Stop loss is essential risk management tools for traders aiming to protect their capital and safeguard ‘wealth within’ volatile markets. By setting predefined price levels for automatic asset sale, these orders limit potential losses and provide strategic exits without disrupting market pricing. Both Market Stop Loss (executes at current price) and Limit Stop Loss (waits for favorable entry price) methods offer control and effective risk management based on individual risk tolerance, market volatility, and profit goals, enabling traders to steer through market fluctuations with confidence and achieve their wealth within objectives.

In the dynamic realm of trading, managing risk is paramount. A foundational concept in this strategy is the stop loss order, designed to protect your wealth within volatile markets. This article demystifies the basics of stop losses, from their definition to their pivotal role in risk management. We’ll explore different types of orders, guide you through setting and managing these safeguards, and share strategies to maximize your wealth within by employing an effective stop loss approach.

- What is Stop Loss?

- Why is Stop Loss Important in Trading?

- Types of Stop Loss Orders

- Setting Your Stop Loss Points

- Managing and Adjusting Stop Losses

- Maximizing Wealth with Effective Stop Loss Strategy

What is Stop Loss?

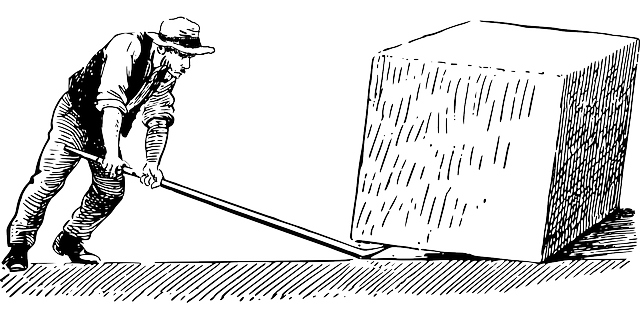

Stop loss is a fundamental concept in trading that allows investors to protect their wealth within the market. It’s a pre-set order to sell a security when it reaches a specific price, aiming to limit potential losses. Imagine it as setting a safety net below your investment, ensuring that even if the market takes a turn for the worse, you won’t drop below a certain point. This strategy is crucial for managing risk, especially in volatile markets.

By implementing a stop loss order, traders can avoid panic-selling at unpredictable lows and instead exit positions in a controlled manner. It’s a simple yet powerful tool that enables investors to focus on growth opportunities while safeguarding their capital. Understanding how stop loss functions is essential for navigating the complexities of trading and unlocking wealth within various market conditions.

Why is Stop Loss Important in Trading?

In the dynamic landscape of trading, managing risk is paramount to preserving and growing wealth within your portfolio. This is where Stop Loss comes into play as a fundamental tool. A Stop Loss order allows traders to define a price level at which they are willing to sell an asset to limit potential losses if the market moves against them. By setting a Stop Loss, investors can protect their capital and manage risk effectively.

The importance of Stop Loss lies in its ability to provide a safety net, especially during volatile market conditions. It helps traders sleep soundly at night, knowing that even if the market takes an unexpected turn, their potential losses are capped. This strategic move enables investors to focus on the bigger picture, making informed decisions and seizing opportunities without constant worry about significant financial setbacks.

Types of Stop Loss Orders

Stop loss orders are a fundamental tool for traders looking to protect their wealth within the market. There are several types of stop loss orders designed to suit different trading strategies and preferences, offering traders increased control over their positions. One such type is the Market Stop Loss order, which executes a trade at the current market price when the specified stop price is reached. This order is ideal for those seeking a quick exit strategy without influencing the asset’s price.

Another variation is the Limit Stop Loss order, allowing traders to set both a stop price and a desired entry price. When the market reaches the stop price, the order automatically sells, but if it moves in the trader’s favor, the trade won’t execute until the specified entry price is reached. This method provides a more controlled exit point while still offering potential for gains if the market moves favorably.

Setting Your Stop Loss Points

When setting your stop loss points, envision where you’d like to safeguard your investment and manage risk effectively. Stop losses are a crucial tool in trading as they automatically close out a position when the market moves against you by a predetermined amount. This prevents significant losses and helps you maintain control over your portfolio.

To determine your stop loss points, consider factors like your risk tolerance, market volatility, and desired profit margins. For instance, if you’re comfortable with a 5% loss, set your stop loss at the price where a 5% drop from your entry point would occur. This strategic placement ensures that even if the market takes a turn, you limit potential downside exposure while allowing room for potential upside growth to achieve wealth within your desired parameters.

Managing and Adjusting Stop Losses

Managing and adjusting your stop losses is a crucial part of trading strategy. These orders are designed to limit potential losses, so it’s essential to set them at appropriate levels based on your risk tolerance and market analysis. Regularly reviewing and adjusting your stop losses can help protect your wealth within the market’s volatility.

As markets evolve, prices can fluctuate unpredictably. Adjusting your stop loss order accordingly allows you to adapt to these changes while minimizing risks. Moving your stop loss above or below a particular price level based on market trends can help ensure that you’re protected against significant drops or rises in asset value, thereby safeguarding your wealth within the trading environment.

Maximizing Wealth with Effective Stop Loss Strategy

In the volatile world of trading, managing risk is paramount for maximizing wealth within your investments. One of the most effective tools in a trader’s arsenal is the stop loss order. A stop loss is not just a safety mechanism; it’s a strategic tool that allows traders to protect their capital and lock in profits while minimizing potential losses. By setting a predetermined price at which an open position will be automatically closed, stop loss orders enable traders to navigate market fluctuations with confidence.

This proactive approach ensures that even if the market moves against your position, you limit the downside risk. As such, a well-placed stop loss can preserve capital and provide opportunities for further growth. By understanding and implementing this basic trading strategy, investors can confidently manage their portfolios, ensuring they achieve their wealth within goals in an unpredictable market.

Understanding and implementing a robust stop loss strategy is key to navigating the markets effectively. By setting clear loss boundaries, traders can protect their investments and manage risk, allowing them to focus on growth opportunities while ensuring wealth within remains intact. Embracing various stop loss orders and fine-tuning these points based on market dynamics is an essential skill for any trader aiming to maximize their potential profits.