Enhance decision-making with real-time market simulations—a powerful tool that revolutionizes how financial professionals navigate complex landscapes. In today’s dynamic market environment, understanding and leveraging real-time data is crucial for achieving excellence in wealth management. This article explores the transformative potential of market simulations, from their foundational concepts to practical implementation strategies. Discover how these tools equip investors with insights, enhance strategic planning, and ultimately drive wealth within.

- Understanding Market Simulations: A Tool for Decision-Making Excellence

- Real-Time Data Integration: Bringing Markets to Life

- The Impact on Wealth Management Strategies

- Case Studies: Success Stories from the Front Line

- Implementing Simulations: Tips for Effective Results

Understanding Market Simulations: A Tool for Decision-Making Excellence

Market simulations, a powerful tool in today’s digital era, offer a dynamic and immersive way to understand complex market behaviors. By creating virtual environments that mirror real-world markets, these simulations allow businesses and investors to make informed decisions with enhanced clarity. In essence, they provide a safe, controlled space to test strategies, predict outcomes, and navigate the intricate web of economic trends without risking actual wealth.

This innovative approach enables participants to gain valuable insights into market dynamics, enabling them to optimize investment strategies and seize opportunities. By simulating various scenarios, from sudden shifts in consumer behavior to global economic changes, individuals can prepare for unexpected events and make strategic moves that foster wealth within their organizations or personal investments.

Real-Time Data Integration: Bringing Markets to Life

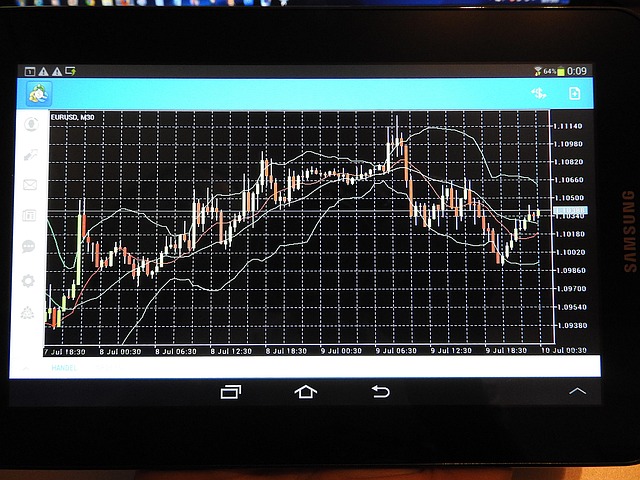

In today’s fast-paced market environments, successful decision-making hinges on access to real-time data. Integrating live market information into simulation models allows businesses and investors to experience the dynamic nature of various industries firsthand. By feeding algorithms with up-to-the-minute prices, news, and trends, these simulations bring markets to life, providing an immersive training ground for strategizing.

Real-time data integration empowers users to witness the immediate impact of their choices. Whether it’s tracking stock fluctuations, analyzing commodity flows, or predicting currency movements, investors can make informed decisions with a deeper understanding of market forces at play. This wealth of information within the simulation fosters a more realistic and effective learning experience, ultimately enhancing overall decision-making capabilities in an ever-changing economic landscape.

The Impact on Wealth Management Strategies

In today’s dynamic market landscape, real-time market simulations are transforming how wealth management strategies are formulated and executed. By creating virtual environments that mirror the complexities of financial markets, investment professionals can gain valuable insights into potential outcomes before committing actual capital. This proactive approach allows for more informed decisions, enabling wealth managers to navigate volatility with confidence and optimize returns for their clients.

Simulations offer a safe, controlled space to test various scenarios, from sudden economic shifts to long-term market trends. By analyzing the impact of these hypothetical events on portfolios, wealth managers can fine-tune their strategies to maximize wealth within their client base. This data-driven approach not only enhances decision-making but also fosters a culture of adaptability and continuous learning, ensuring that wealth management stays ahead of the curve in an ever-changing market.

Case Studies: Success Stories from the Front Line

In the fast-paced world of business, where every second counts, real-time market simulations have emerged as a powerful tool for decision-making. Case studies from various industries paint a compelling picture of success stories driven by this innovative approach. For instance, leading financial institutions have utilized these simulations to train traders and investors, enabling them to navigate volatile markets with confidence. By immersing participants in virtual trading environments, these institutions have witnessed significant improvements in risk management and wealth within their portfolios.

Moreover, retail companies have adopted real-time market simulations to optimize pricing strategies and inventory management. Through dynamic scenario planning, they can swiftly adapt to changing consumer behaviors and market trends, ensuring optimal profit margins. These success stories underscore the transformative potential of simulations, demonstrating how businesses across sectors are leveraging technology to gain a competitive edge, enhance operational efficiency, and ultimately drive wealth within their organizations.

Implementing Simulations: Tips for Effective Results

Implementing real-time market simulations can dramatically enhance decision-making processes, offering a dynamic and immersive experience that traditional methods simply cannot match. To maximize the benefits, focus on creating scenarios that parallel real-world challenges. Start with clear objectives tied to specific goals, such as improving risk assessment or optimizing investment strategies. Incorporate variables that reflect market dynamics—interest rates, stock prices, economic indicators—and ensure your simulations can adapt and change based on user decisions.

Encourage experimentation by providing a safe space where users can make mistakes and learn from them without real-world consequences. Visualize data clearly using intuitive dashboards to help users grasp the impact of their choices immediately. Foster collaboration by allowing teams to share insights and strategies, promoting discussion and innovation. Regularly update simulations with current market data to ensure relevance and accuracy, ultimately cultivating a culture of informed decision-making centered around wealth within your organization.

Market simulations have proven to be a powerful tool for enhancing decision-making processes, especially in dynamic and complex financial landscapes. By integrating real-time data, these simulations provide an immersive experience that mirrors actual market conditions, empowering investors and wealth managers to make informed choices. Through case studies showcasing successful implementations, it’s evident that simulations can improve strategic planning and wealth distribution. Adopting these technologies allows professionals to navigate market uncertainties with confidence, ultimately aiming to achieve optimal wealth within their portfolios.