In Melbourne's dynamic financial landscape, understanding bear and bull markets is crucial for investors and traders. Comprehensive trading courses teach participants how to analyze trends, interpret charts, and make informed decisions during both bullish and bearish periods. These courses equip individuals with risk management strategies, such as stop-loss orders and diversification, enabling them to navigate market fluctuations effectively. Melbourne's diverse economy offers resilient sectors during downturns, making strategic investment choices essential. Specialized trading courses provide insights into unique investment trends and innovative opportunity identification techniques, fostering resilience and potential for substantial gains in both bull and bear markets.

“Uncertain times call for strategic investors, and Melbourne’s financial landscape offers both challenges and opportunities during bear and bull markets. This comprehensive guide explores various aspects of navigating these volatile periods, starting with a deep dive into understanding market dynamics.

We present a Melbourne trading course perspective on identifying trends, providing expert strategies for bear market survival. Risk management is key; we offer an in-depth guide to protect your investments. Explore Melbourne’s investment scene, discover case studies, and unlock advanced techniques to elevate your trading skills.”

- Understanding Bear and Bull Markets: A Melbourne Trading Course Perspective

- Strategies for Navigating a Bear Market in Melbourne: Tips from Experts

- The Role of Risk Management in Bear-Bull Market Trading: A Comprehensive Guide

- Melbourne's Investment Landscape: Opportunities Amidst Volatility

- Case Studies: Successful Bear Market Trades in Melbourne

- Enhancing Your Trading Skills: Advanced Techniques for Melbourne Traders

Understanding Bear and Bull Markets: A Melbourne Trading Course Perspective

In the dynamic financial landscape of Melbourne, understanding bear and bull markets is paramount for investors and traders alike. A comprehensive trading course often delves into these concepts as foundational knowledge, enabling participants to navigate market fluctuations with confidence. Bear markets, characterized by declining prices and investor pessimism, contrast starkly with bull markets, where shares and commodities are on the rise, fueled by optimism and robust economic indicators.

Melbourne’s vibrant financial scene offers various trading courses designed to demystify these market dynamics. These programs typically equip students with tools to analyze market trends, interpret charts, and make informed decisions during both bullish and bearish periods. By grasping the nuances of bear bull markets, traders can develop strategies to mitigate risks and capitalize on opportunities that arise in Melbourne’s ever-evolving financial environment.

Strategies for Navigating a Bear Market in Melbourne: Tips from Experts

Navigating a bear market can be challenging, but with the right strategies, Melbourne investors can weather the storm and even thrive. Experts recommend staying invested for the long term, focusing on quality over quantity when selecting stocks, and diversifying your portfolio to reduce risk. A trading course can provide valuable insights into these techniques, helping you make informed decisions during volatile periods.

Additionally, rebalancing your portfolio regularly and keeping an eye on market trends are crucial. By doing so, you can sell losing investments at the right time and purchase promising ones, ensuring your portfolio remains aligned with your financial goals. Melbourne’s diverse economy offers opportunities in sectors like technology and healthcare, which have proven resilient during past bear markets. Leveraging this knowledge, combined with a strategic trading course, can equip investors with the tools needed to navigate Melbourne’s economic landscape effectively.

The Role of Risk Management in Bear-Bull Market Trading: A Comprehensive Guide

In the volatile world of bear-bull market trading, risk management is a crucial component for any successful investor or trader looking to navigate Melbourne’s financial landscape. A comprehensive understanding and implementation of risk management strategies can significantly enhance your performance in both bullish and bearish markets. This involves setting clear goals, defining risk tolerance levels, and employing various tools and techniques to protect capital. Effective risk management starts with a well-structured trading plan that includes stop-loss orders, position sizing, and diversification—essential elements for any trading course aimed at Melbourne’s market participants.

