Leverage trading, while offering higher investment potential, is a high-risk strategy requiring stringent risk awareness and management. Traders must employ tools like stop-loss orders, portfolio diversification, position sizing, and technical analysis to mitigate risks associated with amplifying profits and losses. Effective risk management in leverage trading involves strategic approaches such as advanced algorithms, real-time data analysis, scenario planning, and stress testing, enabling firms to achieve sustainable success while minimizing vulnerabilities.

Risk management is a cornerstone of successful leverage trading. This strategy allows traders to maximize potential gains while minimizing devastating losses. In this article, we delve into the intricacies of leverage trading and its inherent risks. We explore the vital role of risk management strategies in navigating this high-stakes landscape.

Through key tools and techniques, we uncover effective risk mitigation practices. Additionally, real-world case studies highlight successful risk management approaches, offering valuable insights for both seasoned and aspiring traders looking to thrive in the world of leverage trading.

- Understanding Leverage Trading and Its Potential Risks

- The Role of Risk Management Strategies in Leverage Trading

- Key Tools and Techniques for Effective Risk Mitigation

- Case Studies: Successful Risk Management in Leverage Trading

Understanding Leverage Trading and Its Potential Risks

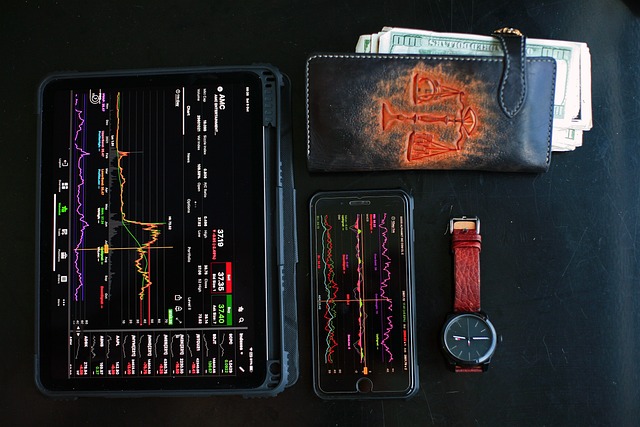

Leverage trading involves using borrowed funds to increase investment exposure and potential returns. While it offers the prospect of significant gains, it also carries substantial risks. The high level of leverage amplifies both profits and losses, meaning small market movements can lead to substantial account fluctuations. This dynamic can quickly turn a seemingly promising trade into a financial loss if the market moves against the trader.

Understanding these risks is crucial for effective risk management in leverage trading. Traders must implement robust strategies, such as setting stop-loss orders to limit potential losses and diversifying their portfolios to spread risk across various assets. Regular monitoring of open positions and a disciplined approach to managing risk are essential practices to navigate the challenges inherent in leverage trading and maximize potential returns while minimizing vulnerabilities.

The Role of Risk Management Strategies in Leverage Trading

In leverage trading, effective risk management strategies are not just beneficial; they’re indispensable. These strategies, tailored to the volatile nature of high-leverage positions, serve as a safety net against potential losses. By implementing measures such as stop-loss orders and position sizing rules, traders can limit their exposure to any single trade, ensuring that a string of unfavorable outcomes doesn’t lead to catastrophic financial loss.

Risk management in leverage trading isn’t just about cutting losses; it’s also about maximizing gains. Well-crafted risk management plans enable traders to pursue profitable opportunities while maintaining a balanced portfolio. They foster discipline, preventing emotional decisions driven by fear or greed that could undermine carefully constructed strategies. In essence, robust risk management transforms the potential pitfalls of leverage trading into powerful tools for wealth accumulation and preservation.

Key Tools and Techniques for Effective Risk Mitigation

In the realm of leverage trading, effective risk management is akin to navigating a labyrinthine market with gossamer threads of safety. Key tools and techniques form the symphony of risk mitigation, enabling folks to dance through the hustle and bustle without getting swept away. One of the most crucial instruments is position sizing, which determines how much capital to allocate per trade. This strategy ensures that even in the event of a loss, it doesn’t swallow up the entire trading account, fostering sustainability and resilience.

Additionally, stop-loss orders function as whispering guardians, protecting against indelible losses. These orders automatically close positions if they reach a certain price level, preventing remnants of risk from festering. In terms of enhancing risk management, leveraging technical analysis and charting patterns can provide valuable insights into market movements, enabling traders to anticipate potential risks and make informed decisions. This proactive approach is a game-changer in the dynamic landscape of leverage trading.

Case Studies: Successful Risk Management in Leverage Trading

In the dynamic landscape of leverage trading, successful risk management is not just a best practice—it’s a differentiator between thriving and faltering. Consider the example of Alpha Fund, a global investment firm that implemented a robust risk management framework to navigate volatile markets. By employing advanced algorithms and real-time data analysis, Alpha Fund could swiftly assess and mitigate potential risks associated with their leveraged positions. This proactive approach allowed them to maintain stability during sharp market swings, ensuring they could capitalize on opportunities without succumbing to catastrophic losses.

Another notable instance is Beta Corp., a smaller but agile trading firm that harnessed the power of scenario planning and stress testing. By forecasting various market scenarios and simulating potential outcomes, Beta Corp. was able to optimize their leverage strategies while keeping risks firmly under control. This holistic risk management strategy not only protected them during unexpected events but also provided valuable insights for refining their trading algorithms over time. These case studies underscore the critical role effective risk management plays in leveraging trading, showcasing how strategic foresight and disciplined execution can pave the way for sustainable success in this high-stakes arena.

Leverage trading presents significant opportunities but also carries substantial risks. As demonstrated through our exploration of understanding leverage, its potential pitfalls, and successful case studies, implementing robust risk management strategies using key tools and techniques is paramount for navigating this dynamic market. By prioritizing effective risk mitigation, traders can maximize their chances of success in the face of market volatility, ultimately fostering a more secure and profitable experience.