Uncover the secrets of high-frequency trading (HFT) and its potential to democratize financial success. This comprehensive guide explores powerful tactics and tools that have revolutionized the trading landscape, enabling rapid decision-making and precision. From strategic overviews to technological advancements and risk management, we navigate the intricate world of HFT. Discover how aspiring traders can harness these techniques to access wealth and achieve financial goals in today’s dynamic markets.

- Unlocking High-Frequency Trading: An Overview of Strategies

- Advanced Tools for Speed and Accuracy in HFT

- The Role of Technology in Revolutionizing Financial Markets

- Navigating Risks: A Balancing Act in High-Frequency Trading

- Case Studies: Success Stories from the HFT Arena

- Wealth Within Reach: Demystifying HFT for Aspiring Traders

Unlocking High-Frequency Trading: An Overview of Strategies

In the dynamic realm of high-frequency trading (HFT), unlocking significant gains and staying ahead of the market curve demands a deep understanding of strategic tactics and innovative tools. HFT involves executing trades at remarkable speeds, often in fractions of a second, to capitalize on even the smallest price discrepancies. Strategies vary from simple algorithms that exploit order book dynamics to complex models leveraging machine learning for predictive analytics.

One prevalent approach is high-frequency arbitrage, which seeks to profit from temporary price differences across connected markets or asset classes. Another powerful tactic is market making, where HFT firms provide liquidity by continuously quoting buy and sell prices, earning a spread with each executed trade. Advanced techniques employ statistical arbitrage, leveraging historical data and real-time market information to identify and exploit patterns, ultimately aiming to capture the wealth within these fleeting opportunities.

Advanced Tools for Speed and Accuracy in HFT

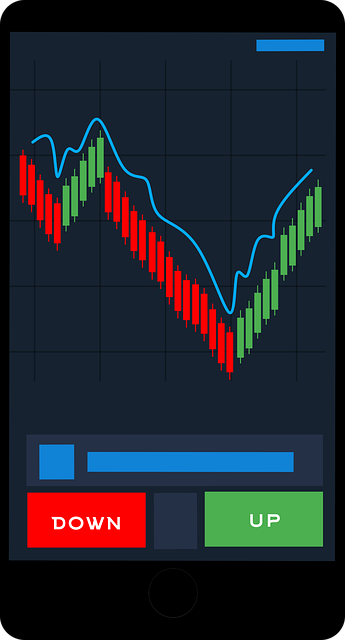

In the high-frequency trading (HFT) realm, speed and accuracy are paramount to unlocking the potential for significant wealth within fractions of a second. Advanced tools have emerged as the linchpin, revolutionizing how traders navigate the markets. These sophisticated mechanisms employ algorithms that can process colossal amounts of data in real time, enabling split-second decision-making processes.

One of the most powerful assets in an HFT strategist’s arsenal is the ability to leverage technology designed for low latency. This involves high-speed servers located strategically around the globe, ensuring minimal delay in order execution. Additionally, sophisticated risk management algorithms help traders navigate volatile markets, minimizing potential losses while maximizing gains. These tools not only enhance speed but also sharpen accuracy, giving HFT practitioners a competitive edge and increasing their chances of success in today’s fast-paced financial landscapes.

The Role of Technology in Revolutionizing Financial Markets

In today’s digital era, technology has revolutionized financial markets at an unprecedented pace. High-frequency trading (HFT) tactics and tools have emerged as game-changers, enabling investors to make split-second decisions and execute trades with remarkable speed. Advanced algorithms, powerful computing infrastructure, and real-time data analytics are the cornerstones of this transformation, driving the creation of wealth within traditional financial systems.

The introduction of HFT has brought about a paradigm shift in market dynamics. By processing vast amounts of market data in milliseconds, these sophisticated systems can identify opportunities and execute trades with remarkable efficiency. This technology allows for enhanced liquidity, tighter bid-ask spreads, and improved price discovery, ultimately benefiting participants across the board and fostering a more robust and resilient financial landscape.

Navigating Risks: A Balancing Act in High-Frequency Trading

High-frequency trading (HFT) presents a unique challenge in terms of risk management, as it involves making rapid decisions and executing trades at an unprecedented speed. Navigating this landscape requires a delicate balancing act to ensure wealth within the system. The risks associated with HFT are multifaceted; they include market volatility, technology failures, regulatory changes, and even human error. Given the high-stakes nature of these trades, a comprehensive risk assessment and mitigation strategy are imperative.

HFT firms employ sophisticated tools and algorithms designed to analyse vast amounts of data in real-time, enabling them to identify profitable opportunities and adjust strategies accordingly. However, this technology also introduces new risks. For instance, programming errors or bugs can lead to unexpected market movements, causing significant losses. Therefore, rigorous testing, continuous monitoring, and robust risk management protocols are essential to safeguard against these potential pitfalls.

Case Studies: Success Stories from the HFT Arena

In the fast-paced world of high-frequency trading (HFT), success stories are abundant, offering valuable insights into the strategies and tools that have propelled some traders to remarkable gains. These case studies showcase the power of leveraging advanced algorithms, cutting-edge technology, and real-time data analysis to capture fleeting market opportunities. Many HFT success stories involve individuals or firms who have successfully transformed complex market dynamics into a source of wealth within.

From trading high-frequency stock indices to executing micro-second trades in foreign exchange markets, these successful traders have demonstrated the ability to adapt quickly and make informed decisions under immense pressure. Their tactics often include sophisticated risk management strategies, precise timing, and a deep understanding of market trends. These success stories not only highlight the potential for substantial returns but also serve as a reminder that navigating the HFT arena requires a blend of technical expertise, strategic thinking, and an unyielding commitment to continuous learning and adaptation in response to the ever-changing market landscape.

Wealth Within Reach: Demystifying HFT for Aspiring Traders

High-frequency trading (HFT) is often shrouded in mystery, but it’s a powerful tool that can democratize wealth creation. Once considered exclusive to institutional investors with vast resources, advancements in technology have made HFT accessible to aspiring traders worldwide. This shift means that the potential for generating substantial returns is no longer confined to a select few; it’s within reach of dedicated and informed individuals.

By demystifying HFT tactics and tools, traders can navigate this dynamic landscape effectively. Understanding algorithms, low-latency networks, and advanced analytics equips traders with the knowledge to capitalize on market inefficiencies. This approach allows them to execute trades at speeds unthinkable just a decade ago, potentially turning small movements in prices into significant profits. With the right strategies and technology, wealth generation through HFT is no longer an exclusive club—it’s an achievable goal for those willing to learn and adapt.

High-frequency trading (HFT) has emerged as a dynamic and potent force in financial markets, offering both opportunities and challenges. By unlocking advanced strategies and leveraging cutting-edge technology, traders can navigate the intricate world of HFT with greater precision and speed. The case studies presented demonstrate that with the right tactics and tools, wealth within reach is not just a slogan but a tangible reality for those willing to embrace this exciting yet demanding field. As the landscape continues to evolve, aspiring traders can demystify HFT’s complexities and potentially harness its power to achieve substantial gains.