informed decisions. This involves learning technical analysis tools like moving averages, RSI indicators, and candlestick patterns to predict future price movements.

Additionally, diversifying your portfolio across various asset classes within the CFD trading course can significantly reduce risk. Don’t put all your eggs in one basket; instead, spread your investments to mitigate potential losses. Regularly reviewing and adjusting your strategies based on market dynamics is crucial. Stay updated with economic calendars and news events that might impact markets, allowing you to adapt quickly and make strategic changes to your trades.

Effective risk management is a cornerstone of successful CFD trading, as demonstrated by Melbourne’s renowned CFD trading courses. By understanding risk dynamics, leveraging key strategies, and utilizing advanced tools and techniques, traders can mitigate potential losses and maximize gains in this dynamic market. Through case studies and practical tips for long-term success, aspiring and seasoned traders alike can navigate the complexities of CFD trading with confidence and achieve their financial objectives. A well-rounded CFD trading course, like those available in Melbourne, equips individuals with the knowledge and skills to make informed decisions and thrive in today’s global market.