Trading the stock market is a powerful tool for building and growing wealth within reach. To succeed, grasp fundamentals like order types, investment strategies (long-term vs short-term), key indicators, market trends, and reading stock charts. Effective risk management techniques are vital for navigating volatility. By understanding these basics, individuals can confidently trade the stock market, achieve their wealth goals, and explore diverse avenues like shares, ETFs, options, futures, and commodities. Continuous learning through fundamental and technical analysis equips investors to make informed decisions while managing risk in their financial portfolio.

“Unleash Your Financial Potential: Simplifying Sydney Stock Market Trading

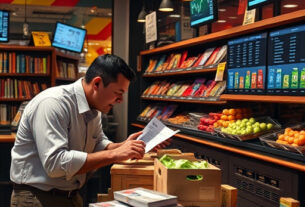

In today’s dynamic economy, understanding the stock market is key to building wealth. This comprehensive guide takes you on a journey through the intricacies of Sydney stock market trading. From grasping the fundamentals—unraveling key terms and exploring traded instruments—to mastering strategies like technical analysis and risk management, we equip you with the tools for success. Learn how to navigate the legal landscape, set up your account, and diversify your portfolio effectively. Discover the balance between long-term growth and short-term gains. Maximize your wealth potential with informed trading decisions tailored to Australia’s thriving market.”

- Understanding the Basics of Stock Market Trading

- – What is stock market trading?

- – Types of financial instruments traded

- – Key terms and concepts explained

Understanding the Basics of Stock Market Trading

Trading in the stock market is a powerful tool for building and growing wealth within. It involves buying and selling shares of publicly traded companies, with the ultimate goal of generating returns on your investments. To begin trading the stock market effectively, one must grasp the fundamentals.

The basics include understanding the different types of orders, such as buy and sell orders, and learning about various investment strategies like long-term investing versus short-term trading. It’s crucial to familiarize yourself with key indicators, market trends, and how to read stock charts. Additionally, educating oneself on risk management techniques is essential for navigating the volatile nature of the stock market while pursuing wealth within its confines.

– What is stock market trading?

Stock market trading is a process where shares of publicly traded companies are bought and sold. It’s a dynamic arena where investors can participate in building their wealth by investing in businesses they believe will thrive. Trading the stock market involves buying shares at a certain price, hoping to sell them later at a higher price, thereby generating a profit. This activity is driven by various factors such as company performance, economic indicators, and market sentiment.

Wealth within reach isn’t just a dream for many; it’s an achievable goal through strategic stock market trading. By carefully researching companies, understanding market trends, and making informed decisions, individuals can position themselves to benefit from the growth of successful businesses. It’s about recognizing opportunities, managing risk, and having the patience to allow investments to grow over time.

– Types of financial instruments traded

In Sydney’s bustling financial landscape, traders navigate a diverse range of financial instruments on the stock market, each offering unique opportunities for building wealth within. These include shares, which represent ownership in companies, allowing investors to participate in their growth and success. Another popular instrument is exchange-traded funds (ETFs), providing diversification across various sectors or asset classes with a single investment. Options and futures contracts offer more advanced trading strategies, enabling traders to speculate on future price movements with the potential for significant returns.

Furthermore, Sydney’s stock market facilitates the trade of commodities like gold and silver, precious metals that have long been considered a storehouse of value. These instruments cater to investors seeking diversification beyond traditional stocks and provide a hedge against economic uncertainties. Trading these financial instruments requires a deep understanding of market dynamics and risk management strategies, but it offers the promise of substantial rewards for those who successfully navigate Sydney’s dynamic stock market.

– Key terms and concepts explained

Trading the stock market is a complex yet accessible path to building wealth within an individual’s financial portfolio. At its core, it involves buying and selling shares of publicly traded companies, allowing investors to capitalize on the growth or stability of these businesses. Key terms like market capitalization, stock price, and dividends are essential to understand; they represent the total value of a company, its current worth in the eyes of investors, and the return on investment it offers, respectively.

To navigate this landscape, beginners often focus on fundamental analysis, studying company financials and industry trends to identify undervalued gems. Alternatively, technical analysis employs charts and patterns to predict price movements. With these strategies and a commitment to continuous learning, individuals can make informed decisions, managing risk while aiming for substantial returns.

Trading the stock market doesn’t have to be complex or intimidating. By understanding the basics and familiarizing yourself with key terms, you can take control of your financial future. The Sydney stock market offers a vast array of opportunities for wealth within, with various financial instruments catering to different investment styles. With this knowledge, individuals can make informed decisions, navigate the market effectively, and potentially unlock substantial returns on their investments.