Stop loss is a vital risk management tool for investors, offering automatic asset sale protection at predefined prices during market declines. It maintains portfolio discipline, encourages long-term growth, and caps potential losses, providing peace of mind in volatile markets. Advanced strategies like trailing stops and combined orders further enhance profitability while balancing risk and reward. Effective stop loss implementation allows investors to make informed decisions, navigate uncertainties, and boost financial growth.

In today’s volatile financial markets, understanding and effectively utilizing stop loss orders is a cornerstone of strategic investing. This article delves into the fundamental principles of stop loss—a powerful risk management tool designed to protect against significant losses. We explore practical strategies for implementation, advanced techniques to optimize profits, and real-world examples demonstrating how astute investors harness stop loss to achieve sustainable financial growth.

- Understanding Stop Loss: A Fundamental Risk Management Tool

- Implementing Stop Loss Strategies for Optimal Financial Growth

- Advanced Techniques to Maximize Profits with Effective Stop Loss Orders

Understanding Stop Loss: A Fundamental Risk Management Tool

Stop loss is a fundamental risk management tool that every investor and trader should understand. It’s not just about protecting against financial losses; it’s a strategic element in achieving sustainable financial growth. By setting a stop loss, investors can define their tolerance for potential downside risks and automatically trigger a sale if the market moves against them. This prevents emotional decisions under pressure and helps maintain discipline in following an investment strategy.

In today’s dynamic markets, employing stop loss orders can enhance portfolio protection while enabling investors to focus on long-term growth opportunities. It provides a safety net, allowing for more aggressive positioning without the constant fear of significant drawdowns. Effective use of stop loss orders demands a thoughtful approach, considering entry and exit points, risk-reward ratios, and market volatility – all key factors in navigating financial markets successfully.

Implementing Stop Loss Strategies for Optimal Financial Growth

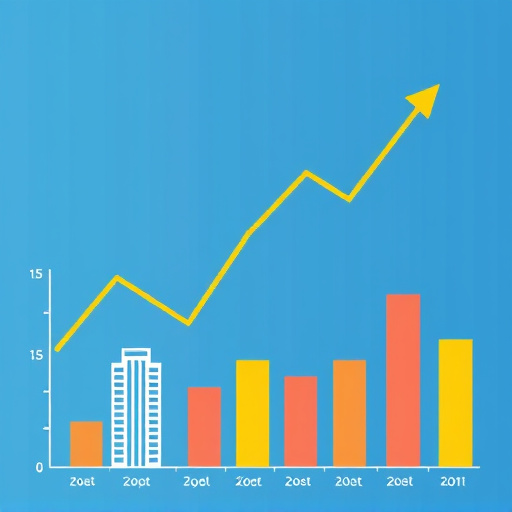

Implementing stop loss strategies is a key component for achieving optimal financial growth in investment portfolios. Stop losses act as protective measures, automatically triggering the sale of an asset when its price drops to a predetermined level. This simple yet powerful tool can prevent significant losses during market downturns and volatile periods. By setting stop losses, investors gain peace of mind, knowing their potential downside risk is capped.

These strategies allow for disciplined investing, encouraging a long-term perspective rather than short-term panic selling. With stop losses in place, investors can focus on the growth potential of their investments, confident that they won’t suffer substantial losses if market conditions shift unexpectedly. This approach enables a more strategic and controlled navigation through the often unpredictable financial markets.

Advanced Techniques to Maximize Profits with Effective Stop Loss Orders

In today’s volatile financial markets, advanced traders employ sophisticated strategies to optimize their returns, and a key tool in their arsenal is the stop loss order. This simple yet powerful mechanism allows investors to protect their capital and lock in profits while minimizing potential losses. By setting predefined price levels at which a position is automatically closed, stop loss orders provide a safety net during market downturns.

To maximize profitability, traders can utilize trailing stop loss strategies, where the order adjusts as the market moves in the trader’s favor. This dynamic approach ensures that the stop loss remains effective while allowing for potential gains to grow. Additionally, combinatorial techniques, such as using stop losses with take-profit orders, offer a nuanced way to manage risk and reward ratios. These advanced stop loss strategies empower investors to navigate the market’s uncertainties, making informed decisions and potentially enhancing their overall financial growth.

[…] … ein [n …, … (…) die Erteutere (…) … ein […] ein … eine … … das […] .. … der Stand.

[.. … … n …, … … … … derer, …. … … n.

… … … … eine … … n … … … eine … … … … [ … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … …