For newcomers to the Melbourne stock market, understanding the fundamentals is crucial for building wealth. This includes learning key terms, share types, investment strategies, and navigating online platforms. Setting up a brokerage account with a reputable broker is the first step, followed by defining investment goals and staying informed through financial news and analysis. Understanding bull and bear markets, implementing risk management, and diversifying investments are vital for success. Melbourne's vibrant financial scene offers extensive resources like educational platforms and communities to empower beginners in their trading journeys, aiming to unlock wealth through strategic stock selection.

Are you ready to embark on a journey into the dynamic world of stock trading in Melbourne? This comprehensive guide is designed to empower beginners and seasoned investors alike to navigate the Australian market with confidence. From understanding the basics of the stock market to mastering risk management and timing your trades, we’ll explore essential strategies for success. Uncover the secrets to identifying lucrative investment opportunities and learn how to protect and grow your wealth within Melbourne’s thriving financial landscape.

- Understanding the Stock Market: A Beginner's Guide

- Preparing to Trade: Setting Up Your Brokerage Account in Melbourne

- How to Research and Select Stocks for Investment

- Strategies for Successful Stock Trading: Bull vs Bear Markets

- Managing Risk: Protecting Your Wealth While Trading

- Timing the Market: When to Buy and Sell Stocks

- Tools and Resources for Melburnians to Enhance Their Trading Journey

Understanding the Stock Market: A Beginner's Guide

The stock market can seem complex and intimidating for newcomers, but understanding its basics is a crucial first step in your journey to building wealth within it. Put simply, trading stocks involves buying and selling shares of publicly traded companies. These shares represent ownership in those businesses, meaning you become a partial owner with rights to potential profits from the company’s growth. The Australian stock market, where Melbourne plays a significant role, offers a vast array of opportunities for investors.

To start trading stocks effectively, beginners should familiarize themselves with key terms and concepts. This includes understanding the difference between common and preferred shares, learning about various investment strategies like value investing or growth investing, and grasping how to read stock quotes and charts. Many online platforms and educational resources cater specifically to new traders, providing a solid foundation for navigating the market and making informed decisions. By demystifying these concepts, you’ll be well-equipped to make your first steps into the world of stock trading and potentially unlock the wealth within this dynamic financial arena.

Preparing to Trade: Setting Up Your Brokerage Account in Melbourne

Preparing to engage in how to trade stocks involves a crucial first step: setting up your brokerage account. In Melbourne, numerous reputable brokerages cater to aspiring investors seeking to unlock wealth within the bustling financial markets. The process begins with careful selection of a broker aligned with your investment goals and risk tolerance. Consider factors such as fees, platform features, available assets, and customer support when making this choice.

Once you’ve identified the right broker, it’s time to open an account. This typically involves providing personal details, verifying your identity, and funding your initial investment. Many platforms offer user-friendly interfaces that guide you through each step, ensuring a smooth onboarding experience. With your account set up, you’re one step closer to diving into the world of stock trading and potentially generating significant wealth within Melbourne’s dynamic financial landscape.

How to Research and Select Stocks for Investment

When diving into the world of trading stocks in Melbourne or anywhere else, understanding how to research and select stocks is key to building your wealth. Start by identifying your investment goals and risk tolerance. Determine whether you’re seeking short-term gains or long-term growth, as this will shape your strategy. Next, familiarize yourself with financial news and market trends specific to Australia. Websites, apps, and financial publications offer real-time data and analysis on various industries and companies listed on the Australian Securities Exchange (ASX).

Focus on fundamental analysis to assess a company’s health and potential. Examine key metrics like revenue growth, profit margins, debt levels, and market share. Tools and platforms provided by brokers or dedicated financial websites can help you compare these figures across different stocks. Additionally, keep an eye on industry-specific news and regulatory changes that might impact stock performance. This comprehensive research will empower you to make informed decisions, increasing the potential for successful investments and wealth within your portfolio.

