Sydney's robust economy and strategic location establish it as a prominent global hub for foreign exchange market investors. Its regulatory framework promotes transparency, attracting seasoned pros and new investors alike. Key economic indicators like GDP growth rates, RBA interest rates, unemployment figures, and trade balances heavily influence the Australian Dollar. Understanding these factors is crucial for successful trading in Sydney's dynamic forex environment, amidst geopolitical influences and volatile price swings.

Global investors eye Sydney’s forex trading scene, drawn by its dynamic nature and Australia’s robust economy. This article explores why Sydney has become a magnet for international capital, delving into the unique characteristics of the foreign exchange market here. We analyze key economic indicators influencing Sydney’s forex, navigate political and regulatory landscapes, and uncover successful trading strategies. Additionally, we weigh the risks and rewards, providing insights crucial for investors considering this exciting market.

- Sydney Forex Trading: Global Investor Magnet

- Understanding the Foreign Exchange Market Dynamics

- Monitoring Key Economic Indicators for Sydney Forex

- Navigating Political and Regulatory Environments in Sydney

- Strategies for Successful Sydney Forex Trading

- Risks and Rewards of Investing in Sydney's Forex Market

Sydney Forex Trading: Global Investor Magnet

Sydney has emerged as a magnet for global investors looking to tap into the dynamic foreign exchange market. The city’s robust economy, coupled with its strategic location, makes it an ideal hub for forex trading activities. This vibrant financial center offers unparalleled access to Asia-Pacific markets and facilitates smooth participation in the global foreign exchange market.

The allure of Sydney for international investors lies not only in its economic strength but also in the regulatory framework that supports transparency and stability. This environment encourages open participation, fostering a diverse range of forex trading opportunities. Consequently, Sydney’s forex trading conditions attract seasoned professionals and new investors alike, contributing to its reputation as a dynamic player on the global financial stage.

Understanding the Foreign Exchange Market Dynamics

The foreign exchange market, a global network where currencies are traded 24/7, is a dynamic and complex ecosystem that captivates investors worldwide. This market, often referred to as Forex, is where central banks, financial institutions, corporations, and individual traders converge to facilitate international trade and investment. Each day, trillions of dollars flow across borders, making it one of the largest and most liquid markets globally.

Understanding the dynamics of this market involves grasping key factors such as economic indicators, geopolitical events, interest rate differentials, and market sentiment. For instance, strong economic performance in a country often strengthens its currency, while political instability or economic downturns can weaken it. Investors must stay abreast of these developments to make informed decisions, ensuring they capitalize on opportunities and mitigate risks effectively within the ever-changing foreign exchange market landscape.

Monitoring Key Economic Indicators for Sydney Forex

Global investors closely monitor key economic indicators when engaging in Sydney forex trading. Australia’s financial hub, renowned for its stability and robust economy, provides a fertile ground for foreign exchange market activities. Key performance indicators such as GDP growth rates, interest rates set by the Reserve Bank of Australia (RBA), unemployment figures, and trade balances are critical factors that influence currency values. These economic signals offer investors valuable insights into the health of the Australian economy, enabling them to make informed decisions regarding currency exchanges.

By analyzing these metrics, traders can predict market trends and identify opportune moments for transactions. For instance, positive GDP growth or interest rate hikes can strengthen the Australian Dollar (AUD), while rising unemployment rates or unfavorable trade balances may weaken it relative to other currencies in the foreign exchange market. This dynamic nature necessitates continuous monitoring to capitalize on or mitigate risks associated with Sydney forex trading.

Navigating Political and Regulatory Environments in Sydney

Sydney, a global financial hub, presents investors with both opportunities and challenges due to its unique political and regulatory landscape. The city’s forex trading scene is influenced by Australia’s robust and transparent regulatory framework, which includes the Australian Securities and Investments Commission (ASIC). ASIC ensures fair market practices and protects investors in the foreign exchange market, fostering a stable environment.

However, navigating political factors is essential for international investors. Australia’s relationship with neighboring countries and its involvement in regional trade agreements can impact currency dynamics. Additionally, domestic political stability and government policies regarding financial markets play a significant role in shaping Sydney’s forex conditions. Investors must stay informed about these developments to make strategic decisions in the dynamic foreign exchange market.

Strategies for Successful Sydney Forex Trading

Sydney, as a bustling financial hub, offers a unique opportunity in the foreign exchange market (Forex) for global investors. Successful Forex trading involves a blend of strategic planning and adaptability to the ever-changing market conditions. One key strategy is to stay informed about local economic indicators and news, which can significantly impact currency values. For instance, tracking employment rates, interest rate decisions by the Reserve Bank of Australia, and trade balance data can provide valuable insights for traders.

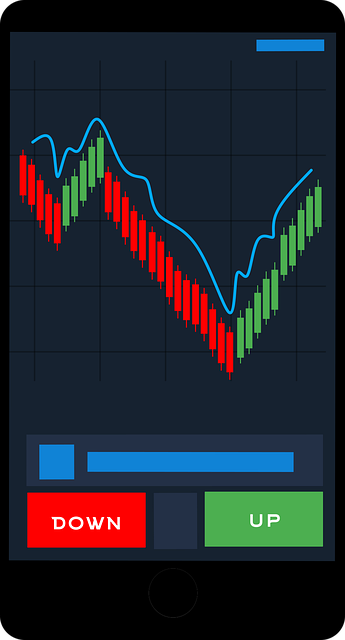

Traders should also consider employing technical analysis tools to identify trends and patterns in price charts. This involves using various indicators, such as moving averages and relative strength indexes, to make informed entry and exit points for trades. Additionally, risk management is paramount; setting stop-loss orders and diversifying investments can protect against substantial losses, ensuring a more sustainable approach to Sydney’s Forex trading conditions.

Risks and Rewards of Investing in Sydney's Forex Market

Investing in Sydney’s forex market presents a unique blend of risks and rewards for global investors. The foreign exchange market, known for its high liquidity and 24-hour operation, offers ample opportunities for significant gains. Sydney, as a major financial hub, benefits from robust economic conditions and a stable political environment, making it an attractive destination for forex trading. However, these conditions also mean that fluctuations can be sharp, and currency values can change dramatically within short periods.

Risks include the potential for substantial losses due to market volatility, as well as exposure to various geopolitical factors and interest rate differentials. Investors must stay informed about economic developments in Australia and globally to anticipate market movements effectively. Despite these risks, the rewards can be substantial, especially when leveraging advanced trading strategies and tools. Sydney’s forex market provides access to a diverse range of currency pairs, enabling investors to diversify their portfolios and manage risk more efficiently.

Sydney’s forex market, with its dynamic foreign exchange market and diverse economic landscape, continues to attract global investors. By carefully monitoring key economic indicators, navigating political and regulatory environments, and employing strategic trading techniques, investors can navigate this vibrant market effectively. However, it’s crucial to also recognize the inherent risks and rewards associated with forex trading in Sydney or any other global hub, ensuring a well-informed and successful investment journey.