Trading with leverage offers beginners a powerful way to maximize wealth in shorter time frames, but it comes with significant risks. To safely participate, newcomers must grasp market dynamics, understand risk management techniques like stop-loss orders and portfolio diversification, and build a solid foundation through education. Starting small and gradually increasing leverage as understanding grows is crucial for managing potential losses while trading with leverage to achieve wealth within financial markets.

“Unleash Your Financial Potential: Sydney’s Guide to Leveraged Trading for Beginners. Discover the power of trading with leverage and unlock new avenues for wealth creation. This comprehensive article demystifies the concept, offering a beginner-friendly exploration of market dynamics.

From understanding basic strategies to navigating risks, we equip you with tools to maximize gains. Learn how to build a robust foundation in leveraged trading, ensuring both confidence and success on your journey towards financial prosperity.”

- What is Trading with Leverage?

- Understanding the Basics for Beginners

- Strategies to Maximize Wealth with Leverage

- Navigating Risks and Building a Solid Foundation

What is Trading with Leverage?

Trading with leverage is a strategy that allows investors to control a larger position in the market with a relatively small amount of capital. It amplifies both potential gains and losses, making it a powerful tool for growing wealth within a shorter time frame. By borrowing funds from a broker, traders can increase their buying power, enabling them to take on more significant positions. This method is often appealing to beginners as it offers the chance to participate in high-value trades that might otherwise be out of reach.

However, leverage trading comes with increased risks. While it can lead to substantial gains, it can also result in significant losses if the market moves against the trader. It’s crucial for beginners to understand the dynamics of leverage and manage risk effectively. This involves setting clear stop-loss orders to limit potential downside and having a solid understanding of the markets they are trading.

Understanding the Basics for Beginners

For beginners venturing into the world of trading with leverage, understanding the basics is crucial for unlocking wealth within the markets. Leverage trading involves using borrowed funds to amplify potential returns on investments, but it’s essential to grasp how this power works. It allows traders to control a more substantial position in the market than their initial capital would permit, offering the prospect of greater gains.

However, beginners must also be aware that leverage magnifies both profits and losses. A small movement in the market can lead to significant changes in an investment’s value, for better or worse. This complexity underscores the importance of education and practice before engaging in trading with leverage. Gaining a solid understanding of market dynamics, risk management strategies, and diverse investment vehicles is key to navigating this exciting yet challenging aspect of financial markets.

Strategies to Maximize Wealth with Leverage

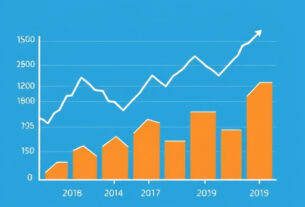

Maximizing wealth through trading with leverage is an effective strategy for beginners looking to boost their investment potential. Leverage allows traders to control a larger position size than their account balance would normally permit, amplifying both profits and losses. A common approach is to use margin trading, where borrowers obtain funds from their broker to purchase assets. This can significantly increase gains if the market moves in your favor. For instance, a beginner investor might borrow a portion of their capital to trade on a higher volume, potentially leading to substantial returns.

However, it’s crucial to employ risk management techniques when trading with leverage. Setting stop-loss orders is essential to limit downside risk and protect against substantial losses if the market turns against you. Diversifying your portfolio across various assets can also help manage risk. Beginners should start small, gain experience, and gradually increase their leverage as they understand the markets better. With careful consideration and discipline, leveraging your trades can be a powerful tool to achieve wealth within the financial markets.

Navigating Risks and Building a Solid Foundation

Navigating risks is an essential part of trading with leverage. Leverage amplifies both gains and losses, making it crucial to understand and manage risk effectively. Beginners should start by learning how to set stop-loss orders, which automatically close positions to limit potential downside risk. Diversifying their portfolio across various assets can also help spread risk. Building a solid foundation involves thorough research and education. Understanding market dynamics, technical indicators, and fundamental analysis empowers traders to make more informed decisions. By grasping these concepts, beginners can begin trading with leverage while keeping their wealth within manageable boundaries.

Sydney leverage trading, simplified for beginners, offers an exciting path towards achieving wealth within. By understanding basic concepts, implementing strategic moves, and carefully managing risks, anyone can navigate this dynamic financial landscape. Embracing these principles paves the way for turning knowledge into substantial gains, making Sydney leverage trading a powerful tool for building financial security and prosperity.