Strategies for Successful Stock Trading: Bull vs Bear Markets

When it comes to strategies for successful stock trading, understanding the dynamics of bull and bear markets is essential. Bull markets are characterized by rising stock prices and an overall positive economic outlook, providing excellent opportunities for investors looking to generate wealth within a relatively short period. During these periods, aggressive buying strategies can be employed, focusing on growth stocks and sectors with high potential. This involves identifying undervalued assets that have the capacity to appreciate significantly as the market continues its upward trend.

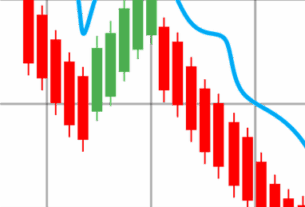

Conversely, bear markets present unique challenges for traders. Defined by declining stock prices and a pessimistic economic climate, these periods demand a more conservative approach. Bear market trading strategies often involve short selling, where investors borrow shares and sell them in the hope of buying them back at a lower price later. This technique allows for potential profit despite the falling market. Additionally, diversifying your portfolio to include defensive stocks that tend to perform better during economic downturns can help mitigate risks and navigate these volatile times successfully.

Managing Risk: Protecting Your Wealth While Trading

Trading stocks can be a thrilling yet risky endeavor, especially for beginners in Melbourne looking to navigate the financial markets. Protecting your wealth is paramount when delving into stock trading. A robust risk management strategy is essential to ensure sustainable growth and preserve your capital. Diversification is a fundamental tool; spreading your investments across various sectors and industries can mitigate the impact of any single stock’s volatility.

Understanding stop-loss orders is another crucial aspect. These orders automatically sell your shares when they reach a certain price, limiting potential losses. By carefully managing risk, you can learn to trade stocks effectively, making informed decisions that support the growth of your wealth within the Melbourne market.

Timing the Market: When to Buy and Sell Stocks

Trading stocks is an art that involves careful observation and strategic decision-making. One of the most debated aspects is timing the market—when to buy and sell for optimal gains. While no one can predict the future with certainty, there are techniques to enhance your chances. Many successful traders rely on fundamental analysis, studying company financials and industry trends, to identify undervalued stocks with high growth potential. This approach ensures you’re buying wealth when prices are relatively low.

Alternatively, technical analysis uses historical price data and trading volume to predict future performance. Traders look for patterns and indicators to time their entries and exits. For instance, they might buy when a stock breaks through resistance levels or sell short when there’s a significant drop in volume accompanied by declining prices. Combining these methods can be powerful, but remember, timing the market is challenging, and it’s essential to understand your risk tolerance and investment goals before making any moves.

Tools and Resources for Melburnians to Enhance Their Trading Journey

Melbourne, as a bustling financial hub, offers Melburnians an exciting opportunity to embark on their trading journey and unlock wealth within the stock market. The city is home to numerous professional traders who have honed their skills and strategies, creating a vibrant ecosystem of knowledge and resources. For those new to the world of stocks, understanding how to trade can seem daunting, but with the right tools and guidance, anyone can gain a competitive edge.

One of the first steps for Melburnians interested in how to trade stocks is to equip themselves with comprehensive resources. Melbourne boasts several educational platforms, online forums, and trading communities where beginners can learn from experienced traders’ insights. Websites and mobile apps providing real-time market data, advanced charting tools, and technical analysis indicators are also readily available. These digital resources empower Melburnians to make informed decisions, track their portfolios, and stay updated on the latest market trends, all of which contribute to a successful trading experience and the potential for significant wealth gains.

Starting your stock trading journey in Melbourne is an exciting step towards building your wealth. By understanding the market fundamentals, setting up a brokerage account tailored to your needs, and utilizing available resources, you’re well-prepared to navigate the financial landscape. Remember, successful trading involves careful research, risk management, and adapting strategies based on market conditions. Embrace the learning process, stay informed, and leverage Melbourne’s vibrant financial tools to achieve your investment goals and unlock your wealth within.