Learn to trade stocks with Carlton seminars, offering interactive sessions on fundamental analysis, technical indicators, and risk management. Gain skills in reading charts, identifying trends, and using tools like moving averages. Value investing strategies, focusing on long-term growth and intrinsic worth determination, are also covered. Attendees learn effective risk protection techniques for confident market navigation.

Uncover the secrets to navigating the stock market like a pro at Carlton’s comprehensive seminars. These insightful sessions equip you with powerful strategies for success in today’s dynamic market. From unlocking the potential of technical analysis for informed trades, to mastering value investing for long-term gains, and implementing effective risk management techniques—you’ll gain the tools needed to learn to trade stocks effectively. Dive into these essential topics and transform your investment journey.

- Unlocking Secrets of Stock Market Success

- Mastering Technical Analysis for Trades

- Value Investing: A Long-Term Strategy

- Risk Management: Protecting Your Portfolio

Unlocking Secrets of Stock Market Success

Unleashing your potential in the stock market starts with understanding its intricacies and mastering key strategies. Carlton seminars offer an immersive experience designed to teach aspiring traders like you the secrets to success in the financial arena. Through interactive sessions and insightful guidance, these seminars empower individuals to navigate the market confidently.

Learn to trade stocks effectively by gaining a comprehensive grasp of fundamental analysis, technical indicators, and risk management techniques. Carlton’s experts break down complex concepts into digestible lessons, enabling you to make informed decisions. With practical knowledge and strategies in hand, you’ll be better equipped to unlock profitable opportunities and chart a course for long-term success in the stock market.

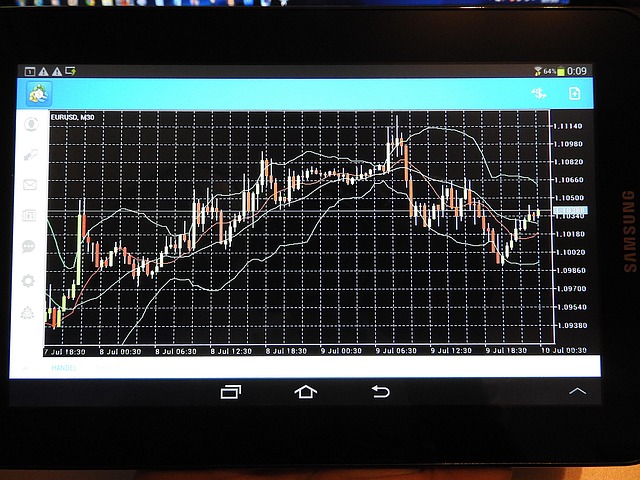

Mastering Technical Analysis for Trades

Mastering technical analysis is a cornerstone for anyone looking to learn to trade stocks effectively. By deciphering price charts and historical data, traders can identify trends, patterns, and signals that indicate potential buy or sell points. This involves understanding various indicators like moving averages, relative strength index (RSI), and Bollinger bands, each providing unique insights into market dynamics.

The Carlton seminars equip participants with the skills to interpret these tools, enabling them to make informed decisions. Through hands-on practice and expert guidance, attendees gain a competitive edge in navigating the stock market. By leveraging technical analysis, traders can minimize risks, capitalize on opportunities, and ultimately enhance their success in the dynamic world of stock trading.

Value Investing: A Long-Term Strategy

Value investing is a long-term strategy that involves identifying undervalued stocks and holding them for an extended period, with the belief that their true value will eventually be recognized by the market. This approach, popularized by legendary investors like Warren Buffett, focuses on fundamental analysis, examining a company’s financial statements, business model, and competitive position to determine its intrinsic worth. By contrast, short-term trading strategies seek immediate gains from price fluctuations, often employing technical analysis tools to time the market.

Learning to trade stocks involves understanding that value investing is not about chasing quick profits but rather building a portfolio of strong companies at reasonable prices. It requires patience and discipline to stick to this strategy, even when the broader market experiences volatility. By focusing on solid fundamentals and avoiding emotional decisions, value investors aim to achieve consistent returns over time, making it an attractive approach for those looking to build wealth steadily through the stock market.

Risk Management: Protecting Your Portfolio

Effective risk management is a cornerstone of successful stock market investing, and Carlton seminars provide invaluable insights into this crucial aspect of learning to trade stocks. By understanding and implementing robust strategies for risk protection, investors can safeguard their portfolios against unexpected losses. This involves diversifying investments across various sectors and asset classes to mitigate the impact of any single stock’s performance.

Attending these seminars equips individuals with the knowledge to assess and manage volatility, a key driver of market fluctuations. Through practical tips and expert guidance, participants learn how to set stop-loss orders to limit potential downside risk and capture gains. By balancing risk and reward, investors can navigate the stock market with confidence, ensuring their capital remains protected while they strive for profitable returns in their learning to trade stocks journey.

The Carlton seminars offer a comprehensive guide for anyone eager to learn to trade stocks. By exploring proven strategies like technical analysis, value investing, and effective risk management, participants gain valuable insights into navigating the market successfully. These sessions empower individuals to make informed decisions, protect their portfolios, and ultimately achieve their financial goals in the stock market.