By learning the art of managing risk, traders can make informed decisions, ensuring their strategies remain disciplined during uncertain periods. This guide emphasizes the importance of staying calm and rational when markets shift, allowing investors to capitalize on opportunities without succumbing to panic or impulsive actions. Melbourne’s dynamic economic environment demands a proactive approach to risk management, which, when combined with the right trading course, can lead to substantial gains and increased market resilience.

Melbourne's Investment Landscape: Opportunities Amidst Volatility

Melbourne’s investment landscape is a dynamic and diverse one, offering both opportunities and challenges for traders and investors alike. The city’s thriving economy, coupled with its status as a global financial hub, creates an environment ripe with potential for growth. However, the market’s inherent volatility requires a strategic approach to navigate successfully. Those who seek to capitalize on Melbourne’s investment scene can benefit from specialized trading courses that equip them with the knowledge and skills needed to thrive in such dynamic conditions.

By enrolling in a comprehensive trading course, individuals can gain insights into the city’s unique investment trends, learn effective risk management strategies, and discover innovative techniques to identify lucrative opportunities. These courses often provide practical training and real-world scenarios, enabling participants to adapt to Melbourne’s ever-changing financial landscape. With the right guidance, traders can turn volatility to their advantage and secure their financial future amidst the bustling market activity of Australia’s cultural capital.

Case Studies: Successful Bear Market Trades in Melbourne

In the volatile world of finance, navigating a bear market requires strategic acumen and a deep understanding of the market’s shifts. Melbourne, as a bustling financial hub, has witnessed its share of economic downturns, yet there are success stories amidst the turmoil. Case studies of traders who thrived during Melbourne’s bear markets offer valuable insights for those seeking to enhance their trading skills.

These successful trades often involve a combination of prudent risk management, diverse investment strategies, and a keen eye for identifying undervalued assets. Many have found that participating in a well-structured trading course has been instrumental in equipping them with the necessary tools to navigate such markets. By learning from these case studies, aspiring traders can gain practical knowledge about how to adapt their approaches, capitalize on opportunities, and even thrive during challenging economic periods.

Enhancing Your Trading Skills: Advanced Techniques for Melbourne Traders

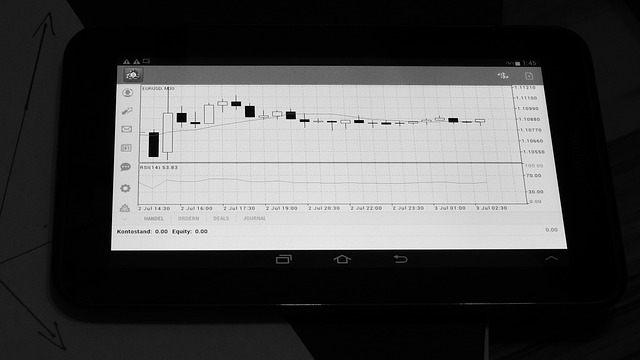

In the dynamic market landscape of Melbourne, traders seeking an edge often look beyond conventional strategies. This involves exploring advanced techniques and refining their skills through comprehensive trading courses. Such educational initiatives empower local traders to navigate the complexities of bull markets more effectively. By delving into sophisticated indicators, risk management strategies, and cutting-edge analytical tools, participants can anticipate market shifts and capitalize on opportunities with enhanced precision.

Melbourne’s vibrant financial scene demands adaptability and continuous learning. Traders who invest in their professional development through specialized trading courses gain a competitive advantage. They learn to interpret intricate market data, identify lucrative entry and exit points, and manage risk efficiently. These skills are invaluable in a bull market, where quick decision-making and strategic adjustments can significantly impact returns.

In navigating Melbourne’s financial landscape, understanding bear and bull markets is crucial. This comprehensive guide, featuring insights from experts and advanced techniques, equips traders with the knowledge to thrive in volatile times. By integrating risk management strategies and exploring opportunities within Melbourne’s investment tapestry, investors can not only survive but excel during bear markets. Embracing these strategies, as demonstrated through real-world case studies, ensures traders are prepared for any market shift, making them true masters of Melbourne’s trading course.