In Australia's volatile market, leverage trading offers both significant gains and substantial risks for investors aiming to maximize wealth. It involves using borrowed funds to increase position sizes, but proper risk management is critical to mitigate potential losses. Effective strategies include setting stop-loss orders, diversifying investments, and regularly adjusting trade plans. Savvy investors balance these tactics to navigate market fluctuations, preserve capital, and achieve substantial returns while ensuring long-term financial security.

“In the dynamic landscape of Australian markets, understanding volatility is key to successful investment strategies, especially when employing leverage. This article delves into the intricate relationship between market fluctuations and leverage trading decisions, offering a comprehensive guide for investors.

From deciphering Australia’s volatile trends to exploring the potential and risks of leverage, we provide insights on navigating these waters. We present case studies, best practices, and expert strategies to help investors harness wealth creation opportunities while managing risk effectively.”

- Understanding Market Volatility in Australia: A Comprehensive Overview

- Leverage Trading: Unlocking Potential but Carrying Risk

- The Impact of Volatility on Leverage Trading Strategies

- Wealth Management: Navigating Volatile Markets with Leverage

- Case Studies: Successful and Unsuccessful Leverage Trades in Australia

- Best Practices for Mitigating Risk in Leverage Trading

Understanding Market Volatility in Australia: A Comprehensive Overview

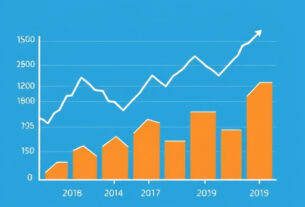

Australia’s market volatility plays a pivotal role in shaping leverage trading decisions, especially for those seeking to maximise wealth within their investment portfolios. Understanding this dynamic is essential for traders navigating the complexities of Australia’s financial landscape. Market volatility refers to the degree of price fluctuations in financial markets over time, and it can significantly impact both risk and potential returns. In Australia, factors such as economic growth rates, political stability, interest rates, and global market trends contribute to overall volatility.

Traders looking to leverage these movements must consider the inherent risks associated with higher volatility. Leverage trading allows investors to amplify gains or losses based on market movements, offering both advantages and potential drawbacks. On one hand, it can lead to substantial wealth accumulation during periods of positive price swings. On the other hand, intense volatility may result in significant losses if positions are not managed carefully. Therefore, a comprehensive understanding of Australia’s market dynamics is crucial for making informed leverage trading decisions that align with wealth accumulation goals.

Leverage Trading: Unlocking Potential but Carrying Risk

Leverage trading offers investors a powerful tool to amplify potential returns and unlock hidden wealth within volatile markets, such as Australia’s dynamic economic landscape. By using borrowed funds, traders can magnify their position size, enabling them to capture significant gains from market movements. This strategy has proven attractive for those seeking to maximize profits during periods of volatility. However, it is not without risk. The very nature of leverage means that losses can also be magnified, potentially resulting in substantial financial setbacks if not managed carefully.

Traders must understand the intricate relationship between leverage and risk management. Proper risk assessment and strategies like stop-loss orders are essential to navigate the challenges of leverage trading. Balancing the pursuit of wealth creation with prudent risk mitigation ensures that market volatility becomes an opportunity rather than a liability, fostering a sustainable approach to building financial success over time.

The Impact of Volatility on Leverage Trading Strategies

In the dynamic landscape of global markets, Australia’s market volatility presents both challenges and opportunities for traders employing leverage strategies. High volatility can significantly amplify both profits and losses in leveraged trading. Traders seeking to maximize wealth within a volatile environment must carefully consider their risk management approaches. Effective strategies involve setting stringent stop-loss orders to mitigate potential downside risks while capturing upward moves.

Volatility also influences the selection of appropriate leverage levels. In more turbulent markets, reducing leverage can be a prudent step to safeguard capital. This conservative approach ensures traders maintain a buffer against abrupt price swings, preserving their ability to navigate market fluctuations and potentially capitalize on emerging opportunities for wealth within the volatile Australian market.

Wealth Management: Navigating Volatile Markets with Leverage

In today’s dynamic financial landscape, navigating market volatility is an art that requires a delicate balance between risk and reward. Wealth management plays a pivotal role in this regard, especially when it comes to leveraging trading strategies. For investors seeking to maximize wealth within these uncertain times, understanding how to utilize leverage effectively becomes a key decision-maker. Leverage trading allows for the potential to amplify gains, offering an attractive opportunity to grow wealth faster. However, it’s a double-edged sword; market volatility can just as quickly lead to significant losses if not managed prudently.

Wealth managers act as navigators in these turbulent seas, guiding clients through the complexities of leverage trading. They employ sophisticated strategies to mitigate risks while capitalizing on market fluctuations. By diversifying investment portfolios and employing risk management techniques, wealth managers ensure that clients’ wealth is protected during volatile periods. This approach enables investors to embrace opportunities presented by leveraged trading, knowing their capital is secure.

Case Studies: Successful and Unsuccessful Leverage Trades in Australia

In the dynamic landscape of Australian markets, leverage trading can be a double-edged sword. Case studies illustrate this point vividly. For instance, a successful leverage trade might involve a savvy investor who uses borrowed funds to capitalize on a anticipated market upswing, leading to significant wealth within a relatively short period. This strategy has proven lucrative for many Australians looking to accelerate their investment growth.

Conversely, unsavvy traders have found themselves in perilous situations due to mismanaged leverage. Unforeseen market downturns can quickly turn profits into losses, especially when leverage is applied excessively. These cases serve as cautionary tales, emphasizing the importance of a well-informed approach and risk management strategies for leverage trading.

Best Practices for Mitigating Risk in Leverage Trading

When engaging in leverage trading, managing risk is paramount to preserving and growing wealth within volatile markets like Australia’s. A key best practice involves setting clear stop-loss orders to automatically limit potential losses. This strategic move ensures that even in unpredictable market shifts, your position sizes remain manageable, safeguarding your capital.

Additionally, diversifying your portfolio across various assets can help mitigate risk specific to any one market. By spreading investments, you reduce the impact of Australia’s market volatility on your overall wealth. Regularly reviewing and adjusting trade strategies based on market conditions is also essential. Staying agile allows for swift responses to changing dynamics, enabling traders to capitalize on opportunities while keeping risks in check.

Australia’s market volatility presents both challenges and opportunities for leverage traders. By understanding the dynamic nature of these markets, investors can strategically navigate volatile periods, optimizing their leverage strategies to build wealth effectively. This article has explored various aspects, from defining volatility to analyzing case studies and offering best practices. Embracing a nuanced approach that balances risk management with growth potential is crucial for achieving success in the Australian market. By implementing the discussed strategies, individuals can make informed decisions, enhance their wealth management, and navigate leverage trading with confidence.