Forex trading offers Australians a globally accessible 24/7 market to grow their wealth within. With high liquidity, diverse currency pairs, and Australia's strategic economic position, it presents both opportunities and challenges. Effective risk management through stop-loss orders, position sizing, and diversification is crucial for success. Reputable Australian brokers regulated by ASIC provide secure platforms with advanced tools. A structured trading plan, setting clear objectives and rules, ensures consistent decision-making and capital preservation while pursuing wealth within this dynamic market.

“Unleash your path to wealth within Australia’s dynamic forex market with our comprehensive, practical course. This guide is tailored for aspiring traders seeking to navigate the complexities of foreign exchange risk management. From understanding the unique Australian Forex Market dynamics to mastering risk management strategies, this course equips you with essential tools. Learn effective money management, broker navigation, and craft a winning trading plan – secure your financial future in Australia’s thriving forex landscape.”

- Understanding Forex Trading: A Gateway to Wealth Within Australia

- The Australian Forex Market: Opportunities and Unique Considerations

- Risk Management Strategies for Forex Traders Down Under

- Practical Tips for Effective Money Management in Forex

- Navigating Forex Brokers and Platforms in Australia

- Building a Successful Forex Trading Plan: Securing Your Financial Future

Understanding Forex Trading: A Gateway to Wealth Within Australia

Forex trading, or foreign exchange trading, is a global market that offers an exciting opportunity for Australians to access and potentially grow their wealth within. It operates 24 hours a day during the week, providing traders with an extensive window of time to make informed decisions. This dynamic market involves buying and selling currencies, allowing investors to profit from exchange rate fluctuations. By understanding the ins and outs of forex trading, individuals can navigate this complex landscape and explore the possibilities of significant gains.

Australia’s strategic location and robust economy make it a hub for international trade, which further underscores the appeal of forex trading within the country. With the right knowledge and risk management strategies, traders can harness the market’s potential to build their financial portfolio and secure their financial future. This course aims to empower Australian investors with the tools and insights needed to confidently embark on their forex journey, ensuring they unlock the wealth within this vast and ever-changing global marketplace.

The Australian Forex Market: Opportunities and Unique Considerations

The Australian Forex market presents a unique blend of opportunities and challenges, especially for those seeking to harness its potential for wealth within. As one of the world’s most liquid financial markets, it offers around-the-clock trading and access to a diverse range of currency pairs. This dynamic environment attracts traders from across the globe, contributing to high volatility and the potential for substantial gains.

However, navigating this market requires a deep understanding of its unique considerations. Factors such as local economic policies, resource prices, and geopolitical events can significantly impact the Australian Dollar’s value. Effective risk management becomes paramount in such an environment. Traders must master tools and strategies that allow them to mitigate potential losses while capitalising on the market’s opportunities, ensuring they have the best chance at achieving wealth within this exciting but demanding space.

Risk Management Strategies for Forex Traders Down Under

In the dynamic world of foreign exchange trading, risk management is a cornerstone for Australian forex traders aiming to unlock wealth within. With markets operating 24/7 and currency pairs experiencing substantial price fluctuations, it’s crucial to implement robust strategies. Down Under, traders can leverage several effective techniques to navigate the volatility.

Firstly, setting clear stop-loss orders is an indispensable practice. These orders automatically close positions when the market moves against you, limiting potential losses. Additionally, position sizing matters; trading with only a small percentage of your account per trade ensures that even significant price movements won’t lead to devastating losses. Diversifying your portfolio across various currency pairs and timeframes can also help mitigate risk. By adopting these strategies, Australian forex enthusiasts can enhance their chances of navigating the market’s intricacies successfully while pursuing their goal of wealth within.

Practical Tips for Effective Money Management in Forex

Practical tips for effective money management in forex involve understanding and accepting the inherent risks associated with trading. Set clear, achievable goals that align with your risk tolerance; never invest more than you can afford to lose. Diversify your portfolio across various currency pairs to spread risk and take advantage of market opportunities. Implement stop-loss orders to limit potential losses, ensuring that even in volatile markets, your capital remains protected. Regularly review and adjust your trading strategies based on market conditions, aiming to continuously refine and improve your approach for optimal results – ultimately, fostering wealth within.

Navigating Forex Brokers and Platforms in Australia

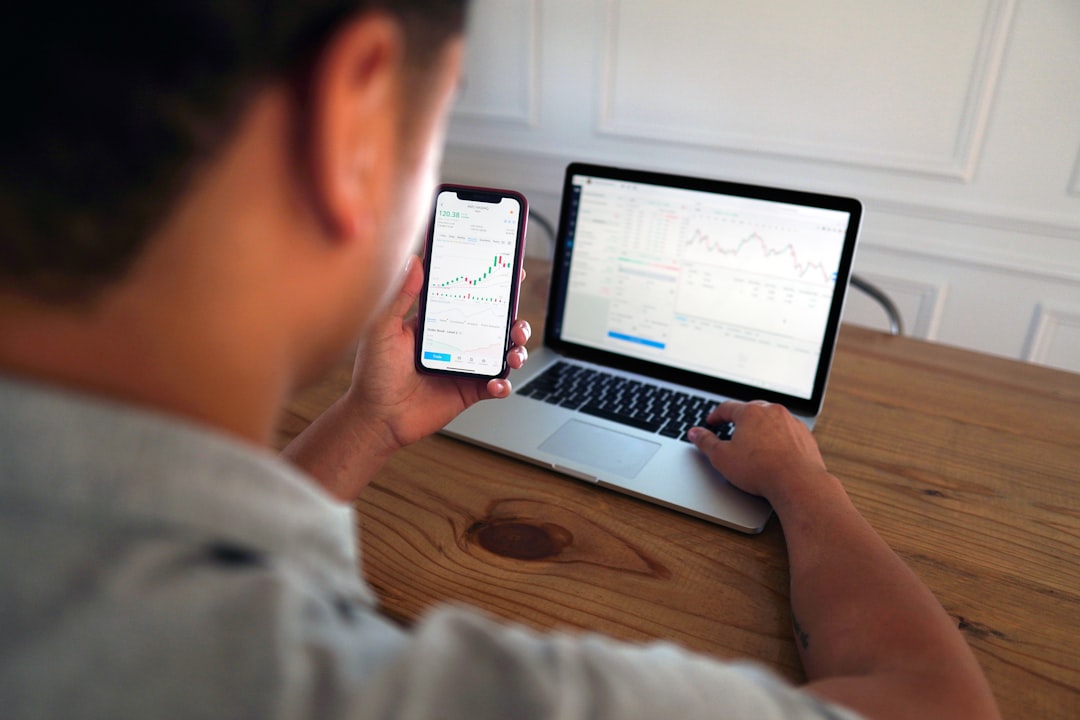

Navigating the vast landscape of Forex brokers and platforms in Australia is a crucial step for anyone aspiring to manage risk effectively while pursuing wealth within this dynamic market. With numerous local and international providers, it’s essential to discern between those that offer robust risk management tools and stringent regulatory compliance. Reputable Australian brokers adhere to strict guidelines set by the Australian Securities and Investments Commission (ASIC), ensuring client funds are secure.

When evaluating platforms, look for advanced order types like stop-loss and take-profit orders, which allow traders to set specific entry and exit points, limiting potential losses. Additionally, consider platforms with low spread rates, as these can significantly impact overall trading costs and contribute to wealth accumulation over time. A user-friendly interface and comprehensive educational resources are also valuable assets for beginners seeking to enhance their risk management skills in the Forex market.

Building a Successful Forex Trading Plan: Securing Your Financial Future

Building a successful forex trading plan is akin to crafting a roadmap to wealth within. It involves defining clear objectives, understanding your risk tolerance, and establishing rules for entering and exiting trades. A well-structured plan ensures consistent decision-making, minimizing emotional biases that often lead to poor choices. By setting specific, measurable goals, you can track your progress and make adjustments as needed.

Risk management is a cornerstone of this strategy. It involves managing both the size of your trades and the overall risk exposure. Techniques like stop-loss orders, position sizing, and diversification across currency pairs help secure your financial future by safeguarding against significant losses. Embracing discipline in adhering to your plan fosters a disciplined approach, enabling you to capitalize on market opportunities while preserving your capital.

In the dynamic world of forex trading, managing risk is key to unlocking the potential for wealth within Australia’s vibrant market. This practical course has equipped readers with essential strategies and insights, from understanding the unique Australian forex landscape to building a robust trading plan. By prioritizing effective money management and navigating the broker landscape judiciously, traders can enhance their chances of success and secure a prosperous financial future.