Sydney stands out as a major hub in the dynamic foreign exchange market (Forex), driven by real-time data, advanced technology, and sophisticated software. Traders leverage minute-to-minute updates on price movements, economic indicators, and global news to make swift decisions, adapt to market shifts, and capitalize on trends. This real-time access provides a significant advantage in the 24/7 global Forex landscape, where speed and accuracy are paramount.

In the dynamic realm of the foreign exchange market, Sydney stands as a global hub, where real-time data drives trading decisions with unparalleled precision. This article explores how live exchange rate fluctuations are harnessed by traders leveraging instant insights from cutting-edge technology. We delve into the advantages this provides, shaping the market dynamics and ensuring informed forex decisions are made at lightning speed.

- Real-time data: Sydney forex market's edge

- Exchange rate fluctuations: Live data impact

- Traders' advantage: Using real-time info

- Market dynamics: Instant data insights

- Forex decisions: Speed and accuracy matter

Real-time data: Sydney forex market's edge

The foreign exchange market, or Forex, is a dynamic and fast-paced arena where currency pairs are traded around the clock. In this high-octane environment, real-time data plays a pivotal role in shaping market decisions. Sydney, as one of the world’s major financial hubs, harnesses the power of live data to gain a significant edge.

Traders in Sydney leverage advanced technology and sophisticated software to access up-to-the-second price updates, news feeds, and economic indicators. This real-time information allows them to make split-second decisions, react to market shifts instantly, and capitalize on emerging trends. The ability to process and analyze vast amounts of data quickly is what sets Sydney apart in the global Forex scene, ensuring traders have a competitive advantage in this ever-changing currency landscape.

Exchange rate fluctuations: Live data impact

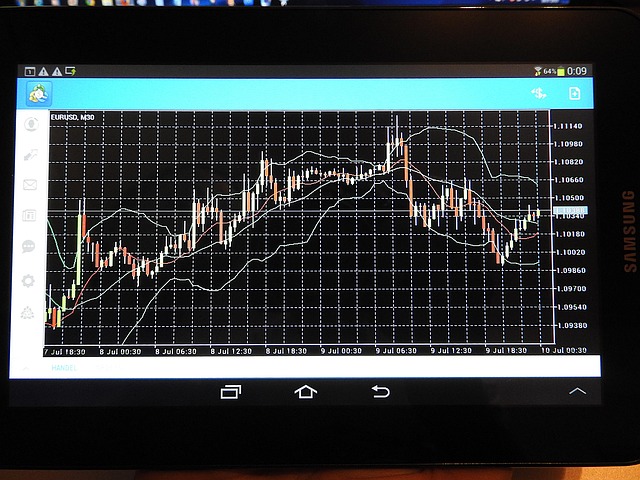

Exchange rate fluctuations in the Sydney forex market are largely driven by real-time data, making it a dynamic and responsive environment for traders. Live currency values can change dramatically within seconds due to various factors such as economic indicators, political events, interest rates, and global news. This constant flux requires traders to stay vigilant and adapt their strategies accordingly.

Traders in the foreign exchange market rely on up-to-the-minute data feeds to make informed decisions. Any significant announcement or release of economic figures can instantly impact exchange rates. For instance, a surprise change in monetary policy by a central bank or unexpected GDP growth numbers can cause rapid shifts in currency values. Traders must be prepared to capitalize on these live market movements or mitigate risks swiftly.

Traders' advantage: Using real-time info

Traders in the dynamic Sydney forex market have a distinct advantage thanks to real-time data. This instant access to the latest price movements, economic indicators, and global news allows them to make informed decisions swiftly. Unlike traditional methods relying on delayed information, real-time data enables traders to identify trends as they unfold, providing a competitive edge in the fast-paced foreign exchange market.

With just a glance at their screens, Sydney-based forex traders can gauge the current market sentiment and adjust their strategies accordingly. This capability is particularly crucial during volatile periods when market conditions can change dramatically within seconds. Real-time data empowers them to capitalize on emerging opportunities or mitigate risks promptly, ensuring they stay ahead of the curve in this highly competitive environment.

Market dynamics: Instant data insights

The foreign exchange market, a dynamic and ever-evolving sector, relies heavily on real-time data to make informed trading decisions. With markets opening 24/7 globally, traders in Sydney have access to instantaneous insights that provide a competitive edge. This real-time data deluge includes economic indicators, news releases, geopolitical events, and market sentiment—all factors that influence currency exchange rates.

Traders can quickly identify trends, react to sudden shifts, and adapt their strategies within seconds. The speed at which this information circulates allows for more agile trading, enabling participants in the Sydney forex market to capitalize on short-term opportunities or mitigate risks promptly. This dynamic nature of real-time data is transforming how forex traders operate, demanding a constant connection to stay ahead in the global financial arena.

Forex decisions: Speed and accuracy matter

In the fast-paced world of the foreign exchange market (Forex), decisions are made in the blink of an eye. The ability to process and act on real-time data is paramount, as even a second’s delay can result in significant losses or missed opportunities. Speed and accuracy go hand in hand; traders must be able to swiftly analyze vast amounts of information, from economic indicators to global news, to make informed choices.

The Forex market operates 24/7, with events and releases happening at breakneck speed, especially during major trading sessions. Traders need tools that can keep up with this dynamic environment, providing instant insights and alerts to ensure they are always ahead of the curve. Accurate, timely data is the cornerstone of successful Forex decision-making, enabling participants to navigate this complex landscape with confidence.

Real-time data is the linchpin of today’s dynamic foreign exchange market, empowering Sydney traders with speed and accuracy. By embracing live exchange rate fluctuations, traders can navigate market dynamics with unparalleled precision, making informed decisions that capitalize on fleeting opportunities. This rapid-fire information flow isn’t just an advantage—it’s a necessity in the ever-evolving Sydney forex landscape.