Volume analysis, a key skill taught in stock trading courses, empowers investors to interpret market sentiment and optimize trade timing by tracking share volume over time. By identifying trends, anticipating price movements, and making informed decisions based on volume patterns and investor sentiment, traders can build wealth effectively within the stock market. Understanding volume analysis provides a powerful tool for navigating market complexities, aiming to generate substantial returns across various asset classes.

“Unlock the secrets of volume analysis and master the art of entry-exit timing in stock trading. This comprehensive guide takes you on a journey through understanding market sentiment, decoding volume patterns, and implementing effective strategies. From introductory stock trading courses to real-world success stories, learn how to identify optimal entry and exit points for maximizing wealth within. Discover powerful tools and techniques that can transform your trading strategy, enabling you to navigate the markets with confidence.”

- Understanding Volume Analysis: Unlocking Market Sentiment in Stock Trading Courses

- Decoding Volume Patterns: Identifying Entry and Exit Points for Optimal Wealth Within

- Tools and Techniques: Implementing Volume Analysis in Your Trading Strategy

- Real-World Applications: Success Stories and Best Practices for Effective Volume Analysis

Understanding Volume Analysis: Unlocking Market Sentiment in Stock Trading Courses

Volume analysis is a powerful tool in stock trading courses, allowing investors to uncover hidden market sentiment and make informed decisions for entry and exit timing. By examining the volume of shares traded over a specific period, traders can gain valuable insights into the overall health and momentum of an asset. In today’s fast-paced financial markets, understanding volume patterns can be a game-changer for those seeking wealth within.

In stock trading courses, learners often discover that market volume acts as a mirror to investor sentiment. High volume typically indicates strong interest and potential price movements, while low volume may suggest a lack of enthusiasm or a potential reversal. By decoding these signals, traders can anticipate trends, identify critical turning points, and execute trades with greater precision. This strategic approach not only enhances the chances of successful transactions but also contributes to building wealth within the market.

Decoding Volume Patterns: Identifying Entry and Exit Points for Optimal Wealth Within

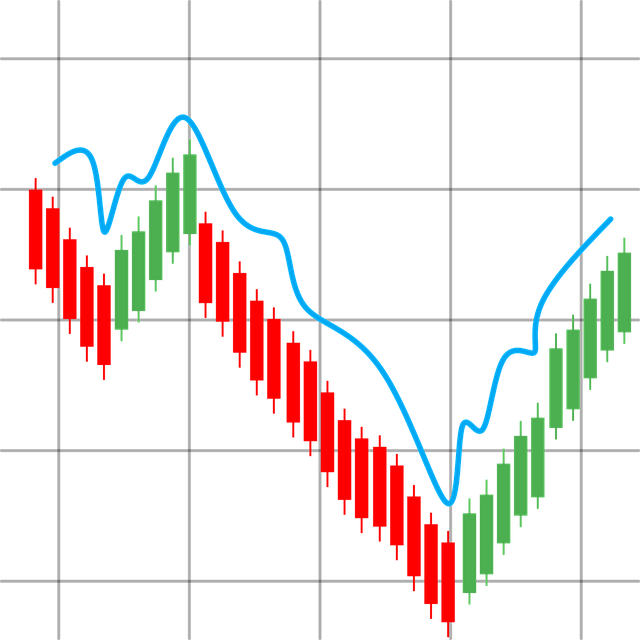

Decoding volume patterns is a powerful tool for traders looking to enhance their entry and exit strategies in stock trading courses. By analyzing trading volume alongside price movements, investors can uncover valuable insights into market sentiment and potential turning points. Volume serves as a barometer of market activity, indicating the intensity of buying or selling pressure. When coupled with price action, it becomes an indispensable guide for identifying optimal entry and exit points, aiming to maximize wealth within.

Traders often look for specific volume patterns, such as breakouts or reversals, to confirm trends and make informed decisions. For example, a sharp increase in volume during a price ascent might signal a strong upward trend, suggesting a potential entry point. Conversely, a decline in volume during a downtrend could indicate weakening momentum, serving as an exit signal. These insights are particularly valuable for those seeking to navigate the complexities of the market with precision and aim to grow their wealth effectively through strategic trading.

Tools and Techniques: Implementing Volume Analysis in Your Trading Strategy

In the realm of stock trading courses, understanding volume analysis is a game-changer for aspiring traders aiming to unlock wealth within the markets. This powerful tool provides insights into the overall sentiment and momentum behind price movements. By examining the relationship between stock prices and trading volume, traders can make more informed decisions about entry and exit points. Simple yet effective techniques include identifying unusual volume spikes, which often signal significant price breaks or potential reversals, and using moving averages to smooth out noise and confirm trends.

Traders can leverage various indicators, such as the On-Balance Volume (OBV) and Average True Range (ATR), to enhance their analysis. The OBV measures cumulative volume flow, helping traders gauge strength in price movements, while the ATR provides volatility metrics crucial for risk management. Combining these tools with fundamental analysis offers a comprehensive approach, allowing traders to navigate market fluctuations effectively.

Real-World Applications: Success Stories and Best Practices for Effective Volume Analysis

In the realm of stock trading courses, volume analysis stands out as a powerful tool for navigating the markets and achieving wealth within. Real-world applications of this strategy have yielded remarkable success stories, particularly among traders who understand how to interpret price movements in conjunction with trading volumes. For instance, many seasoned investors attribute their consistent profitability to effective volume analysis, enabling them to time their entries and exits with precision.

Best practices for leveraging volume analysis include close attention to significant changes in trading volume, identifying patterns that signal strong market sentiment, and using these insights to make informed decisions. By integrating volume indicators into their strategies, traders can avoid false signals and minimize risks, ultimately enhancing the potential for substantial returns. This approach has proven effective across various asset classes, from stocks to commodities, underscoring its versatility in the pursuit of wealth creation.

Volume analysis is a powerful tool that, when mastered through quality stock trading courses, can significantly enhance entry-exit timing strategies. By understanding and decoding volume patterns, traders can make more informed decisions, ultimately aiming to optimize their wealth within the market. Through practical applications and real-world success stories, it becomes evident that effective volume analysis is not just a concept but a game-changer for those looking to navigate the intricate landscape of financial markets.