Algorithmic trading leverages machine learning and data analytics to optimize returns and manage risks in financial markets, enabling investors to enhance wealth within complex environments. By automating trades and processing vast data quickly, algorithms capitalize on fleeting market inefficiencies and execute strategic risk-taking with precision. This approach, when combined with leverage, amplifies potential gains while controlling losses, offering a powerful tool for achieving substantial wealth within short time frames. Advanced algorithmic strategies navigate market volatility through dynamic position adjustments and adaptive strategies, fostering a more responsive and rewarding investment landscape.

In today’s dynamic financial landscape, leveraging algorithmic trading strategies offers a compelling path towards achieving wealth within. As markets become increasingly complex, algorithms provide a modern approach to navigating the hustle and bustle of high-frequency trading. This article explores how algorithmic trading complements leverage dynamics, unlocking capital efficiency while enhancing potential returns. We delve into various strategies, risk management techniques, and the future integration of leverage and algorithms, guiding readers towards mastering this game-changing trading methodology.

- Understanding Leverage Trading: Unlocking Capital Efficiency

- The Rise of Algorithmic Trading: A Modern Approach

- Strategies for Success: Algorithmic Techniques Revealed

- Enhancing Wealth: Leveraging Algorithms for Better Returns

- Risk Management in Algorithmic Trading: Balancing Act

- The Future of Trading: Integrating Leverage and Algorithms

Understanding Leverage Trading: Unlocking Capital Efficiency

Leverage trading involves utilizing borrowed funds to amplify potential returns, a strategy that can significantly impact an investor’s wealth within a short period. This approach allows traders to access more capital, enabling them to take larger positions and potentially earn higher profits. However, it also increases risk since losses can be magnified as well. Understanding this dynamic is crucial for those seeking to harness the power of algorithmic trading strategies.

By employing algorithms, traders can automate the process of leveraging market inefficiencies, identifying opportunities, and executing trades with precision. These strategies help navigate the complexities of high-frequency trading, ensuring capital efficiency while mitigating risks associated with manual intervention. With algorithmic support, leverage trading becomes a calculated risk, where gains are maximized while potential losses remain within manageable boundaries.

The Rise of Algorithmic Trading: A Modern Approach

The rise of algorithmic trading has revolutionized the financial markets, offering a modern approach to capturing wealth within dynamic trading environments. This innovative strategy leverages advanced computer programs to execute trades at speeds unattainable by human traders. By employing complex algorithms, traders can analyze vast amounts of market data in milliseconds, identifying patterns and opportunities that might otherwise be overlooked.

Algorithmic trading provides a structured and systematic approach, enabling investors to make informed decisions based on predefined rules and criteria. This precision allows for more consistent and efficient wealth accumulation, especially when combined with leverage dynamics. With algorithmic strategies, traders can magnify potential gains while managing risk effectively, making it an attractive option for those seeking to navigate the complexities of modern markets and unlock new avenues for wealth within.

Strategies for Success: Algorithmic Techniques Revealed

In the realm of financial markets, algorithmic trading strategies have emerged as a powerful tool for navigating the dynamic landscape of leverage trading. These sophisticated algorithms offer a comprehensive suite of techniques designed to optimize returns and mitigate risks, ultimately fostering wealth within. By employing machine learning and advanced analytics, traders can identify intricate patterns and make informed decisions at speeds unattainable by human operators.

Successful algorithmic strategies often hinge on several key elements. First, high-frequency data analysis enables algorithms to detect subtle market inefficiencies and capitalize on them swiftly. Next, backtesting and optimization processes ensure that trading rules are rigorously tested against historical data before deployment, increasing the likelihood of consistent performance. Additionally, risk management protocols, such as stop-loss orders and position sizing strategies, play a crucial role in safeguarding capital during volatile markets.

Enhancing Wealth: Leveraging Algorithms for Better Returns

In today’s financial landscape, algorithmic trading strategies have emerged as a powerful tool for investors seeking to enhance their wealth within the market. By leveraging advanced algorithms, traders can navigate complex dynamics with precision and speed, capitalizing on opportunities that traditional methods might miss. These algorithms are designed to process vast amounts of data in real-time, enabling informed decision-making at lightning speed.

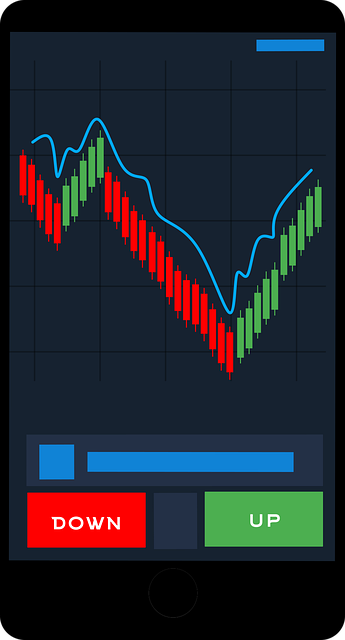

Through algorithmic trading, investors can employ various strategies that complement leverage trading dynamics. This approach allows for more effective risk management while amplifying potential returns. By automating the trading process and utilizing sophisticated mathematical models, algorithms can identify profitable trends, execute trades with minimal delay, and adapt to market changes swiftly. As a result, investors have an edge in achieving their wealth-building goals, taking advantage of every movement in the market.

Risk Management in Algorithmic Trading: Balancing Act

In algorithmic trading, risk management is a delicate balancing act that leverages the power of technology and data. Algorithms can rapidly process vast amounts of market data, enabling traders to make informed decisions in fractions of a second. This speed and efficiency are crucial for managing risk dynamically, as they allow for quick adjustments to positions based on real-time market conditions. By employing sophisticated models and strategies, algorithmic trading systems aim to optimize returns while minimizing exposure to potential losses.

One key aspect of this balance is the strategic use of leverage, a double-edged sword that can amplify both gains and drawbacks. Algorithmic systems are designed to monitor and control risk by setting precise limits on leverage, ensuring that wealth within the portfolio remains secure. Through continuous monitoring and adaptive strategies, these algorithms navigate the market’s volatility, aiming to preserve capital and foster sustainable growth over time.

The Future of Trading: Integrating Leverage and Algorithms

The future of trading lies in the harmonious integration of leverage and algorithms, a dynamic duo that has the potential to unlock unprecedented levels of wealth within financial markets. As technology advances, algorithmic trading strategies are becoming increasingly sophisticated, allowing traders to navigate complex market landscapes with precision and speed. By leveraging powerful computing capabilities and data analytics, these algorithms can identify patterns, execute trades, and manage risk more efficiently than traditional methods.

This evolution is especially significant when combined with leverage, a strategy that amplifies potential returns but also increases risk. When executed correctly, the fusion of algorithmic trading and leveraged positions can lead to substantial gains. Traders can capitalize on market inefficiencies, exploit short-term opportunities, and diversify their portfolios, all while minimizing manual intervention. This approach promises to democratize access to high-return trading strategies, enabling investors to participate in a more dynamic and responsive market environment.

Algorithmic trading strategies, when combined with leverage dynamics, offer a powerful toolset for navigating today’s financial landscapes. By unlocking capital efficiency and enhancing wealth potential, these integrated approaches provide traders with an edge in achieving their financial goals. As the article has highlighted, understanding the interplay between leverage and algorithms is crucial for success in the modern trading world. Embracing these innovations enables investors to make informed decisions, manage risks effectively, and potentially unlock new opportunities for growth, ultimately fostering a more dynamic and lucrative trading environment.