The foreign exchange market (FOREX), a $6 trillion daily volume behemoth, is shaped by global economic forces like interest rates and political events, directly impacting Sydney businesses reliant on international trade. To navigate currency volatility, traders leverage real-time data, advanced analytics, diversification, and risk management techniques. Tech-driven platforms democratize access to FOREX, enabling individuals and startups to participate with enhanced tools and automation; however, rapid market fluctuations present both risks and opportunities, requiring continuous learning and proactive strategies for success.

Rapid currency fluctuations significantly impact Sydney’s forex decisions, posing both challenges and opportunities for businesses operating in this dynamic economic hub. This article delves into the intricate world of the foreign exchange market (FOREX), exploring how unpredictable exchange rates affect local enterprises. We’ll dissect the causes behind sudden currency shifts, provide strategies for navigating volatility, and highlight technological advancements transforming FOREX trading. Additionally, real-world case studies will demonstrate successful forex management in Sydney, offering insights into mitigating risks and maximizing opportunities amidst fluctuating market dynamics.

- Understanding Rapid Currency Fluctuations

- The Foreign Exchange Market (FOREX) Basics

- How Sydney Businesses Are Affected by Currency Volatility

- Strategies for Navigating Unpredictable Exchange Rates

- Case Studies: Successful Forex Management in Sydney

- Technological Advancements in FOREX Trading

- Mitigating Risks and Maximizing Opportunities

Understanding Rapid Currency Fluctuations

Rapid currency fluctuations are a common feature of the dynamic foreign exchange market, where exchange rates can change drastically within minutes, influenced by various economic factors. These fluctuations present both challenges and opportunities for traders and businesses in Sydney, Australia. One key aspect to grasp is that they often occur due to sudden shifts in global economic conditions, such as changes in interest rates, political events, or significant economic releases. For instance, a strong economic report from the United States might strengthen the US dollar, causing other currencies to depreciate accordingly.

Traders in Sydney need to stay informed and adapt quickly to these market movements. Using real-time data and advanced analytical tools, they can predict potential fluctuations and make informed decisions. Additionally, diversifying investments across multiple currencies can help mitigate risks associated with rapid changes. Understanding the drivers of currency volatility is essential for navigating the foreign exchange market effectively in today’s fast-paced economic environment.

The Foreign Exchange Market (FOREX) Basics

The Foreign Exchange Market (FOREX), often referred to as “the market,” is a global decentralized network where currencies are traded 24 hours a day, five days a week. It’s the largest financial market in the world, with an estimated average daily trading volume of over $6 trillion. This massive liquidity makes it possible for investors, banks, and institutions to buy and sell various fiat currencies at competitive rates.

At its core, FOREX operates on the principle of exchange rate fluctuations. Exchange rates represent the value of one country’s currency in terms of another. These rates are influenced by a multitude of economic factors, including interest rates, inflation, political stability, trade balances, and global events. Rapid and unpredictable currency fluctuations can significantly impact decisions made by businesses, investors, and individuals in Sydney and worldwide.

How Sydney Businesses Are Affected by Currency Volatility

Sydney businesses, deeply embedded in a vibrant economy centred around international trade and tourism, are increasingly navigating the complex waters of currency volatility. Rapid fluctuations in the foreign exchange market (FX) directly impact their operational decisions, from pricing strategies to supply chain management. When the Australian dollar strengthens against its peers, Sydney-based exporters may face challenges as their goods become more expensive on global markets, potentially affecting sales and market share.

Conversely, a depreciating currency can be a double-edged sword. It makes imports cheaper but also increases the cost of overseas travel and investments, sectors crucial to Sydney’s economy. This volatility demands agility from businesses, pushing them to adopt dynamic risk management strategies, monitor FX trends closely, and sometimes even hedge against unpredictable market movements to safeguard financial stability and maintain competitiveness in both local and international arenas.

Strategies for Navigating Unpredictable Exchange Rates

In the volatile realm of the foreign exchange market, Sydney traders must continually adapt their strategies to cope with rapid currency fluctuations. One proven method is diversification, spreading investments across multiple currencies to mitigate risk. This approach ensures that a sudden drop in one currency’s value against the Australian dollar doesn’t significantly impact the overall portfolio.

Additionally, staying informed and proactive is key. Traders should closely monitor economic indicators, news releases, and global events that can trigger exchange rate swings. Utilizing advanced charting tools and technical analysis techniques allows for better prediction of market movements. Actively managing risk through stop-loss orders and setting profit targets can also help protect against substantial losses during unpredictable periods.

Case Studies: Successful Forex Management in Sydney

In Sydney, where the foreign exchange market is vibrant and competitive, successful forex management involves a keen understanding of rapid currency fluctuations. Case studies show that forward-thinking businesses and investors have adapted their strategies to capitalize on these swings. One notable example is “Forex Pioneer,” a local financial services firm that employs real-time data analytics and AI algorithms to predict short-term price movements. By acting swiftly, they’ve achieved consistent growth despite market volatility.

Another success story involves a tech startup that expanded internationally, leveraging the foreign exchange market’s dynamic nature. They strategically timed their currency conversions during significant fluctuations, minimizing costs and maximizing profits. This approach underscores the importance of staying informed and agile in the forex arena, allowing Sydney-based entities to not just survive but thrive amidst rapid currency shifts.

Technological Advancements in FOREX Trading

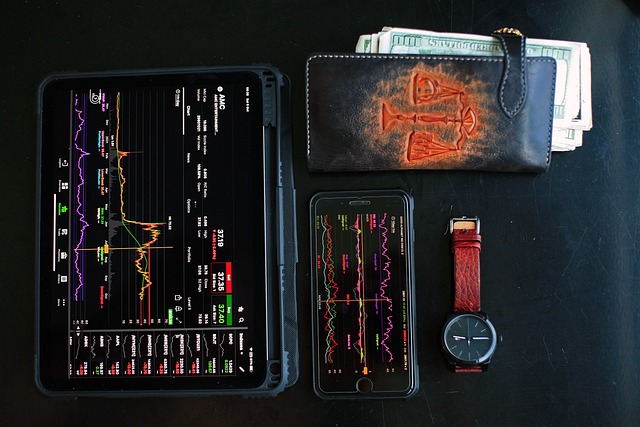

The foreign exchange market, or Forex, has undergone a profound transformation with the advent of technology, especially in recent years. Technological advancements have democratized access to trading, enabling individuals and businesses alike to participate in the global Forex market with ease. Online trading platforms now offer real-time data feeds, advanced charting tools, and sophisticated analytical software, empowering traders to make informed decisions even outside traditional financial institutions.

Automation is another significant trend shaping Forex trading. High-frequency trading (HFT) algorithms execute trades at lightning speed, taking advantage of the smallest price discrepancies. This technology has heightened market liquidity and efficiency but also added complexity, requiring sophisticated risk management strategies. As a result, traders now have access to more tools and resources than ever before, necessitating a deeper understanding of the market dynamics and continuous learning to navigate these rapid currency fluctuations effectively.

Mitigating Risks and Maximizing Opportunities

In the volatile realm of the foreign exchange market, rapid currency fluctuations present both risks and opportunities for Sydney traders. To navigate this dynamic environment effectively, implementing robust risk management strategies is paramount. One key approach involves setting clear stop-loss orders to limit potential losses should the market move against anticipated positions. Additionally, diversifying investment portfolios across various currency pairs can spread risk, ensuring that unexpected swings in a single market do not sink an entire strategy.

On the flip side, active monitoring of market trends and news events allows for swift identification of emerging opportunities. For instance, political developments, economic indicators, or global events can trigger significant currency shifts, offering Sydney forex traders the chance to capitalize on profit margins. By staying agile and informed, participants in this dynamic market can mitigate risks while maximizing the potential returns that rapid fluctuations present.

Rapid currency fluctuations significantly shape Sydney’s forex decisions, impacting businesses across various sectors. By understanding the intricacies of the foreign exchange market and adopting strategic approaches, such as leveraging technological advancements and implementing risk mitigation tactics, Sydney enterprises can navigate this volatile landscape effectively. Case studies demonstrate that successful forex management not only mitigates risks but also maximizes opportunities, ensuring business resilience in an increasingly globalized world.