Beginners in stock trading must first grasp fundamental concepts, including key terms, market dynamics, and investment strategies. This involves understanding buy/sell orders, price quotes, IPOs, and investment approaches like long-term holds, value, or growth investing. Online resources, books, and mentorship are crucial for learning.

Successful trading requires mastering two key strategies: selectivity (through fundamental analysis of companies) and diversification (spreading investments across sectors). Technical analysis, involving chart patterns and indicators, is a proven method to predict price movements.

Risk management is equally important; setting stop-loss orders and diversifying portfolios help mitigate risks. Trading psychology plays a role in maintaining discipline under pressure.

Finally, creating a winning trading plan with clear objectives, risk tolerance alignment, and continuous learning ensures long-term success in navigating the dynamic stock market.

Unlock the secrets of stock trading with our comprehensive guide designed for aspiring traders. This step-by-step journey delves into the fundamentals, from understanding basic concepts to advanced strategies like technical and fundamental analysis. Learn how to choose the right stocks through selectivity and diversification techniques. Master key chart patterns, indicators, and company financials to make informed decisions. Explore risk management, trading psychology, and building a winning plan that combines discipline with continuous learning. Discover the path to thriving in the stock market with this definitive how-to guide.

- Understanding the Basics of Stock Trading: A Step-by-Step Guide for Beginners

- Choosing the Right Stocks: Strategies for Selectivity and Diversification

- Technical Analysis 101: Chart Patterns and Indicators to Master

- Fundamental Analysis: Unlocking Company Financials for Informed Decisions

- Risk Management and Trading Psychology: Safeguarding Your Capital and Staying Calm Under Pressure

- Building a Winning Trading Plan: Strategy, Discipline, and Continuous Learning

Understanding the Basics of Stock Trading: A Step-by-Step Guide for Beginners

Embarking on your journey into the stock market? Understanding the basics is crucial for any beginner looking to trade the stock market successfully. Start by familiarizing yourself with key terms and concepts like buy and sell orders, price quotes, and market order types (market, limit, stop). Next, grasp the fundamentals of supply and demand dynamics that drive stock prices. Learn how companies raise capital through initial public offerings (IPOs) and subsequent share sales.

Delve into different investment strategies such as long-term buy-and-hold, value investing, and growth investing to identify which aligns best with your financial goals and risk tolerance. Educate yourself on various factors influencing stock prices, including company performance, industry trends, economic indicators, and geopolitical events. Online resources, books, and even mentorship from experienced traders can greatly aid in this step-by-step learning process, empowering you to make informed decisions as you navigate the stock market.

Choosing the Right Stocks: Strategies for Selectivity and Diversification

When learning how to trade the stock market, selecting the right stocks is a crucial step in unlocking its secrets. The key to success lies in both selectivity and diversification. Start by understanding the fundamentals of each company’s business model, financial health, and industry position. This involves analyzing their revenue growth, profit margins, and competitive landscape.

Diversification is another powerful strategy. Instead of pouring all your capital into one stock, spread your investments across multiple companies in various sectors. This reduces risk; if one stock underperforms, others may offset the loss. Consider factors like market capitalization (large-cap vs. small-cap stocks), growth potential, and sector trends to build a well-rounded portfolio that maximizes opportunities while minimizing vulnerability.

