Day trading in Australia offers a dynamic path to building wealth by exploiting short-term price fluctuations across diverse sectors like banking, resources, tech, and agriculture. It requires swift decision-making, understanding market trends, and effective risk management using tools like stop-loss orders and diversification. While high-intensity and risky, with potential for substantial financial losses, continuous learning and staying informed enhance success in this challenging yet potentially lucrative approach to generating wealth within Australia's robust financial markets.

Discover the thrilling world of day trading in Australia and unlock wealth like never before! This comprehensive guide will transform your understanding of what is day trading. Explore the dynamic Australian financial markets and learn how to navigate them effectively. From comprehending market trends to mastering strategic techniques, we’ll equip you with the tools to build wealth through short-term trades. Prepare to embark on a journey that could redefine your financial future.

- What is Day Trading? A Comprehensive Overview

- Understanding the Australian Financial Market Landscape

- Strategies for Building Wealth Through Day Trading

- Overcoming Challenges and Risks in Day trading Australia

What is Day Trading? A Comprehensive Overview

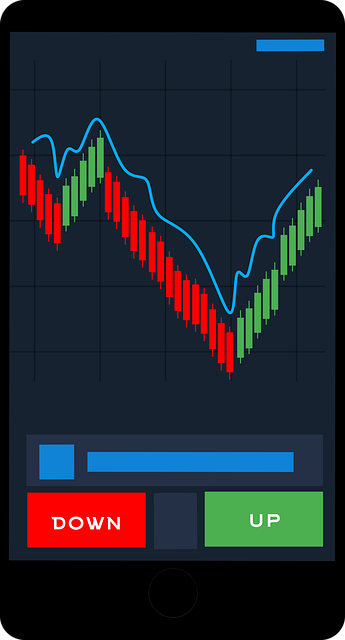

Day trading is a high-intensity investment strategy where traders aim to profit from short-term price fluctuations in financial markets. It involves buying and selling assets, such as stocks, within the same trading day, seeking to capitalise on minor price movements. This dynamic approach demands quick decision-making skills, as traders must analyse market data, identify trends, and execute trades swiftly.

Australia’s robust financial markets offer a conducive environment for day trading, providing ample opportunities for those seeking wealth within. With advanced trading platforms and accessible brokerages, aspiring day traders can enter the market with a relatively low barrier to entry. However, it’s crucial to understand that day trading is not without risks; it requires extensive knowledge, discipline, and risk management strategies to navigate the volatile nature of financial markets successfully.

Understanding the Australian Financial Market Landscape

The Australian financial market landscape offers a dynamic environment for day traders seeking to build wealth. Understanding local markets and their unique characteristics is essential for success. Australia boasts diverse sectors, from robust banking and resources to emerging tech and agriculture, providing ample opportunities for skilled traders to capitalize on short-term price movements.

Day trading, a strategy focused on buying and selling within the same trading day, requires a deep understanding of market dynamics. By analyzing price trends, volume, and news events specific to Australia’s financial markets, traders can identify high-potential trades. The goal is to generate consistent profits from small price discrepancies, ultimately building substantial wealth within the dynamic Australian economic sphere.

Strategies for Building Wealth Through Day Trading

Building wealth through day trading involves a strategic approach that leverages Australia’s dynamic financial markets. Unlike long-term investments, what is day trading focuses on short-term price fluctuations, allowing investors to capitalize on intraday gains. Key strategies for achieving this within the Australian context include understanding market trends and patterns, utilizing technical analysis tools like charts and indicators, and employing risk management techniques such as stop-loss orders.

Diversifying your portfolio across various asset classes—from stocks and commodities to currencies—is another effective tactic. This approach spreads risk while amplifying potential returns. Additionally, staying informed about economic news and global events that can impact markets is crucial. Adaptability and speed are key; successful day traders in Australia act swiftly on market signals, using high-speed trading platforms to execute trades promptly.

Overcoming Challenges and Risks in Day Trading Australia

Overcoming Challenges and Risks in Day Trading Australia

Day trading involves navigating highly volatile financial markets, presenting significant challenges and risks for aspiring traders. What is day trading if not a constant dance with market fluctuations? The pursuit of wealth within this dynamic environment demands unwavering discipline, robust risk management strategies, and a deep understanding of the markets. Australian investors must be adept at interpreting complex data, swiftly adapting to shifting trends, and making informed decisions in fractions of a second.

One of the primary risks lies in the potential for substantial financial losses. The market’s unpredictable nature can lead to significant swings in trade outcomes. To mitigate these risks, traders need to implement strict stop-loss orders, diversifying their portfolios across various assets. By embracing continuous learning and staying abreast of market dynamics, Australian day traders can enhance their decision-making processes, increasing their chances of achieving wealth within this demanding yet potentially lucrative arena.

Day trading in Australia offers a unique opportunity to build significant wealth through strategic market navigation. By understanding the intricacies of what is day trading and leveraging successful strategies, individuals can effectively manage risks and capitalise on the dynamic Australian financial markets. With the right approach, it’s possible to achieve substantial gains and create a secure future, showcasing that building wealth within the local context is achievable for those willing to learn and adapt to the ever-changing market landscape.