In today's dynamic economic landscape, Australia's stock market offers a captivating opportunity for savvy investors seeking to unlock wealth within. Known for transparency, robust regulation, and diverse sectors, it provides a unique blend of growth and stability. A strategic approach involves defining financial goals, understanding risk tolerance, diversifying portfolios, staying informed about trends, and tax-efficient planning. Personalized investment roadmaps, aligned with individual circumstances, guide decisions to achieve wealth within the dynamic Australian market.

“Discover the secrets to unlocking significant wealth through practical investment planning in Australia’s dynamic stock market. This comprehensive guide takes you on a journey, from understanding the local market dynamics in ‘Unlocking Wealth: Australia’s Stock Market Secrets’ to mastering step-by-step strategies in ‘Practical Investing’. Learn how to navigate risks for sustainable growth, diversify your portfolio, optimize returns with tax-efficient planning, and create a personalized investment roadmap tailored to your financial aspirations. Uncover the path to achieving wealth within.”

- Unlocking Wealth: Australia's Stock Market Secrets

- Practical Investing: A Step-by-Step Guide

- Navigating Risks for Sustainable Growth

- Diversification Strategies for Optimal Returns

- Tax-Efficient Planning for Long-Term Success

- Building a Personalized Investment Roadmap

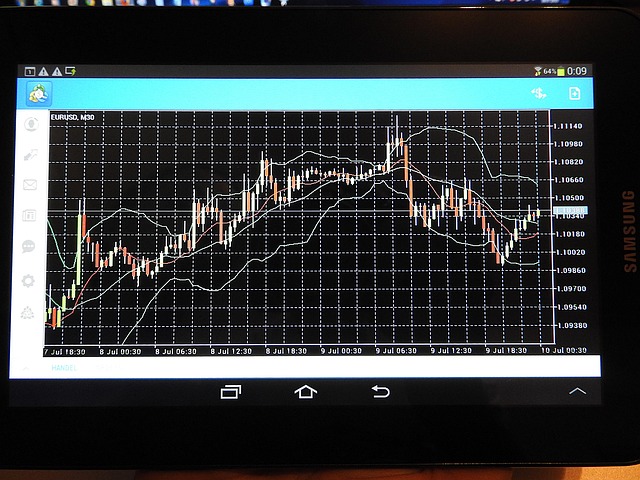

Unlocking Wealth: Australia's Stock Market Secrets

In today’s dynamic economic landscape, Australia’s stock market presents a captivating opportunity for savvy investors seeking to unlock wealth within. Beyond theoretical frameworks, this vibrant market is a tapestry of diverse sectors and innovative companies, offering a unique blend of growth and stability. By delving into its intricacies, investors can discover well-kept secrets that have the potential to significantly enhance their financial portfolios.

Australia’s stock exchange stands out for its transparency and robust regulatory framework, fostering an environment conducive to practical investment planning. This enables investors to make informed decisions by analysing market trends, industry insights, and company performance. With a strategic approach, individuals can navigate the market’s opportunities, identify promising investments, and chart a course towards achieving their financial aspirations.

Practical Investing: A Step-by-Step Guide

Practical investing involves a step-by-step approach designed to help individuals navigate the complexities of the stock market and achieve their financial goals, including generating wealth within. The initial step is to define your investment objectives, whether it’s saving for retirement, funding education, or growing your capital. Understanding your risk tolerance is crucial here; are you comfortable with volatile investments or do you prefer more stable options? This self-assessment guides your asset allocation strategy.

Next, build a diversified portfolio by investing in various assets like stocks, bonds, and real estate. Diversification reduces risk by spreading your investments across different sectors and industries. A well-diversified portfolio can withstand market fluctuations better. Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance. Additionally, stay informed about economic trends, industry news, and company performance updates to make informed investment decisions that contribute to the growth of your wealth within the market.

Navigating Risks for Sustainable Growth

Navigating risks is a crucial aspect of any investment strategy, and Australia’s stock market is no exception. Investors seeking sustainable growth must understand that managing risk is key to building wealth within the market’s dynamic landscape. By diversifying their portfolios and employing strategic asset allocation, investors can mitigate potential losses while maximizing returns over time.

This approach allows for a more balanced investment journey, ensuring stability even in volatile markets. Additionally, staying informed about industry trends, economic indicators, and company-specific risks enables investors to make informed decisions. Such proactive risk management facilitates long-term success, fostering an environment conducive to wealth creation and preserving capital for future opportunities.

Diversification Strategies for Optimal Returns

In the pursuit of wealth within the Australian stock market, diversification stands as a cornerstone strategy for optimal returns. By spreading investments across various sectors, industries, and even asset classes, investors can mitigate risks that might arise from any single investment’s performance. This approach ensures that a downturn in one area doesn’t sink an entire portfolio. For instance, allocating resources into both technology stocks and healthcare bonds allows for a more balanced and resilient investment strategy.

A well-diversified portfolio not only cushions against market volatility but also enhances the potential for consistent growth over time. Australia’s diverse economy offers numerous opportunities to achieve this balance; investors can choose from a range of sectors, including mining, agriculture, services, and technology. By embracing diversification, savvy investors can unlock the true potential of their wealth within the dynamic Australian stock market landscape.

Tax-Efficient Planning for Long-Term Success

Tax-efficient planning plays a pivotal role in achieving long-term success in any stock market investment journey, especially in Australia’s dynamic financial landscape. By strategically utilizing tax advantages, investors can significantly enhance their wealth within. This involves careful consideration of tax-friendly investments and structured planning to minimize tax liabilities over time.

One effective approach is to focus on tax-efficient sectors and assets that offer long-term growth potential. Additionally, taking advantage of tax offsets and deductions available for certain types of investments can substantially impact overall returns. A well-planned investment strategy, tailored to individual financial goals, ensures that taxes work in harmony with wealth creation rather than hindering it, paving the way for a prosperous future.

Building a Personalized Investment Roadmap

Creating a personalized investment roadmap is a key step in achieving wealth within the Australian stock market. This process involves understanding your financial goals, risk tolerance, and time horizon. By mapping out these factors, investors can tailor their strategies to align with their unique circumstances. A well-crafted roadmap will guide decisions on asset allocation, diversification, and the selection of suitable investment vehicles.

This individualized approach allows for a more focused and efficient investment journey. It enables investors to make informed choices, such as choosing between growth-oriented or income-generating investments, while ensuring their portfolio reflects their personal values and aspirations. With a solid roadmap in place, building wealth becomes a structured, strategic endeavor, enhancing the likelihood of achieving financial success in the dynamic Australian market.

Australia’s stock market offers unique opportunities for savvy investors. By combining practical investment strategies, risk management, diversification, and tax-efficient planning outlined in this guide, you can unlock your wealth within and pave the way for sustainable financial success. Remember, a well-informed and personalized approach is key to navigating the market’s complexities and achieving long-term goals.