Technical Analysis 101: Chart Patterns and Indicators to Master

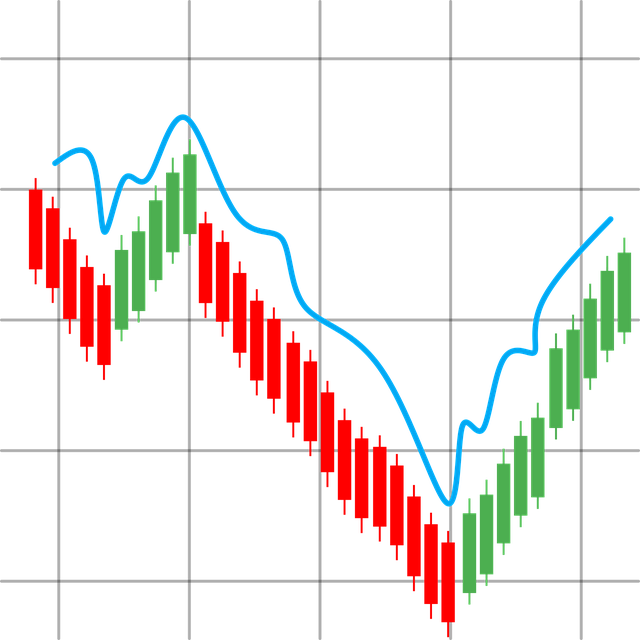

Technical analysis is a powerful tool for anyone looking to how to trade the stock market. At its core, it involves studying historical price and volume data to identify trends and potential future movements. One of the fundamental aspects of technical analysis is understanding chart patterns – visual representations that offer insights into the behavior of a stock’s price. Common patterns include head and shoulders, double tops/bottoms, and triangles, each with unique implications for buying or selling.

Beyond patterns, traders rely on various indicators to validate their analyses. Moving averages, relative strength index (RSI), and Bollinger bands are just a few examples that help smooth out price fluctuations and reveal underlying trends. Combining chart patterns and indicators allows for a more comprehensive understanding of the market, enabling informed decisions on when to buy low and sell high. Master these tools, and you’ll be well on your way to navigating the stock market with confidence.

Fundamental Analysis: Unlocking Company Financials for Informed Decisions

To master how to trade the stock market, delving into fundamental analysis is a game-changer. This involves scrutinizing a company’s financial health and performance, going beyond surface-level trends. By unlocking these financials, investors gain insights into a business’s intrinsic value, enabling them to make informed decisions in the stock market.

Understanding balance sheets, income statements, and cash flow statements provides a comprehensive view of a company’s operations. Key metrics like revenue growth, profit margins, debt levels, and return on equity become powerful tools for gauging investment potential. Armed with this knowledge, traders can identify undervalued gems or avoid overpriced stocks, enhancing their trading strategies in the dynamic stock market.

Risk Management and Trading Psychology: Safeguarding Your Capital and Staying Calm Under Pressure

In the fast-paced world of stock trading, understanding risk management is as crucial as mastering technical analysis. Effective risk management involves setting clear stop-loss orders to limit potential losses and diversifying your portfolio across various sectors and asset classes. By doing so, you create a safety net that shields your capital from sudden market downturns. This strategic approach empowers traders to navigate volatility with confidence, knowing their investments are protected.

Beyond technical strategies, trading psychology plays an equally vital role in how to trade the stock market successfully. Maintaining a calm and disciplined mindset is essential under pressure. Traders who allow fear or greed to dictate their decisions often make impulsive choices that can lead to significant losses. Developing mental resilience and adhering to a well-defined trading plan help traders stay focused, stick to their strategies, and make rational decisions even in the face of market uncertainty.

Building a Winning Trading Plan: Strategy, Discipline, and Continuous Learning

Building a winning trading plan is the cornerstone of successful stock market navigation. It’s not just about picking winners; it’s a strategic approach that combines well-defined rules, discipline, and an unending thirst for knowledge. To thrive in how to trade the stock market, establish clear objectives and develop a strategy that aligns with your risk tolerance and financial goals. Consistency is key; adhere to your plan, even amidst market volatility.

Continuous learning is paramount. Stay updated on market trends, explore various trading techniques, and adapt your strategies as you gain experience. Remember, the stock market is ever-evolving, and so too should your approach. Embrace failure as a learning opportunity, refine your tactics, and maintain a growth mindset. This combination of discipline, strategy, and continuous improvement will empower you to make informed decisions, enhance your trading performance, and increase your chances of achieving long-term success.

Unlocking the secrets of stock trading is a journey that combines knowledge, strategy, and discipline. By mastering the basics, understanding market dynamics through technical and fundamental analysis, and implementing robust risk management, you can confidently navigate the stock market. Remember, successful trading isn’t just about choosing the right stocks; it’s about following a well-structured plan, staying calm under pressure, and continuously learning from both victories and setbacks. So, with the right approach, you too can thrive in the world of stock trading.