Melbourne's vibrant stock market offers opportunities for building "wealth within". Key steps include understanding local businesses, staying informed, educating oneself in trading fundamentals, selecting suitable brokers, strategically choosing stocks, diversifying portfolios, and employing risk management techniques like stop-loss orders and diversification. These practices empower Melbournians to navigate the market effectively and achieve their financial goals.

Looking to harness the power of Melbourne’s stock market and build your wealth? This comprehensive guide is your roadmap. We’ll navigate you through the bustling financial landscape, from understanding key players to mastering strategies for successful trading. Learn how to choose the right brokerage, select winning stocks, execute trades effectively, and manage risks. Discover techniques that empower you to create sustainable wealth within Melbourne’s dynamic market.

- Understanding Melbourne's Stock Market Landscape

- Building a Solid Foundation for Trading Success

- Choosing the Right Brokerage for Your Needs

- Strategies for Effective Stock Selection

- Mastering Order Types and Execution

- Risk Management and Portfolio Diversification Techniques

Understanding Melbourne's Stock Market Landscape

Melbourne, Australia’s cultural hub, is also a financial powerhouse with a dynamic stock market scene. Understanding this landscape is crucial for anyone aiming to build wealth within the city’s vibrant economy. The Melbourne Stock Exchange (MSE) is a significant player, facilitating trading activities among local and international investors. Here, you’ll find a mix of established Australian companies and promising startups, reflecting the diverse nature of Melbourne’s businesses.

Navigating this market requires knowledge and strategies tailored to Melbourne’s unique environment. Investors can capitalize on the city’s strong focus on innovation, particularly in sectors like technology, healthcare, and clean energy, which often drive stock price movements. Keeping an eye on local news and economic trends is essential, as these can significantly impact the performance of listed companies. By understanding Melbourne’s Stock Market landscape, individuals have the potential to make informed decisions and harness the city’s economic growth for their financial gain.

Building a Solid Foundation for Trading Success

Building a solid foundation is crucial for anyone aiming to navigate the stock market successfully, and Melbourne’s vibrant financial landscape offers numerous opportunities for aspiring traders. The first step towards trading success involves educating oneself about the stock market. Understanding basic concepts such as shares, stocks, and trading platforms is essential. Many beginners start by familiarizing themselves with different investment strategies, risk management techniques, and market analysis tools. Online resources, books, and courses can provide a comprehensive foundation, empowering traders to make informed decisions.

Additionally, developing a disciplined approach to trading is vital for wealth within. This includes setting clear goals, defining a trading strategy, and sticking to a consistent plan. Traders should practice patience, as the stock market requires time and careful observation. By building this solid foundation, Melbourne-based investors can confidently navigate the markets, making calculated moves to potentially grow their wealth while managing risks effectively.

Choosing the Right Brokerage for Your Needs

When it comes to trading stocks in Melbourne, selecting the right brokerage is a crucial step in your journey towards building wealth within the market. Not all brokers are created equal, and finding one that aligns with your investment goals and risk tolerance is essential. Consider your trading style; do you prefer mobile app accessibility for on-the-go transactions, or do you require advanced desktop platforms for more intricate strategies? Some brokers offer a range of tools and resources tailored to beginners, while others cater to experienced traders.

Moreover, evaluate the brokerage’s fees, including commission rates, data subscription charges, and any hidden costs. Low-cost brokers are often preferred as they allow investors to keep more of their profits. Also, check the types of assets they offer, such as stocks, ETFs, or options, ensuring that your desired investment choices are available. Remember, a good brokerage should provide a balance between features, support, and cost-effectiveness to help you make informed trades and work towards your financial aspirations.

Strategies for Effective Stock Selection

When it comes to trading stocks in Melbourne or anywhere else, one of the key factors for success lies in your ability to select effective stocks. The first step is to define your investment goals and risk tolerance. Are you looking for short-term gains or long-term wealth within? Understanding this will shape your strategy. Diversification is also crucial; don’t put all your eggs in one basket. Consider sectors that align with market trends, such as technology, healthcare, or renewable energy, which have shown consistent growth over the years.

Research and analysis are paramount. Study company financials, including revenue, earnings per share (EPS), and debt-to-equity ratio. Look for companies with strong track records of consistent profitability and robust balance sheets. Additionally, keep an eye on industry news and regulatory changes that could impact your chosen stocks. By combining fundamental and technical analysis, you can make informed decisions and increase the likelihood of identifying promising investment opportunities to build and grow your wealth within the Melbourne stock market.

Mastering Order Types and Execution

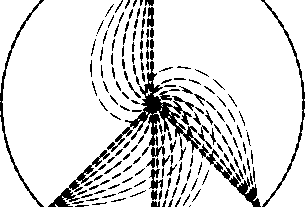

Mastering order types is a crucial step in navigating the stock market. Understanding different order types, such as market orders, limit orders, and stop-loss orders, enables investors to execute trades with precision and confidence. Market orders ensure immediate execution at the current market price, ideal for quick decisions. Limit orders provide control by specifying a maximum or minimum price, allowing traders to lock in profits or set specific entry points. Stop-loss orders protect wealth within a defined risk threshold, automatically triggering a sale if the stock’s price drops below a certain level.

Effective order execution is key to optimizing returns on your investments. It involves choosing the right broker and utilizing their platform for speed and efficiency. Advanced traders can employ strategies like trailing stops to lock in gains as prices rise or scale out positions gradually to manage risk. By combining a deep understanding of order types with strategic execution, Melbourne’s stock market offers opportunities to build wealth within a dynamic financial landscape.

Risk Management and Portfolio Diversification Techniques

Trading stocks can be a powerful tool for building wealth within Melbourne’s financial landscape. However, it also comes with inherent risks that require careful management. Effective risk management involves setting clear stop-loss orders to limit potential losses and diversifying your portfolio across different sectors and asset classes. This strategy helps to distribute risk, ensuring that a poor performance in one area doesn’t severely impact your overall wealth.

Portfolio diversification is an art that goes hand in hand with risk management. By spreading your investments across various stocks, industries, and even international markets, you enhance the potential for growth while minimizing vulnerability. This approach allows investors to navigate market fluctuations more effectively, ultimately contributing to a more stable path towards achieving their financial goals within Melbourne’s dynamic economic environment.

Melbourne’s stock market offers a dynamic environment for aspiring traders seeking to unlock their wealth potential. By understanding the local landscape, building a strong trading foundation, and adopting effective strategies, you can navigate this exciting arena with confidence. From choosing the right brokerage partner to mastering risk management, each step is crucial in your journey towards achieving financial success and creating lasting wealth within the Australian market.