Specialized trading courses in dynamic Sydney offer immersive learning experiences that empower students to navigate global financial markets. Through interactive sessions with expert traders, hands-on market tool practice, and real-world examples from Australia's bustling landscape, aspiring professionals gain a competitive edge. These courses emphasize practical skills like Technical Analysis, Risk Management, and networking, fostering confidence and collaboration for successful trading careers. Post-course, live market simulations provide vital real-world experience, transforming theoretical knowledge into actionable expertise.

“Unleash your trading potential in vibrant Sydney classrooms, where dynamic markets meet hands-on learning. This article explores the benefits of in-person trading courses, providing a comprehensive guide to enhancing your market understanding. Engage with expert traders, master strategies from technical analysis to risk management, and gain practical experience through simulations. Build a supportive community while networking with like-minded investors. Take the next step by applying your knowledge in live markets—all within Sydney’s dynamic educational landscape.”

- Understanding Dynamic Trading Markets: A Sydney Classroom Perspective

- Benefits of In-Person Learning for Trading Courses

- Interactive Learning: Engaging with Expert Traders in Real-Time

- Strategies Taught: From Technical Analysis to Risk Management

- Hands-on Experience: Simulations and Practice Trades

- Building a Community: Networking with Like-Minded Investors

- Taking the Next Step: Applying Knowledge in Live Markets

Understanding Dynamic Trading Markets: A Sydney Classroom Perspective

In the heart of dynamic Sydney, classrooms are evolving to meet the demands of today’s fast-paced financial markets. A quality trading course in this environment offers students a unique advantage—it prepares them for the unpredictable nature of global trading. Here, participants learn not just technical analysis and risk management but also how to navigate through market volatility, utilizing real-world examples from Australia’s bustling financial landscape.

These classrooms foster an immersive learning experience, where theories come alive with practical demonstrations. Students engage with seasoned traders who share insights on adapting strategies in response to market dynamics. By understanding the intricate dance of supply and demand in Sydney’s classrooms, aspiring traders gain a competitive edge, equipping them with the skills to make informed decisions in their future endeavors within the ever-changing trading markets.

Benefits of In-Person Learning for Trading Courses

Learning to trade in a dynamic Sydney classroom offers a host of benefits that simply can’t be replicated online. Being physically present allows for immediate interaction with experienced instructors and fellow traders, fostering a collaborative environment that enhances knowledge retention. In-person learning enables real-time clarification of concepts, practical demonstrations of trading strategies, and hands-on experience with various market tools – crucial aspects of mastering a trading course.

Additionally, the social aspect of classroom learning creates a support system where students can exchange ideas, discuss market trends, and learn from each other’s successes and mistakes. This dynamic exchanges of information can accelerate your understanding of complex trading concepts and strategies, ultimately preparing you more effectively for real-world trading scenarios.

Interactive Learning: Engaging with Expert Traders in Real-Time

In dynamic Sydney classrooms, learners engage in interactive learning experiences that bring trading strategies to life. This unique approach involves direct interaction with expert traders who provide real-time insights and feedback. Students don’t just study theory; they practice analysis, make decisions, and witness market reactions instantly. The back-and-forth exchange allows for a deeper understanding of market dynamics, as concepts are immediately put into context.

This interactive format is particularly beneficial for those pursuing a trading course. It offers a hands-on learning environment where students can refine their skills, test their mettle, and gain confidence in navigating the complexities of financial markets. By learning from seasoned professionals, aspirants traders can avoid common pitfalls and develop strategies tailored to their risk tolerance and investment goals.

Strategies Taught: From Technical Analysis to Risk Management

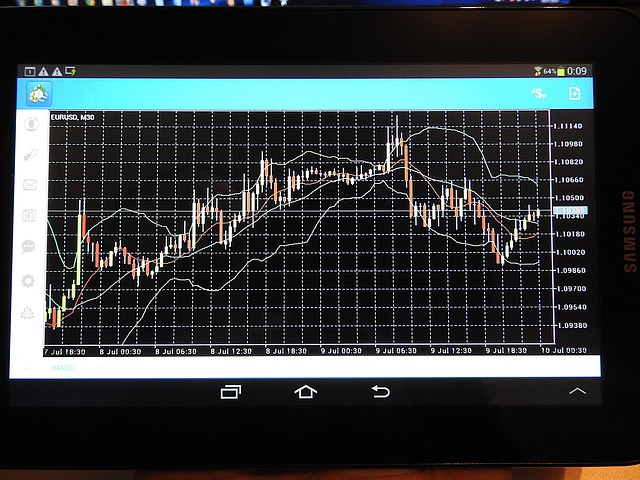

In dynamic Sydney classrooms, a wide array of trading strategies are meticulously crafted and taught within comprehensive trading courses. Students are introduced to foundational concepts such as Technical Analysis, where they learn to interpret market charts, identify trends, and use key indicators to make informed trade decisions. This strategy empowers them to anticipate price movements based on historical data and visual patterns.

Risk Management is another cornerstone of the curriculum. Students gain a deep understanding of how to mitigate potential losses by employing strategies like setting stop-loss orders, diversifying their portfolios, and calculating risk-reward ratios. These skills are crucial for navigating the volatile financial markets with confidence and ensuring long-term success in their trading journeys.

Hands-on Experience: Simulations and Practice Trades

In dynamic Sydney classrooms, learning trading strategies through hands-on experience is a key feature of our comprehensive trading courses. Students are equipped with advanced simulation tools that replicate real-world market conditions, allowing them to test and refine their skills in a risk-free environment. These simulations provide an immersive experience, enabling traders-in-training to navigate complex markets, make split-second decisions, and analyze the outcomes.

Beyond simulations, students engage in practice trades using virtual funds. This practical approach empowers them to apply theoretical knowledge to real trading scenarios. By experiencing both successes and challenges, learners gain valuable insights into market dynamics, risk management, and strategic adjustment. Through this hands-on learning process, our trading courses ensure that graduates are well-prepared to enter the dynamic financial markets with confidence.

Building a Community: Networking with Like-Minded Investors

In dynamic Sydney classrooms, learning trading strategies isn’t just about acquiring skills; it’s also about building a community. Networking with like-minded investors is an invaluable aspect of any trading course. Students get to exchange ideas, share insights, and learn from one another’s successes and mistakes. This collaborative environment fosters a deeper understanding of the market dynamics and helps traders develop strategies tailored to their individual goals and risk appetites.

The connections made during these sessions can lead to long-lasting professional partnerships. Many trading courses in Sydney capitalize on this by organizing networking events, guest speaker sessions, and online forums where students can continue to engage with peers and industry experts well after the course has ended. This ongoing interaction ensures that learners stay updated with market trends and innovative strategies while also building a support system that can be instrumental in their trading journey.

Taking the Next Step: Applying Knowledge in Live Markets

Taking the Next Step: Applying Knowledge in Live Markets

After mastering the fundamentals and advanced techniques through a comprehensive trading course in dynamic Sydney classrooms, it’s time to put your newfound skills into action. The real-world experience gained from live market simulations is invaluable for any aspiring trader. These practical sessions allow you to apply your knowledge under actual market conditions, testing your strategies against the ever-changing dynamics of global financial markets.

By stepping into live trading, you gain a deeper understanding of market behavior and learn to adapt your strategies on the fly. This hands-on approach sharpens your decision-making skills, enhances your risk management techniques, and prepares you for the excitement (and challenges) of the real trading floor. It’s a crucial step in transforming theoretical knowledge into practical expertise, setting the stage for future success in the dynamic world of trading.

(Rev/v/ → in h/s?