For beginners aiming to build wealth, understanding the fundamentals of investing in the stock market is crucial. Stock market training equips individuals with knowledge about long-term growth through buying company shares and dividends. By learning diverse strategies, portfolio diversification, and staying informed about trends, newcomers can confidently navigate this complex landscape using educational resources and financial advisors. Opening a brokerage account is the first step, followed by familiarizing oneself with trading platforms and practicing in demo environments. Building wealth requires strategic decision-making, setting clear goals, diversifying investments, and staying informed about market developments to achieve desired financial aspirations through stock market training.

“Unsure where to begin your investment journey? This beginner’s guide to the Newcastle Maitland stock market demystifies complex concepts, empowering you to take control of your financial future. We’ll walk you through understanding basic investments, deciphering stocks and shares, and opening a brokerage account. Learn effective strategies for building wealth, managing risks, and diversifying your portfolio. With our step-by-step approach, you’ll gain the knowledge needed to navigate trading platforms successfully and unlock the potential of the stock market for wealth within reach.”

- Understanding the Basics of Stock Market Investing

- Demystifying Stocks and Shares: A Beginner's Guide

- Getting Started: Opening a Brokerage Account

- Navigating Trading Platforms: Tools for Success

- Strategies for Building Wealth in the Stock Market

- Risk Management and Diversification Techniques

Understanding the Basics of Stock Market Investing

Understanding the basics of investing in the stock market is crucial for beginners looking to build their wealth within this dynamic environment. Stock market training often emphasizes the concept of long-term growth, where investors buy shares of companies they believe will thrive over time, leading to increased share prices and potential dividends. This approach requires patience and a keen eye for identifying promising investment opportunities.

By learning about different investment strategies, diversifying their portfolios, and staying informed about market trends, beginners can navigate the stock market with confidence. Educational resources and guidance from financial advisors play a vital role in helping folks demystify this complex landscape, enabling them to make informed decisions that align with their financial goals and aspirations for achieving wealth.

Demystifying Stocks and Shares: A Beginner's Guide

For beginners stepping into the world of investing, understanding stocks and shares can seem like navigating a complex maze. But fear not! It’s time to demystify this fascinating aspect of building wealth. Stocks represent a piece of ownership in a company, while shares are units that make up those stocks. When you buy a share, you become a partial owner of the business, allowing you to participate in its success and growth.

Stock market training is an excellent way to gain knowledge about different investment options. By learning how companies raise capital through stock offerings, you’ll grasp the concept of equity financing. This simple yet powerful idea forms the backbone of building wealth within the stock market. With a solid understanding of these fundamentals, beginners can make informed decisions and embark on their journey towards financial prosperity.

Getting Started: Opening a Brokerage Account

To begin your journey in the stock market, the first step is opening a brokerage account. This platform serves as your gateway to investing and trading shares, providing access to the potential wealth within various companies. Choose a reputable broker that suits your needs, considering factors like fees, ease of use, and available investment options. Many brokers offer user-friendly interfaces, educational resources, and even stock market training for beginners, making it easier to navigate this new world.

Once you’ve selected a broker, the account opening process is typically straightforward. You’ll need to provide personal information, such as your name, address, and contact details. Some brokers may also require identification documents for security purposes. After submitting these, you can fund your account using various methods like bank transfers or credit cards. With your account set up, you’re ready to explore the world of stocks and start building your wealth.

Navigating Trading Platforms: Tools for Success

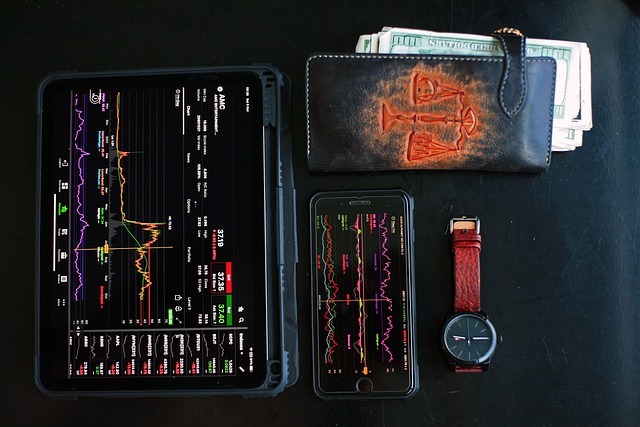

Navigating Trading Platforms is a crucial step for beginners looking to dive into the world of stock markets. These platforms serve as your gateway to buying and selling shares, providing access to real-time market data and facilitating transactions. A good understanding of these tools can empower investors to make informed decisions. With various options available, choosing the right platform aligns with your investment goals and experience level.

The ideal trading platform offers features like intuitive interfaces, advanced charting tools, and educational resources for stock market training. These platforms often provide a demo account where users can practice trading in a risk-free environment. By leveraging such tools, beginners can enhance their understanding of wealth creation within the stock market while gaining confidence before committing real capital.

Strategies for Building Wealth in the Stock Market

Building wealth in the stock market is a long-term strategy that requires patience and a solid understanding of financial principles. One crucial step for beginners is to educate themselves through stock market training programs and resources. Learning about different investment strategies, risk management, and market analysis will empower investors to make informed decisions. Diversification is key; spreading investments across various sectors and asset classes can mitigate risks and maximize returns over time.

Setting clear financial goals and creating a well-defined plan are essential for success. Regularly reviewing and adjusting your portfolio based on market trends and personal circumstances ensures that your investments align with your wealth within aspirations. Staying informed about economic indicators, company news, and industry developments allows investors to identify promising opportunities and make timely adjustments, ultimately contributing to the growth of their financial resources.

Risk Management and Diversification Techniques

When diving into the Newcastle Maitland stock market, understanding risk management is key to navigating this dynamic landscape and achieving wealth within your investment goals. Risk management involves strategies to protect your capital from significant losses during volatile periods. A common technique is setting stop-loss orders, which automatically sell investments when they reach a certain price, limiting potential downside. Diversification is another powerful tool for beginners; it means spreading your investments across various sectors and asset classes, reducing the impact of any single investment’s poor performance.

By diversifying, you can construct a balanced portfolio that aligns with your risk tolerance and financial objectives. Stock market training often emphasizes this principle, as it teaches investors to manage their expectations and embrace a long-term perspective. Embracing these risk management and diversification techniques empowers beginners to take calculated risks and work towards building sustainable wealth.

For beginners navigating the Newcastle Maitland stock market, this guide has demystified essential concepts from understanding basic investments to advanced strategies. By opening a brokerage account and leveraging the right trading platforms, you can start your journey towards building wealth in the stock market. Remember, effective risk management and diversification are key to long-term success. With the right stock market training and a commitment to continuous learning, achieving your financial goals becomes more attainable. Embrace the opportunities within this dynamic landscape to transform your financial future.