Leverage trading offers Australian investors a high-risk, high-reward strategy to accelerate wealth creation through borrowed funds, amplifying investment returns. However, this powerful tool also magnifies losses, requiring strict risk management including stop-loss orders and portfolio diversification to navigate volatile markets successfully. When executed correctly, leverage trading can yield significant gains in Australia's dynamic financial landscape.

“Unleash High Margins, Transform Your Finance: Exploring Leverage Trading in Australia’s Dynamic Market. This comprehensive guide delves into the world of leverage trading, a powerful strategy to amplify returns in Australia’s financial landscape. We demystify high-margin trading, highlighting its potential for wealth creation through popular instruments like CFDs and futures. By navigating regulatory frameworks and adopting expert tips on risk management and diversification, Australian traders can unlock profitable opportunities while staying informed about market trends.”

- Understanding Leverage Trading: Unlocking High Margins

- – Definition and basics of leverage trading

- – Benefits and risks associated with high-leverage strategies

Understanding Leverage Trading: Unlocking High Margins

Leverage trading is a powerful tool that enables investors and traders in Australia to unlock significant gains and accelerate their path to wealth within the financial markets. By leveraging a small amount of capital, often borrowed from brokers or through margin lending, traders can control larger positions. This strategy amplifies potential profits, allowing for higher margins and more substantial returns on investment.

Understanding leverage trading involves grasping the concept of risk and reward. While it offers the prospect of wealth within a shorter time frame, it also increases exposure to loss. Traders must carefully manage their position sizes, risk ratios, and stop-loss orders to protect their capital. Effective leverage trading requires discipline, thorough market analysis, and a well-defined strategy to navigate the dynamic Australian financial landscape.

– Definition and basics of leverage trading

Leverage trading is a powerful strategy that involves borrowing funds to increase purchasing power and aim for higher returns. In simple terms, it’s a way to amplify potential gains in investments. Traders use leverage by taking out loans from brokers, which allows them to trade with a larger sum of money than they initially possess. This can lead to significant wealth within a shorter time frame as even small price movements in the market can result in substantial profits.

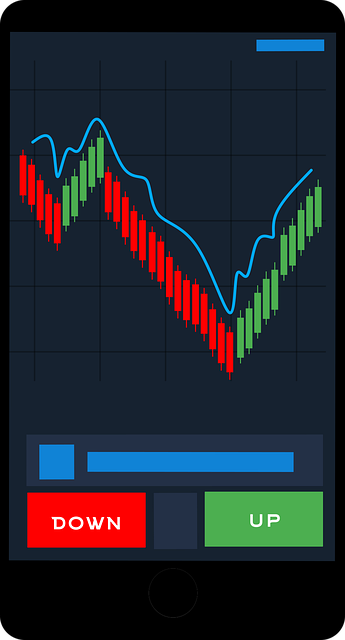

The concept is based on the idea that a small increase in the value of an asset can lead to a proportionally larger gain due to the leverage. For instance, with a 10x leverage, a 1% rise in the asset’s price translates into a 10% return for the trader. However, it’s crucial to understand the risks associated with leverage trading. While it offers the potential for high returns, it also magnifies losses. Traders must manage risk effectively by setting stop-loss orders and diversifying their portfolio to navigate this dynamic trading approach successfully within the Australian financial landscape.

– Benefits and risks associated with high-leverage strategies

High-leverage trading strategies, often referred to as leverage trading, offer Australian investors the potential for significant gains and the opportunity to accelerate wealth creation. By borrowing funds to increase their buying power, traders can amplify returns on successful investments. This approach is particularly appealing in volatile markets where swift actions can lead to substantial profits. However, it’s crucial to acknowledge the risks inherent in such strategies. High leverage magnifies both potential gains and losses, meaning even small market movements can result in substantial negative impacts on investment capital.

Traders must possess a robust risk management strategy to navigate these volatility risks effectively. This includes setting clear stop-loss orders, diversifying their portfolio, and staying informed about market dynamics. With the right approach, leverage trading can be a powerful tool for those seeking to accelerate wealth within the Australian financial landscape.

Leverage trading has emerged as a powerful tool for Australian investors seeking to unlock significant wealth within their portfolios. By understanding the intricacies of this strategy and carefully managing the associated risks, individuals can harness the potential for substantial returns. As the financial landscape continues to evolve, leveraging smartly may well be the key to achieving financial success in the dynamic Australian market.